Everybody's Gotta Live

w.270 | Chris Hohn, 401Ks, Restaurant Patterns, Duolingo, & America against America

Dear Friends,

I’m going for quality over quantity this week with a few deeper dives. To address one topic that I’ll treat with brevity, I do not think there is any new information in the Moody’s downgrade of the United States. But perhaps the relevant audiences will heed the message this time.

It’s heating up early here in Austin with our first few days over 100 degrees and a dollop of humidity to boot. That didn’t stop me from going outside!

Today's Contents:

Sensible Investing

America vs America

Song of the Week: Everybody’s Gotta Live

Sensible Investing

Sir Chris Hohn - In Good Company, an interview with Norges Bank Investment Management. If you are going to consume only one piece of media this week, it should be this.

Chris Hohn is one of the best investors in the world with his fund, The Children’s Investment Fund, and he rarely gives interviews. But everyone has a boss - and if you manage public equities, it’s hard to do better than Norway’s sovereign wealth fund. You can look up all the positions and returns of the $1.8 trillion fund here. It’s ~70% public equities. Here is their annual report from 2024. I thought this line was funny: The strategy for security selection is based on fundamental analysis of companies, and Norges Bank uses both internal and external managers. In 2024, the overall contribution from security selection was negative. External management made a positive contribution, but the negative contribution from internal management was larger.

In the interview, Chris shares what he looks for in businesses. As you might expect being a reader of this newsletter, he cites many Buffettisms:

He holds only ten positions—you can view them here on the 13F filing. His biggest positions are at GE Aerospace, Moody’s, Microsoft, and Visa.

Obsessed with moats, i.e., Physical Assets, IP, Network Effects, Installed Base, Scale, Brands, Customer Switching Costs.

Long list of industries he would never invest in: Airlines, banks (low quality of earnings from too much leverage, too opaque), insurance, manufacturing, traditional asset managers, fossil fuel utilities, wireless telecom, media, and advertising agencies, among others. Each of these areas are competitive - and investors underappreciate the impact of competition. He says this from experience earlier in his career.

Most important is the ‘essential product or service’, not discretionary-like rating agencies.

Growth isn’t that important because you can have profitless growth (he cites Airlines as an example). Growth without barriers to entry is not what you want. Pricing growth is better than volume growth.

His average hold period is 8 years. This is quite long in the industry. He has the advantage of long-termism. This makes it easy to copy his portfolio, btw.

There are more good companies in the public than in the private markets. Companies sold to private equity aren’t as good. Large companies are more likely to beat small companies - they have more money. PE can’t buy the largest companies. If a public company sells a company to PE, it’s usually not the best business, and PE, like all asset management, is prone to the principal-agent problem. The best businesses in the public market are better than the 100 best companies in the private market. The first released video was a joint panel with him and Christian Sinding of EQT (a large PE player), and Christian comes off as quite defensive. Defensiveness is not a sign of strength.

You can be wrong; getting out of a public company is much easier in private markets. And what kills you as an investor is the permanent loss of capital (though this happens all the time in venture!)

Why are you a good investor? “Humility.” Being a good investor can be learned. He also reflected on the importance of intuition and said it’s improved over the last five years.

Activist investments aren’t worth it because it’s usually a second-class business, and the quality of business (or lack thereof) always wins. He used to be quite the activist!

Shorting is generally a bad business. You can’t afford the losses in the many years that you are wrong. Warren and Charlie agree because of the asymmetric risk and reward. He did short Wirecard, however.

Chris comes from a relatively humble background. His mother was a secretary, and his dad was a car mechanic. His fund name is directly linked to the charity (The Children’s Investment Fund), one of Europe's largest. He laughs as he says it’s different from Tiger or Viking. Growing up this way made him an independent thinker and an outsider; it gave him a work ethic and a desire to achieve something.

One of my friends who runs a long-only fund in Europe told me a Chris Hohn story that always makes me smile. A few years ago, Chris gathered a bunch of other long equity managers together for dinner in London. He sat himself at the head of the table. After they ordered and before the food arrived, he read an investment thesis he had on a company. And then he got up and walked out.

Everyone Wants A Shot at 401(k)s

There is $12 trillion in Americans’ 401K retirement accounts. Alternative investment managers are pushing hard to get the relevant blessings to put PE and other private investments in these accounts. Today, fewer than one in 10 plans offer any alternative investment.

