Walking On A Dream

w.289 | World Portfolio, State of Software, Ribbit & Tokens, Dalio & Gold, Bubble & Venture, & Trusts

Dear Friends,

Exciting times to be alive with so much change happening every week. Enjoying sunshine and the mid-60s in the Northeast in late October is delightful, too, and feels a far cry from five years ago.

Thanks, as always, for reading and joining along.

Today's Contents:

Sensible Investing

Weeklies: Selfie & Song

Sensible Investing

TCI & Chris Hohn Continue to Crush. I think about his insights from that interview in April all the time.

Investing in Everything, Everywhere, All at Once. Portfolio strategy paper from Goldman Sachs. TL/DR:

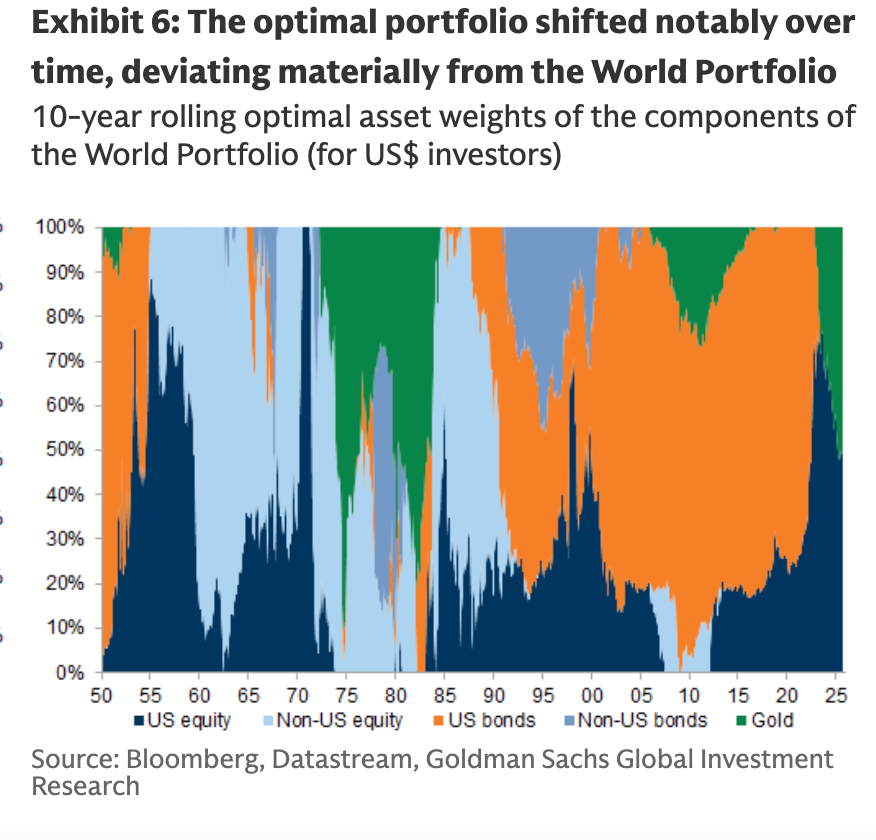

Persistent shifts in asset weights are often closely linked to macroeconomic trends, such as inflation, which boosts gold relative to equity and bond markets during the 1970s, or equity bubbles, like the Tech Bubble, during the late 1990s.

Currently there are three major trends visible: (1) the equity weight relative to bonds has increased materially since the GFC but it remains below levels from the 1990s, (2) both in equities and bonds the US has accrued a larger weight and is very dominant and (3) alternatives such as private markets, Gold and cryptocurrencies have grown relative to public equities and bonds (but remain relatively small).

This is a fun diagram, although obviously backward-looking. Noting that this is heavily risk-adjusted, which is why bonds dominate 2000-2022.

State of Software 2025: Rethinking the Playbook (PDF). Analysis of the software market by Iconiq (a massive multi-family office of successful tech founders, including Mark Zuckerberg).

