What Ever Happened?

w.294 | SPVs, Social Signals, OpenAI, Inference Cost, Mag7 Winners, & Vibecession.

Dear Friends,

If you’ll allow me, I would like to take a victory lap. Back in August, I wrote to you about the grift economy (You Get What You Give) before the welfare fraud scandal in Minnesota went national last week. We are just at the beginning of untangling this, and I predict it will remain a feature of much discussion in 2026 as we figure out what ever happened?

Today's Contents:

Sensible Investing: Trends

Weeklies: Selfie & Song

Sensible Investing

Be Careful with Late-Stage SPVs. Matt Grimm (Anduril) goes off on a Fund Manager/Broker offering an investment opportunity in Anduril. I’m on a ton of mailing lists, and I was offered this SPV and see ones like it ALL THE TIME. Stay safe out there, friends.

Social Signals 2025 with 441 slides on social media trends. Fun browse.

I liked this slide on Duolingo. I hate to say ‘I told you so,’ but I did! Sort of. In the process, I lost the only Guatemalan reader I cared about.

Luis, you are welcome back anytime!

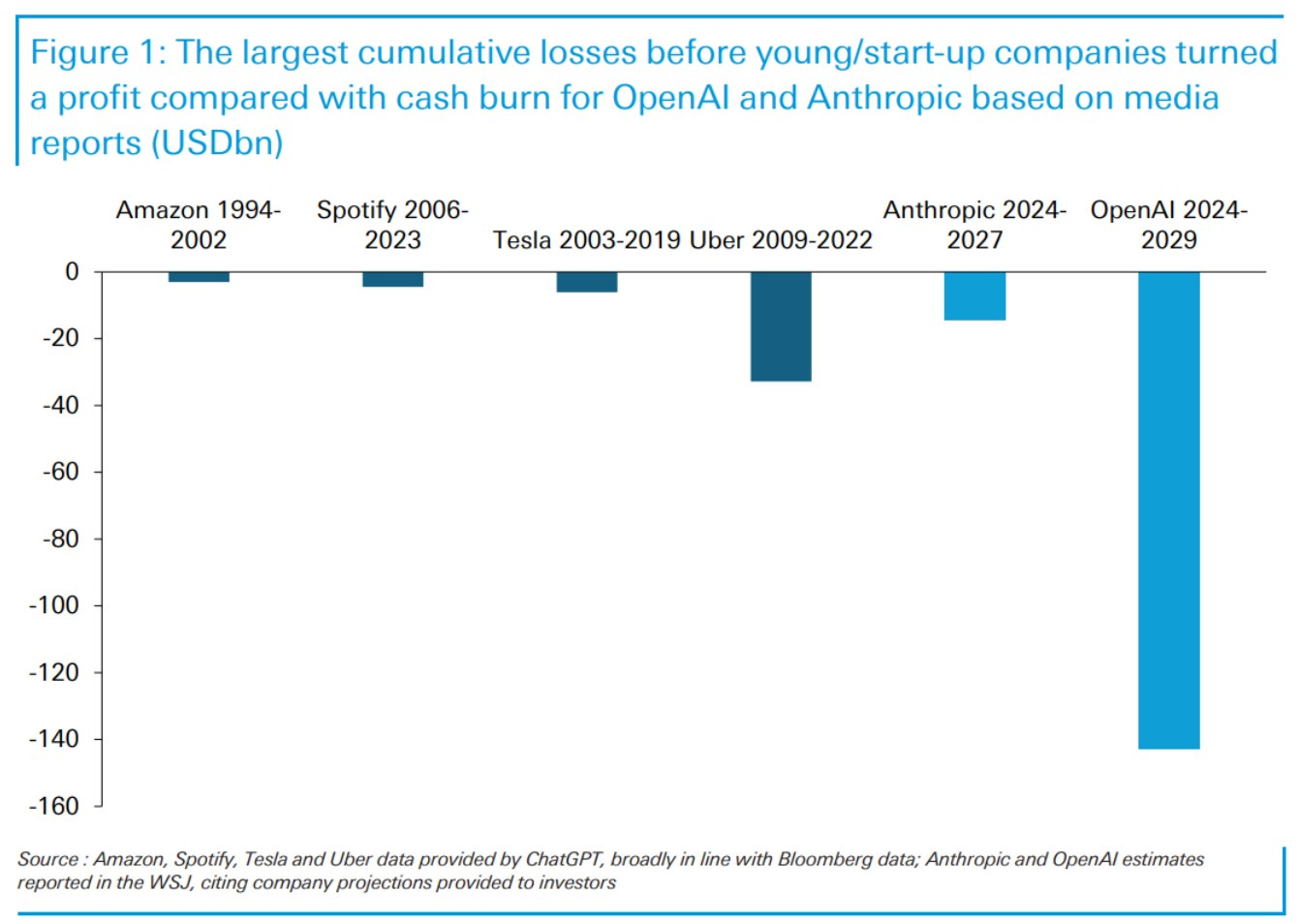

Is Sentiment Shifting on OpenAI? This chart is from a Deutsche Bank report, posted on X and analyzed by FT Alphaville.

Here’s the theory. Proprietary large-language models like ChatGPT turn out to be not that great for GDP. Core technologies still have value, but their developers’ individual business models marry persistently high operating costs with shallow commercial moats and their innovations quickly become commoditised.

This is fine. Commoditisation is for the common good. The result is better machine learning for all. Companies will die, but the spoils of more than $1tn in capital expenditures can trickle down equitably to a nation’s underfunded labs, studios, factories and faculties. We won’t get Artificial General Intelligence, but we might get improved weather forecasting and some new antibiotics.

People will start running the models locally without paying infinite tokens to the big models. Below was posted to X.

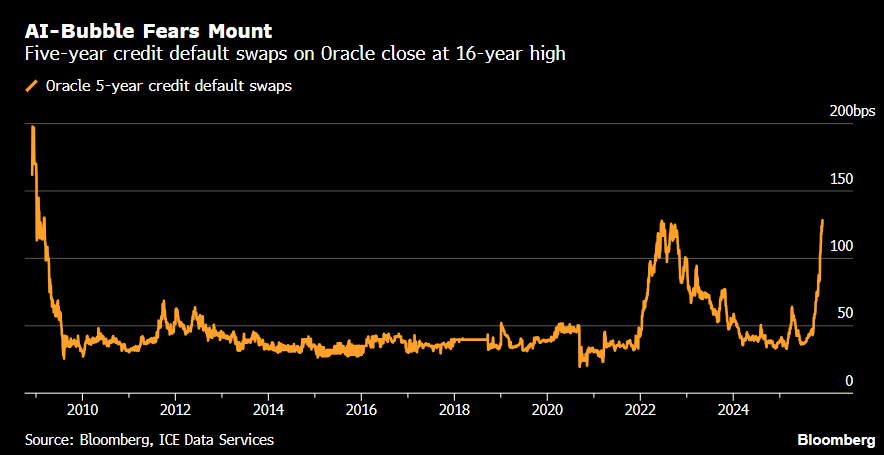

Oracle Credit Fear Gauge Hits Highest Since 2009 on AI Bubble Fears in Bloomberg.

The rising cost of default protection reflects investor angst over the gap between the massive investments already made in AI and when investors can expect to see productivity gains and an increase in corporate profits.

The Tragic Algebra of the MAG7: We Ran Michael Burry’s Math from Quant Signals.

The Takeaway:

Nvidia is the trap. The spread between “Street P/E” and “Real P/E” is massive because their buybacks are 100% defensive.

Microsoft & Meta are inflated. They look cheap on GAAP, but once you strip out the SBC offset, they trade at a premium.

The Surprise: Google (Alphabet).

Burry noted that Alphabet’s Real Earnings are actually 102% of GAAP. Their buybacks are so massive that they overpower the dilution. Under Burry’s math, Google is the only honest stock in Big Tech.

Vibecession: Much More Than You Wanted To Know by Scott Alexander. This is an incredibly long piece covering many graphics and analyses from this newsletter, without any definitive conclusions. This seems like a response (but not explicitly) to Michael Green’s recent viral and provocative posts about why people feel economically poor (part 1 here, part 2 here). I thought Green did a good job examining various assumptions, and quibbles about exact numbers are beside the point.

TL/DR: Many people feel the economy is bad or their situation isn’t good, but the current economic indicators suggest that’s not the case.

No one really knows.

Weekly Grift: Disabilities in HigherEd

Accommodation Nation in The Atlantic. Sign of the times, really. Play the game or be played, unless we decide to care about collectively enforcing shared judgment of ‘the rules.’

Accommodations in higher education were supposed to help disabled Americans enjoy the same opportunities as everyone else. No one should be kept from taking a class, for example, because they are physically unable to enter the building where it’s taught. Over the past decade and a half, however, the share of students at selective universities who qualify for accommodations—often, extra time on tests—has grown at a breathtaking pace.

- At Brown and Harvard, more than 20% of undergraduates are registered as disabled

- At Amherst: more than 30 percent

- At Stanford: nearly 40 percent

Weeklies: Selfie & Song

Selfie: Hazel Grace ‘HG’, Madison Park, & Investing

Feeling grateful this year for getting to spend time and work with one of my favorite people: Hazel Grace. HG is a former founder turned angel investor. She defines the modern woman shaping both the investing and social scene in Seattle. Recently, I spent 36 hours with HG on her home turf. Our time included lunching with the mayor, downloading the latest gossip from the Seattle Tennis Club, hosting a tech ladies’ brunch, and walking the new Seattle waterfront promenade (which is super lovely, much nicer than expectations).

The ultimate hostess, Hazel, knows EVERYONE. What they are up to, where they are going, what they are interested in, and what they can be convinced to do. She’s a sharp judge of people, quickly assessing and positively resolving social situations. This is a superpower, and she makes it look effortless. Hazel is kind, welcoming, and works every day to make her community better. I’ve learned a lot from her and am glad to call her a friend.

Song: What Ever Happened?

Here on YouTube.

“Whatever Happened?” is a question asked about many famous figures who have dropped out of the public eye.

This song is about oscillating feelings between acquiescence to the eventual decline in fame and defiance to preserve the present.

With the 24-hour news cycle, there are so many stories, narratives, personalities that come to prominence and then, poof, are gone, never to be heard of again, and we are left with ‘whatever happened?’ I think the whole story is far more interesting (and relevant for learning) than the initial glimpse.

“What Ever Happened?” by The Strokes

I wanna be forgotten

And I don’t wanna be reminded

You say, “Please don’t make this harder”

No, I won't yetThanks for reading, friends. Please always be in touch.

As always,

Katelyn

Great take on the grift economy ~ the 'layers' of the fraud in Minnesota is interesting, as the protests of 2020 over George Floyd really was a hotbed event in Minn, and I can see in that fervor Aimee and other opportunists pounced to exploit the gov ~ immutable records/public ledger would've prevented this but I do not foresee government adoption soon.

Wrapper companies were invested into like crypto companies in the 2019-2021 market craze, mimetic investments are possibly cyclical among the unprincipled. I think the demise of YC is largely due to Paul Graham having principled investments leading up to 2014, then he leaves.

I think Google is honest as they frankly have a massive data and hardware moat thats unrivaled and will continue on into the future as students across the country all have Google accounts without their permission due to schools using Google software through hardware exclusively.

People feel the situation isn't good primarily because they are stretched thin and their assets, that are granted immense importance upon the post war American Dream, cars and homes, are killing them financially, even if at large things are OK. Due to having to go to a shop for a certified inspection, it's fascinating to listen into peoples conversations upon hearing a service bill, and I think beyond any graph/poll you can get a lot of alpha from it. Many households earn <120,000, finance two cars totaling $70k+ (often 90k+), have to pay home insurance and mortgage. Then, to "feel fine" they will take upon BNPL/credit debt for non assets, and it stacks, leading them to believe they are stuck. I quibbled over this with a junior PE analyst as he believed financial education solves this, but I disagree.

I am extremely optimistic for the future, but the fact that people's necessity of survival often overrides abstract fear will be persistent.

I really like this piece: https://www.brookings.edu/articles/consumerism-isnt-a-sellout-if-capitalism-works-for-all/ - Reeves has a Substack, "Of Boys and Men", but I haven't read any of his pieces on there.

I find this YouTuber's takes too doomerish, but I saw this video: https://youtu.be/julHFXsKsdQ?si=GmA_CLnrEtHJuMDj on an app "Covrd", allowing you to gamble upon your own debt.