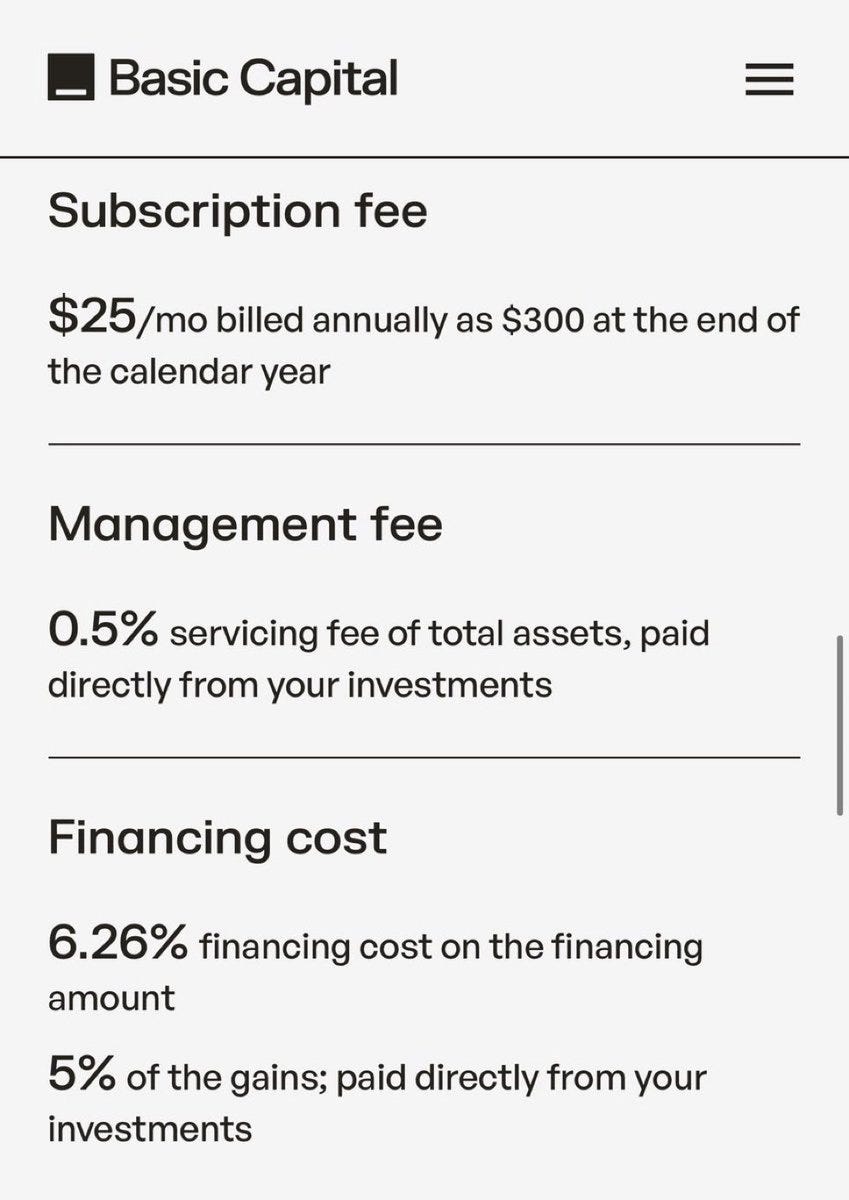

This 30-year-old startup is bringing leverage to 401(k) savers. Basic Capital made a splash this week with a widely denounced product on X (mostly because of the fees—see below).

I wonder what Lux Capital's partner meeting was like when they decided to do the deal, and the GPs proudly declared to be ‘democratizing wealth creation in America.’

Want to invest like the wealthy? Buy Berkshire, Chris Hohn’s 10 stocks, and/or a basket of Vanguard indexes. Invest more. Don’t sell. Avoid fees. Fin.

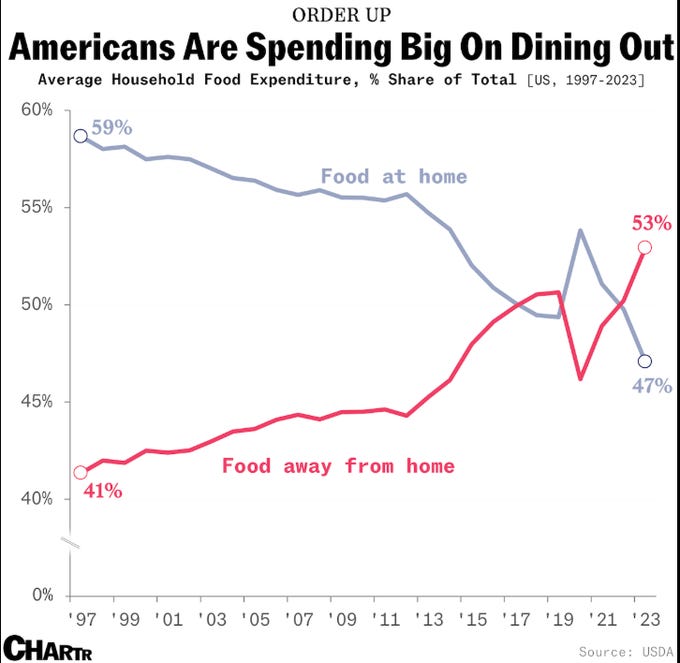

Takeout Used to Be a Convenience, Now It’s a Culture. Industry surveys suggest that ~75% of restaurant traffic is now takeout, with speed and convenience driving consumer choices - and a majority of Americans’ spend on food expenditures happens on food away from home.

