Alright

w.284 | Venezuelan Oil, Gold, DATCOs, Corporate Jobs, Doodle Mania & Psychedelics

Dear Friends,

I hope you’ve had a good transition into the post-summer stretch. We have 12 weeks until Thanksgiving, in case you were also feeling as though 2025 happened fast.

Also, thanks to everyone for sending me your favorite grifts and scams as mentioned in the newsletter last week! That was fun - and very much echoed the point that there are a harrowing number of schemes out there.

Today's Contents:

Charts on Venezuelan Oil

Sensible Investing: Trends

Song of the Week: Alright

Charts on Venezuelan Oil

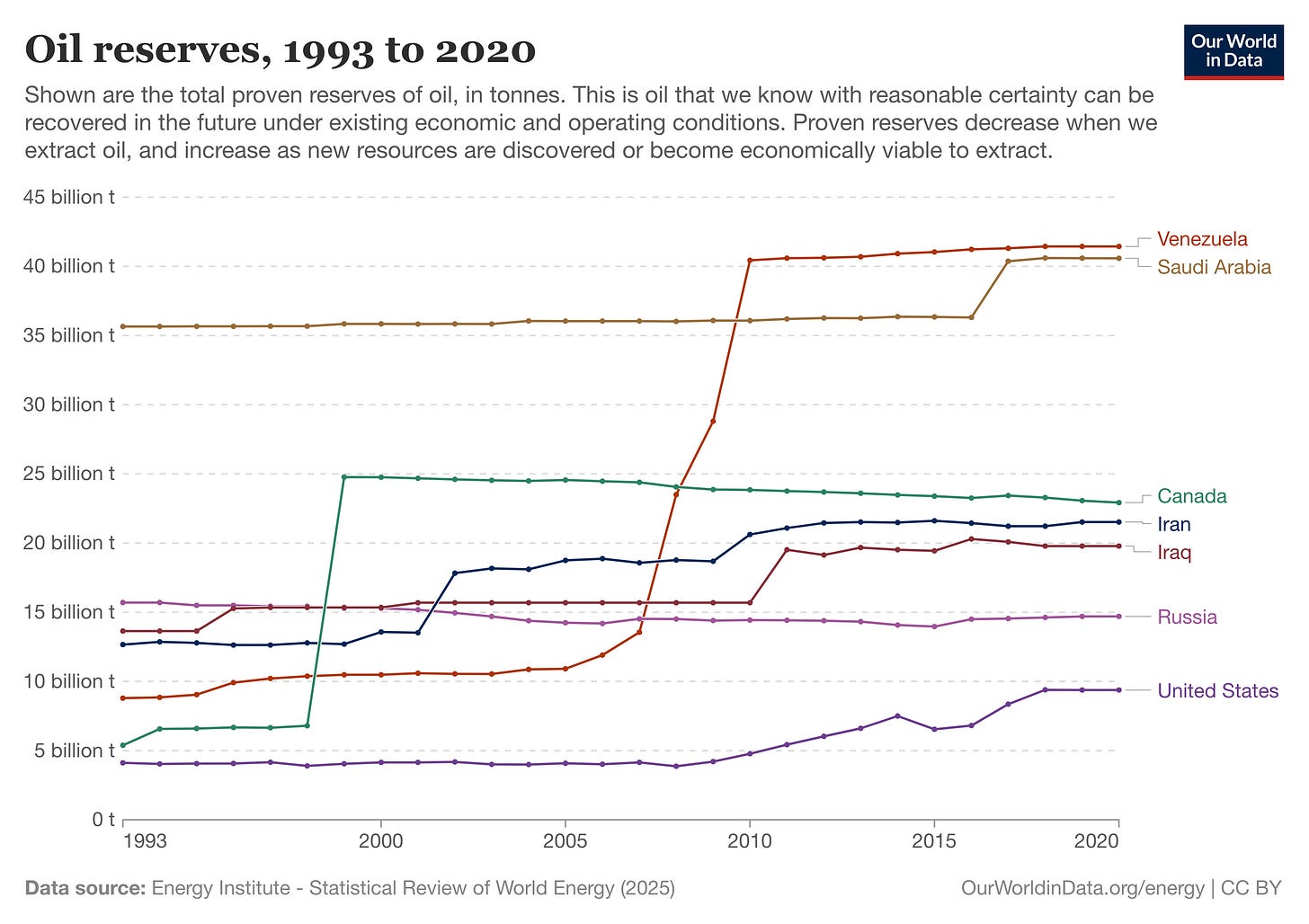

Since the country is in the news as the latest potential target for the newly renamed ‘Department of War, ’ I thought it was worth looking at this chart from Our World In Data. Venezuela is the global leader - ahead of Saudi Arabia - in oil reserves, but only produces 10% of what Saudi Arabia does (chart below).

Sensible Investing: Trends

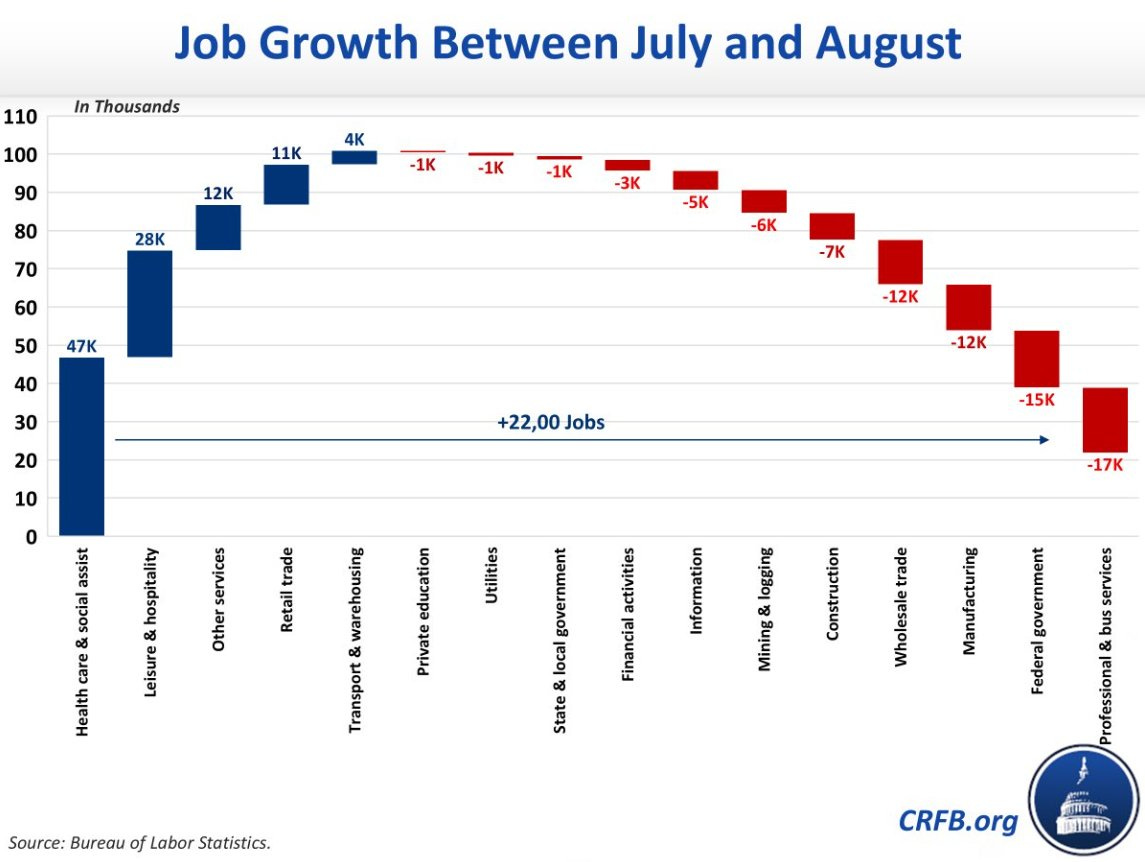

Going into the fall, I’d sum up the US economic landscape as continued inevitable devaluation of the Dollar from uncontrolled deficit spending and declining interest rates (achieved any way possible) as data to suggest a weakening labor market provides the political cover, despite inflation on the upswing.

The key areas of potential economic growth are capital expenditures for AI (as discussed in DSw281), healthcare for the aging population, and gambling (including sports, prediction markets, and cryptocurrency). Education across the board is hit with a demographic cliff and other headwinds, including government financing pullbacks, lower immigration, and declining international student numbers.

The international picture for deficits and rising long-term interest rates is challenging in the Western world, particularly in the UK, France, and the US.