After a turbulent reset period, the market is recalibrating - rewarding companies that demonstrate not just growth and discipline, but also a credible AI strategy. Investors are anchoring on efficiency today across the broader software market, but placing option value on an AI-fueled upside tomorrow. We are also seeing AI-native companies redefine the growth curve, reshaping expectations across the market, and emerge with a new playbook.

Ribbit Token Letter (PDF in DocSend). Excellent analysis on an obvious mega-trend - the merging of AI & Crypto to upend the financial system.

Financial services are the perfect target in an age of intelligent machines. Outside of Tech itself, the industry spends more money ($700Bn annually) and a higher share of revenue on technology than any other sector.

Ray Dalio: My Answers to Your Questions on Gold. He’s bullish.

To me gold is the most sound fundamental investment rather than a metal. Gold is money like cash and short-term credit, but unlike cash and short-term credit which creates debt, it settles transactions—i.e., it pays for things without creating debt and it pays off debt.

Anyway, it has been obvious to me for some time that the relative supplies and demands of debt-money and gold-money were shifting against debt money’s value relative to gold money’s value.

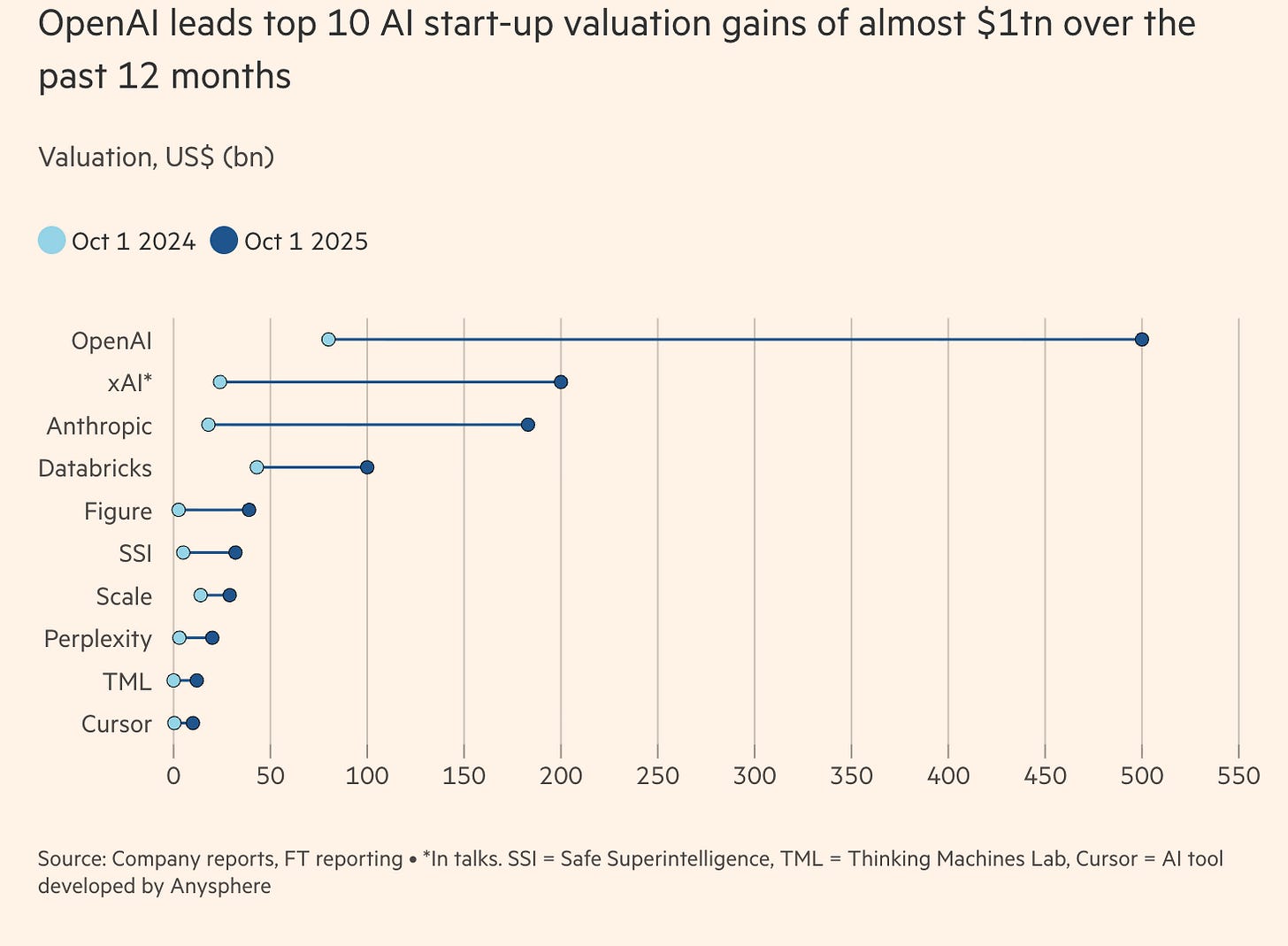

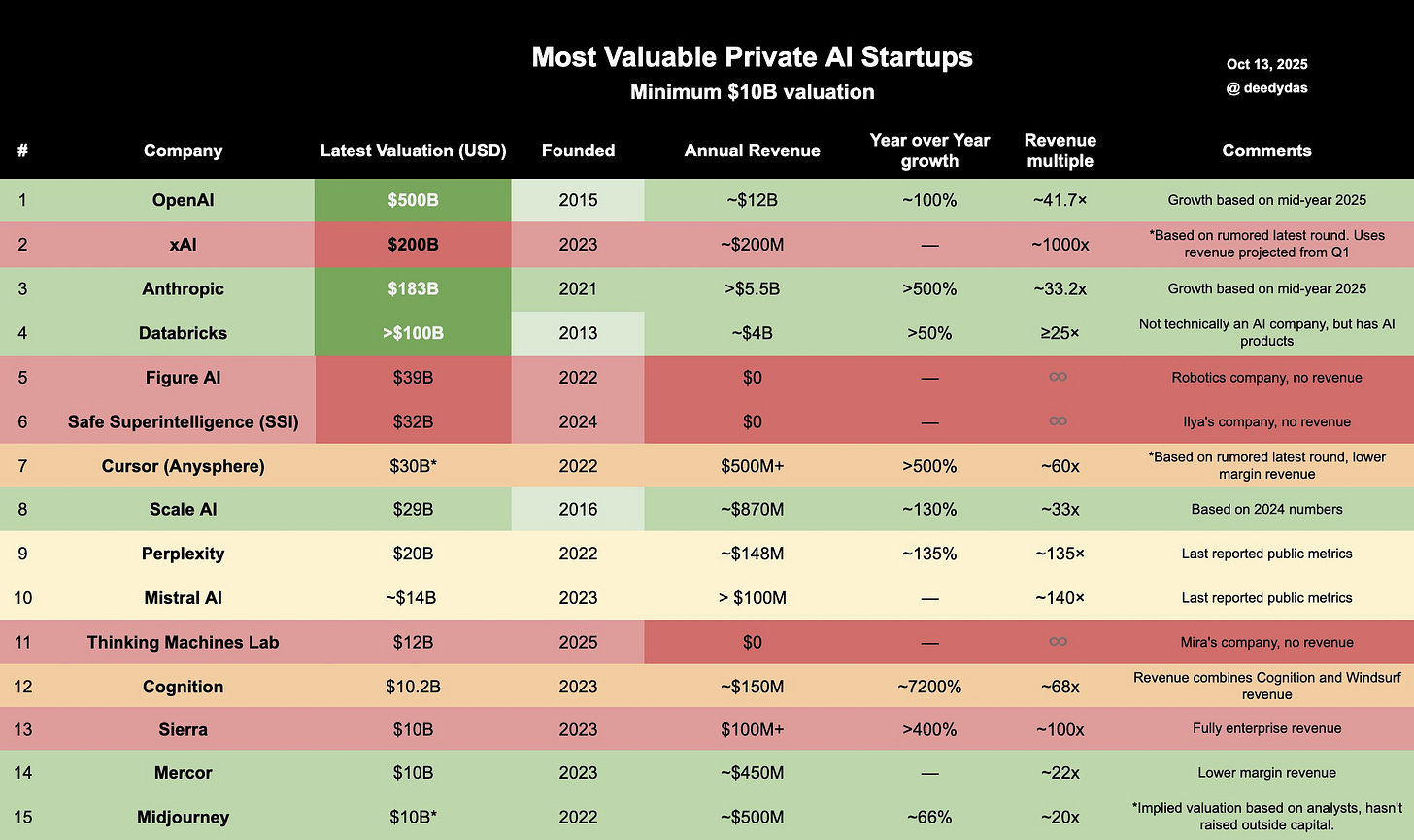

‘Of Course it’s a Bubble’: AI start-up valuations soar in investor frenzy (The FT).