Duolingo Enrages Millennials and Gen Z With Its "AI-First" Controversy. Duolingo deleted all their videos on TikTok following backlash from CEO Louis’s post about being AI-first and replacing contractors with AI. H/T to Josh Shapiro for the discussion.

My take: This is an interesting development that could foreshadow the coming AI implementation backlash. Humans want to lead meaningful lives, and meaning is intertwined with human social interaction. Computers talking to computers—great. Computers saving you time and headaches—great. Computers producing slop that turns the human experience into a vision of Wall-E—no, thank you.

Speaking of America.

America Against America by Wang Huning. Read it for free here.

The book is a 1991 travelogue by Wang Huning, a political theorist who is now a long-standing member of the Politburo Standing Committee, a seven-person entourage of the highest-ranking officials in the Chinese Communist Party. Chinese netizens call him guoshi (literally, “teacher of the state”), an honorific bestowed upon powerful state councillors in China’s imperial past.

How a Book About America’s History Foretold China’s Future was reviewed in The New Yorker in 2022.

My friend, Rush, recommended the book to me at Berkshire. Given all the talk about US vs. China and understanding the dynamics, I’m embarrassed to say that I hadn’t read it or heard of it until now.

I am not afraid to be a life-long learner, through. I’ve now read it cover-to-cover, online and for free. Here are a few notable observations and quotes:

It’s written powerfully, clearly, and simply. It’s so easy to read, and each sentence is backed with insight. Impressive writing and thinking throughout.

Some things never change: constant contradictions of American society (some people are super hardworking, others don’t work at all; Americans are very lonely but others don’t think this is true at all)

“Money governs society. When people manage money, they actually manage people. This non-governmental money mechanism regulates people’s thinking, emotions, and behavior.” “Perhaps mobilizing the ability of a society’s money to govern people is a very important aspect of reducing the pressure on the political system to manage.”

Chapter on ‘Diversity or Excellence’ and the observation that ‘the rule of geniuses is a common feature of societies under the capitalist system’ and ‘Americans conceptually advocate popular democracy and practically accept the rule of excellence’. He recognizes that the dilemma of the contradiction between a popular democracy and the rule of excellence and that ‘it will be broken in the future operation of the American social system, but it which direction it will go cannot be predicted’.

The US is distinct in its four C’s - Cars, Call (phone calls & communication), Computers, Cards (credit cards, ID cards, etc.)

Americans hate theories and abstract thinking; they are not interested in philosophy beyond common sense.

Americans’ core beliefs are in equality and freedom, with freedom as the dominant value of the two. He resolves this: ‘because the equality guaranteed by the Western system is only formal political equality, not social or economic equality.’ This is such a big part of the current cultural wars, it’s uncanny.

The development of a society is inseparably related to the dissemination of knowledge, especially advanced knowledge. The role of dissemination in the evolution and development of Western societies cannot be underestimated (his observation of the US relative to China). A library is like an open reservoir of knowledge where everyone can swim. The progress of a society lies in the ability of each individual to receive and master the knowledge accumulated and created by that society.

The modernization of American society is not centered on big cities like New York but on thousands of small towns, and big cities are just the top of the hill.

Undercurrents of crisis - the family. ‘The government bears a heavy burden due to family fragmentation, from children’s education to elderly issues.' ‘The fragmentation of the family has deprived society of many human feelings, which is also detrimental to a harmonious society.’

His observations are 25 years old, which is important context. It would be fascinating to get his updated take.

My theory is that modern America is a vortex or a black hole. Everything slowly becomes ‘America’ and American. Some people are getting there faster than others. Global culture is merging, certainly among the elite, to a more unified, similar experience with investments, technology, and culture all becoming one. I continue to think about this and may write this up more thoroughly sometime.

On Americana, I also discovered these books of industrial photos in this bookshop in Omaha. Beautiful stuff! What Bernd and Hilla Becher Saw in the Remnants of Industry

Song of the Week: Everybody’s Gotta Live

Here on YouTube.

This is a 1970s tune about the fact that everyone has to live and everyone will eventually die, but the reason why we live is to enjoy life and have a good time. It’s featured prominently in JoJo Rabbit, a WWII satire film.

”Everybody’s Gotta Live“ by Arthur Lee (Love)

Eveybody's gotta live

And everybody's gonna die

Everybody's tryin' to have a–a good time

I think you know the reason whySelfie of the Week

My friend Maren, who is awesome, has a partner who organized a mini-music festival with live performers in Austin this weekend—no AI in sight (poster designed by a human).

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn