You Get What You Give

w.283 | A.I. & Private Markets, Cal Newport, Vanguard, Smart & Grift Economy

Dear Friends,

Yes, this one got a little long. I was on a cross-continent flight, so I had deep work time. And it’s a long weekend, so there’s a little something extra for those of you at home or seeking interesting content to go along with your travels.

Today's Contents:

Sensible Investing: Trends

“Being Smart” and the Grift Economy

Not You, Vanguard!

Song of the Week: You Get What You Give

Sensible Investing: Trends

Are We Underestimating How A.I. Will Change Private Markets? In Colossus. I don’t think anyone is underestimating the implications of better and faster analytical tools that are easy to use. There will be increasing competition and need for differentiation to outperform the average. Most of the fun, new tools will increase the operational floor, decrease costs - and a few proprietary techniques will outperform; importantly (and perhaps obviously), those will be used internally and not sold on as tools.

I don’t think things have changed that much since I wrote Quant Comes To Venture in 2022. It’s obviously the future, but it also takes longer to implement fully and will seem less revolutionary when it happens.

What if A.I. Doesn’t Get Much Better Than This? GPT-5, a new release from OpenAI, is the latest indication that progress on large language models has stalled. Article by Cal Newport in The New Yorker. Cal joined Rob Montz for a deeper dive conversation on his view, which can be found here on YouTube; I quote here:

New models also write more naturally and fluidly, and this is reflected in the benchmarks as well. But these changes now feel narrow—more like the targeted improvements you’d expect from a software update than like the broad expansion of capabilities in earlier generative-A.I. breakthroughs.

A Dangerous Standoff: What a U.S.–Venezuela Clash Would Mean for Caracas and the Region? In The Diplomatic Affairs. To quote the most relevant part:

Over the weekend, pro-government crowds in Venezuela lined up to join the national militia after President Nicolás Maduro ordered a nationwide mobilization of 4.5 million members.

The U.S. deployment, directed by President Donald Trump, involves three guided-missile destroyers, an amphibious squadron, at least 4,500 sailors and roughly 22,000 Marines, according to the Navy.

This story feels under-reported in an attention-saturated world and is worth noting.

“Being Smart” and the Grift Economy

Different Kinds of Smart by Morgan Housel was a worthwhile read, as usual.

But Nathan’s counsel to his daughter better captures the zeitgeist of our era:

I like this definition and think it’s broadly true. Of course, there are a few challenges. First, most people don’t know what they want or have a vague definition, so that’s a moving target.

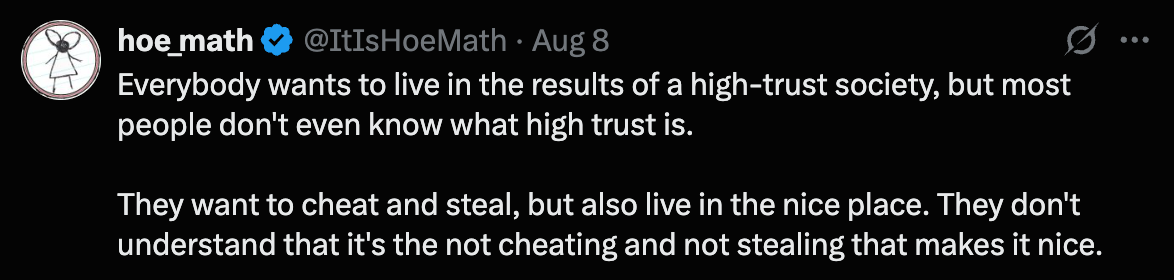

Secondly, the system of ‘getting what you want’ has now become exceedingly short-term, as ‘wants’ have the longevity of our collective attention span. This means people increasingly want to ‘get rich quickly,’ which is nothing new, or seek the next dopamine hit, their 15-minutes of fame, etc. And ‘learning how things work’ has meant that people (young and old) can now see transparently how the system works, who is exploiting it, and execute the fastest hacks. There are limited consequences for those who cheat, particularly as the gray area of what is deception has expanded. Over time, this degrades all societal systems.

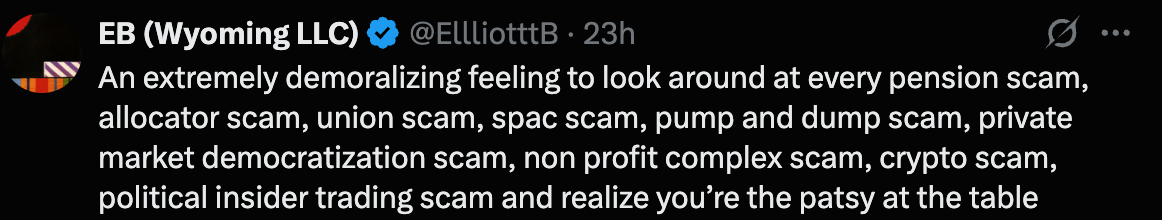

Over the last month or so, I’ve been collecting examples of various gambles, games, and scams. As investors, operators, and citizens, we should pay attention to the ‘way things work’ and plan accordingly or otherwise risk being left behind, under-performing, or worse: being the patsy.

The old way things used to work (for most people) is ‘work hard, be honest, and you’ll get just rewards.’ But now the way things work is something more like ‘if you can, you should, and if you don’t, you’re stupid.’

And no one wants to be stupid.

Grift has always existed, of course, and now it's much more visible and normalized, and so everyone is looking to get theirs when they can. And it's socially - and legally, perhaps? - acceptable.

From Matt Levine’s article about the Trump sons’ SPAC.

The optics from the lens of integrity are bad. It’s tacky. But they might don’t care as much about tact or the long-term, systemic repercussions on others’ decisions and resulting actions. For more on this you can read Bloomberg’s weekend essay: The Cracks in America’s Rule of Law Are Getting Deeper.

When the rule of law is not consistently enforced or widely accepted, the scam economy thrives, and everyone suffers. Classic tragedy of the economic commons.

Show me the incentive, I’ll show you the outcome.

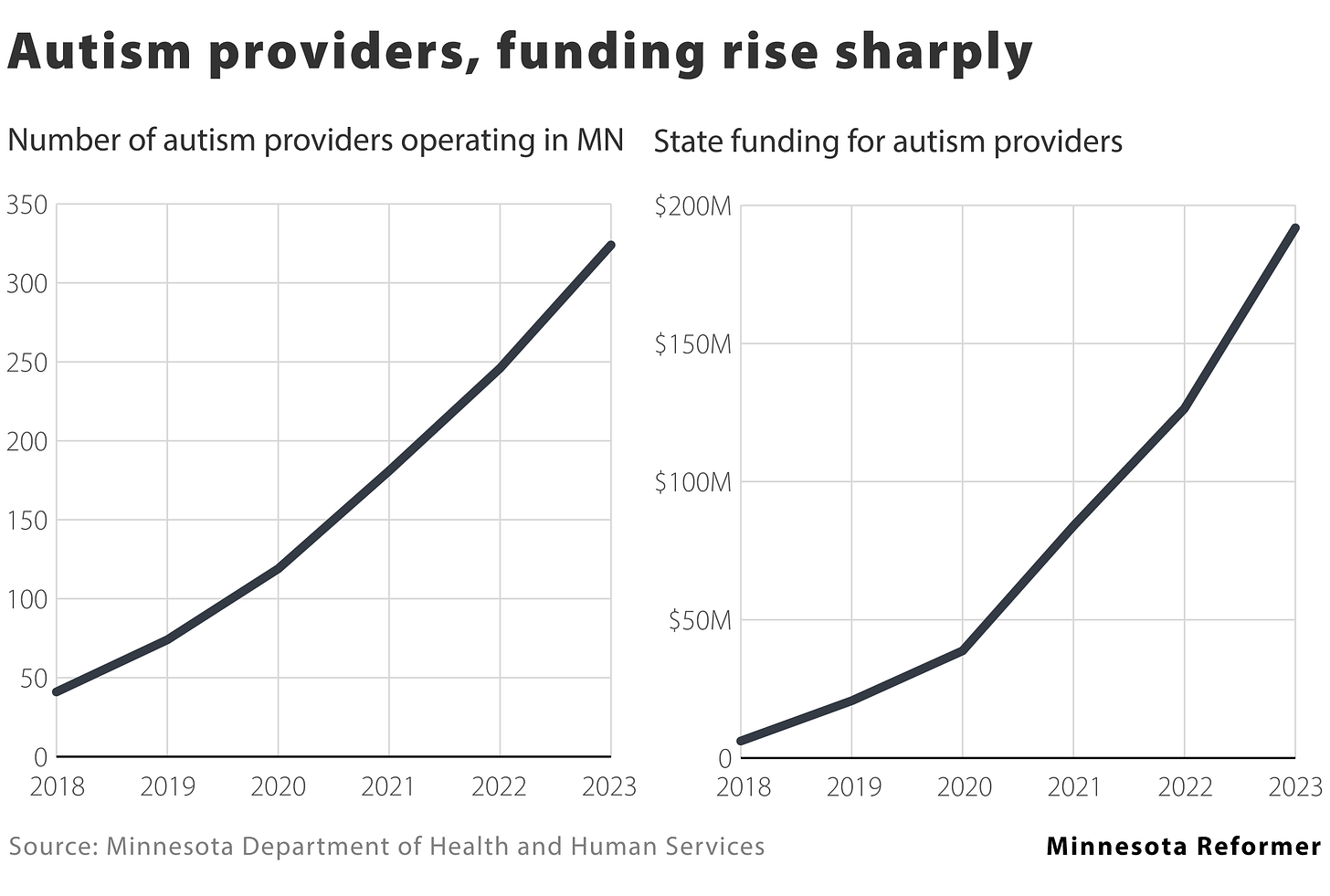

My home state of Minnesota has quietly become a target for scams, particularly a $250M expense supposedly to feed low income children during the Covid pandemic and most recently a surge in autism care reimbursements (explained below).

This is from an op-ed in the StarTribune. Super well-written.

Minnesota’s leaders confuse compassion with competence. They prioritize equity over efficacy, feelings over facts and optics over outcomes. They trust but never verify. Programs like HSS weren’t just poorly designed, they were built for abuse. The state basically invited fraudsters to the table and handed them a silver spoon. Minnesota has become a sucker state. One ripe for exploitation by anyone with a printer, a business license, and the desire to swindle, scheme, and scam.

EIDBI autism claims to Medicaid in Minnesota shot up from $3 million in 2018 to nearing $400 million most of the way through 2024 for a total of over $1.4 billion.

Public Sector grifters are everywhere of course, not just Minnesota.

The value system behind these schemes are people believing that they are being smart. They could, so they did.

I’m not going to spend too much time on the influencer grifters in the attention economy grift. Sadly, there are too many examples.

Systems can be changed, values can be reinforced.

In systems of systemic grift, it’s hard to know what to do to avoid being the patsy or to long-term improve the systems. A few thoughts from my travels:

Do your own work and continually learn from the lessons of financial fraud and grift.

Slowly fix the systems. Minnesota is establishing an oversight department that utilizes AI for fraud detection. That is better than nothing; the first step often is acknowledging there is a problem.

But, there is no substitute for a strong sense of ethical conduct, so:

Make it socially unacceptable to be a grifter, and reintroduce consequences for those who engage in such behavior. This might mean distancing yourself from people who stretch the truth, exploit systems for personal gain, and engage in the attention economy. The Chinese government prosecutes fraudsters and executes those found guilty, as was the case with Li Jianping last year for $421 million embezzlement.

Celebrate stewards of good governance and high-integrity systems. See selfie of the week.

Not you, Vanguard!!!!

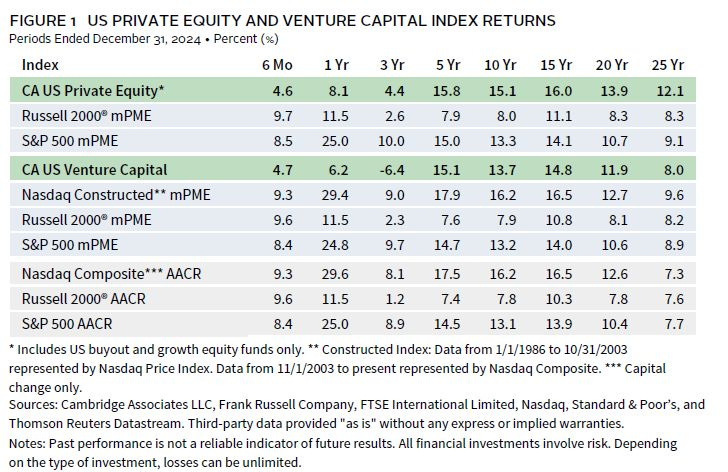

Let’s do our own thinking and evidence gathering. See below. Found on X. Let’s look at the 15-year or the 5-year results for a few cohorts: PE vs Nasdaq, maybe? S&P 500, yes? The performance gap seems to have disappeared.