From the comments: Bubbles are not only good. They’re great. If you are in and out early.

They are also beneficial if you can charge fees on the allocations. The underlying cottage industry benefiting is the SPV brokers who place the secondaries and various allocations, often with layered fees. But the buyers are (relatively) sophisticated and they want what they want, so give it to them! Just remember that basically no one in venture is trained in (or wakes up caring deeply about) accounting, let alone understands revenue recognition and quality of earnings, which gets me to the next article…

A Menlo Ventures partner posted this on X.

Regulators Are Investigating MassMutual’s Accounting Practices (WSJ). SEC is focused on how the insurer accounts for income on billions of dollars of loans. This is interesting because usually insurance companies have good accounting. This type of thing happens at the top of market bubbles.

Weeklies: Selfie & Song

Selfie: Rush! YC, Stockpicking, Trust software

Recently, I hung out with my friend Rush Sadiwala in San Francisco. I’ve been friends with Rush since college, when we were both eager economists interested in investing. We both competed in a campus-wide Morgan Stanley-sponsored trading game. I won in 2007 (for making roughly accurate, broad-based macro calls) and he won in 2008 (for making roughly accurate equity calls).

Friends and investors ever since, I’ve invested in and helped his last two companies, and I won my ‘correct call’ adulthood stripes by being early to (and talking incessantly about) crypto. Rush was early to (and talked incessantly about) Shopify. He’s continued his streak of investment calls on his security analysis, a blog I’ve featured here before. Recently, he has been excited by the opportunity with a cancer-diagnostic company called Personalis (his investment write-up linked).

Alas, he’s putting stockpicking on hold to pursue the tech-startup game once more and recently got into YC’s latest cohort.

Rush and his co-founder, Nimit, are building a company called Sava, a full-stack, AI-powered trust company. Think what Mercury/Brex did for old-school banking, but for trusts. Trusts are legal accounts that hold and pass on family wealth; today, they’re run by brick-and-mortar firms, which makes everything slow. Sava is replacing that with one modern platform where trust creators, beneficiaries, financial advisors, and estate attorneys can collaborate quickly, with fast onboarding, streamlined approvals, and efficient, transparent distributions.

They would love to speak with family offices and wealth advisors who would like to explore the product. Let me know if you would like to chat with them. I’m happy to connect you, or you can email him here.

Song: Walking on a Dream

Here on YouTube.

Walking on a dream can be interpreted as a metaphor for living life with a sense of wonder and curiosity, allowing oneself to explore new horizons and possibilities. It encourages listeners to let go of their fears and embrace the unknown.

Classic song that never gets old!

“Walking on a Dream” by Empire Of The Sun

We are always running for the thrill of it thrill of it

Always pushing up the hill searching for the thrill of itThanks for reading, friends. Please always be in touch.

As always,

Katelyn

Interesting to see what got you into crypto early, hopefully you're enjoying New England! Though there's nothing to see, Newport is nice this time of year, my favorite beach in the state is Easton's Beach.

I believe Molly O'Shea from Sourcery still works in the family office space ~ the main issue is that people have very elderly family office managers. If I was 20 working in a family office, people I was contacting were in their 70's, as people have trust in those who have sometimes done it "forever".

One I had to deal with quite often still used a Nokia 105, for example. Others didn't know that the iPhone had a mute switch.

Bullish on that product though!

Integrating crypto with AI for Sava would benefit him greatly. I've found crypto immensely aides security, and many people are surprisingly open to integrating crypto, far more than companies typically are.