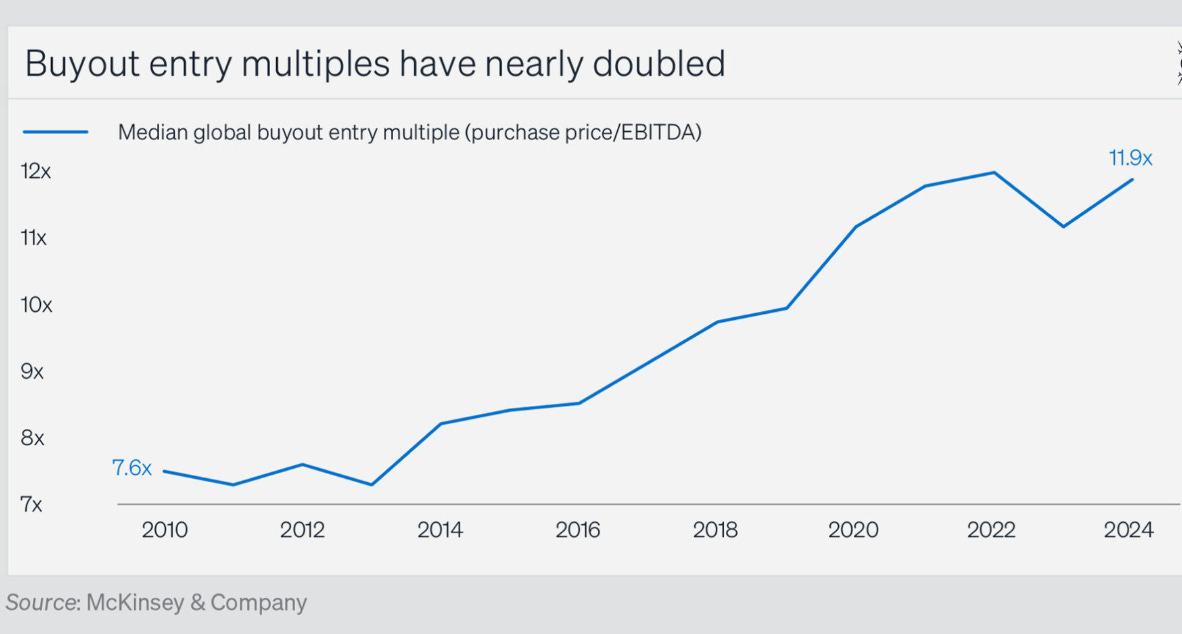

And as we all know, PE today is an order of magnitude more competitive than in 20025; every asset goes to auction, so prices have gone up (see below), and there is a massive liquidity problem.

Past performance does not predict future returns, indeed. It also takes half a century for an institution to build a reputation for offering low-fee, honest products, and then one millisecond for it to lose it.

Song of the Week: You Get What You Give

Here on YouTube.

According to Alexander (lead artist of New Radicals), the song is a reminder to “fly high and be completely off your head in a world where you can’t control all elements.”

Thought it was worth ending this edition on a positive note with this old, popular ‘90s song.

Erik Bergman, an entrepreneur, recently shared on X how he was scammed out of $1.25 million through a sophisticated web of deception that relied on a series of social pressure tactics. It’s an admirable share because he feels that he’s been ‘stupid’ and thus always worth reading these to help inoculate oneself from scams, as they can happen to anyone and everyone.

The more salient message was what his brother told him after the fact:

"Little brother, this fucking sucks! BUT, one of your admirable qualities is your positive view of people. Your starting point is that the world is a good place. With that mindset, sometimes you take a hit. The alternative would be to be suspicious, to never trust anyone… to just be bitter about the world! YUCK, ugh… that’s a lonely and boring world. (Trust me, I know how dark life gets when you’re bitter about the world!)

Today, your view of people has taken a hit. Someone is working hard to make you change… And sure as hell, it’s easy to get bitter and shut yourself off… But they don’t know who they’re dealing with! They don’t know you’ve inherited Dad’s enormous stubbornness and Mom’s big heart. As if some damn (my words) parasites could stop you from making a difference…

“You Get What You Give” by New Radicals

You've got a reason to live

Can't forget

We only get what we give

Don't let go

I feel the music in youSelfie of the Week

I’ve been lucky to spend a few days out east with old and dear friends (all long-time loyal readers of this newsletter; many a reference was made to various editions — I’ll admit these are among my favorite dinner time conversations). Terry, Rick, Charlie and Elise.

Of course there are many wonderful things to say about every person in this photo but for this edition I focus on Terry Stone, one of my first true career inspirations!

Even though you can tick through the list of impressive positions and postings, it’s the stories with the detail from the trenches that are the most exciting.

Terry and Rick met at the MIT Sloan School. Charlie, their son, worked at the Duke Endowment, where I overlapped with him and became friends. During this time, he would frequently relay on stories from his power mom, who inspired him to be an investor.

Terry started in investment banking for Morgan Stanley, where she was the first female Managing Director. She then ran and/or served on the board of several insurance companies, Duke Energy, the Board of the Federal Reserve Bank of Richmond and was brought in to lead the audit committee of AIG after the Great Financial Crisis.

Most recently she served as MIT’s chief financial officer and was responsible for MIT’s non-academic operations. She also was a member of the MIT Corporation, and chaired the MIT Investment Management Company.

She still serves on the board of Harold Alfrod Foundation which is leading a highly successful revitalization of the education systems and economic develops in Maine. (In 1993, at age 79, Harold Alfond sold Dexter Shoe Company to Berkshire Hathaway for Berkshire Hathaway stock — a very good trade!)

Although Labor Day in America is dedicated to the efforts of the American worker, it is also worth recognizing and celebrating the high-integrity stewards of governance and finance, whose sky-high standards and diligent work ensure that systems function as intended to improve society for all.

To rebuild our institutions, we’ll need more leaders like Terry.

We’ll all get what we give.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

I’m a Vanguard PE investor so I’ll let you know in 10 years how I did. So far so good. The product is what you would expect from Vanguard, low fee and diversified portfolio.