Even as policymakers try to lower short-term interest rates, the long-term rates rise in step.

Given these recent reports, I gave some thought this week to the devaluing of the Dollar and the various alternatives. For this, I read up on what Balaji is saying about this topic because he’s been prescient about many of these mega trends in the past. Here is a recent post of his on India’s potential ability to decouple from the Dollar, and his suggestion that ‘if you have to hold fiat, you should be in AED (UAE Dirham) or SGD (Singaporean Dollar')’.

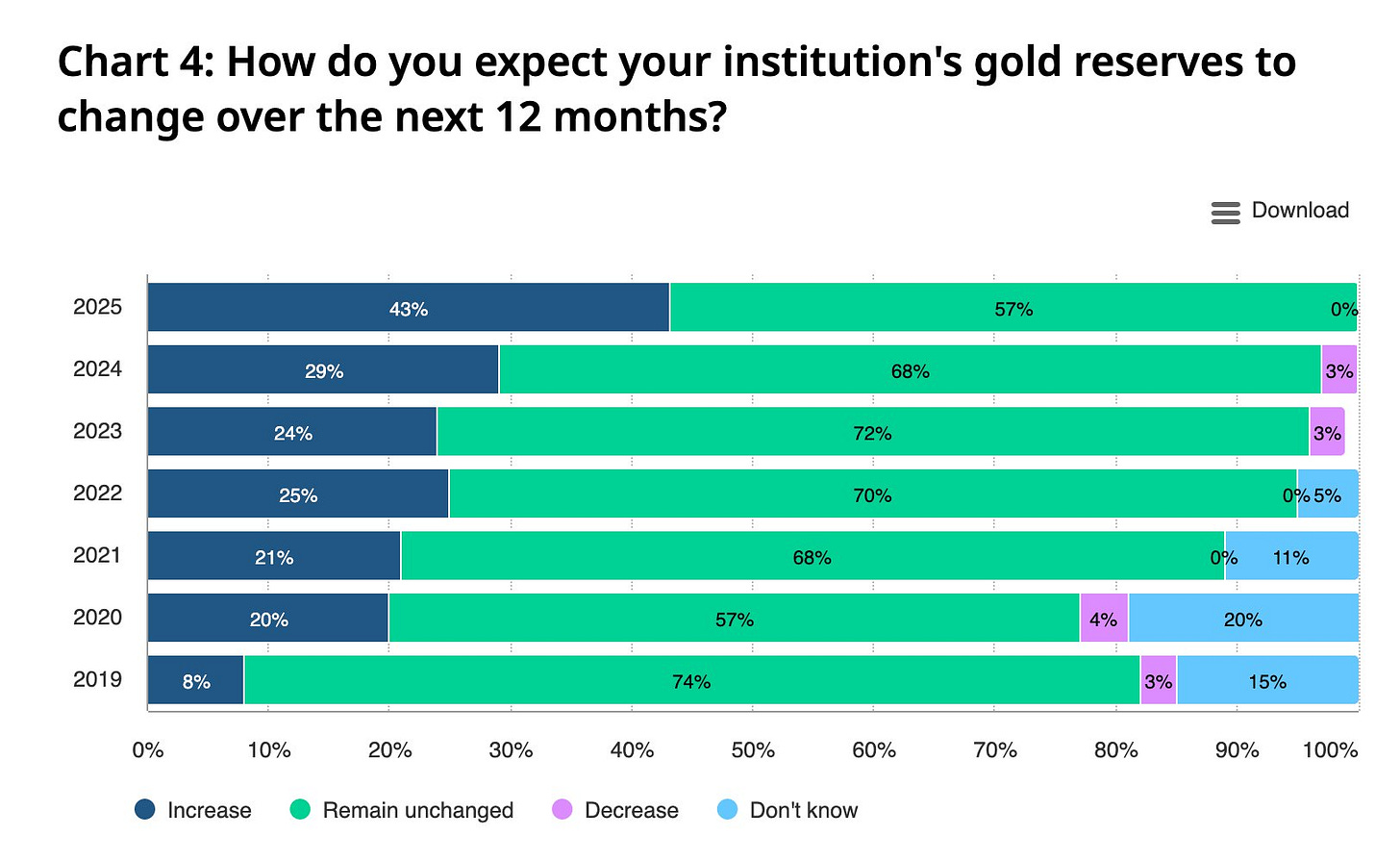

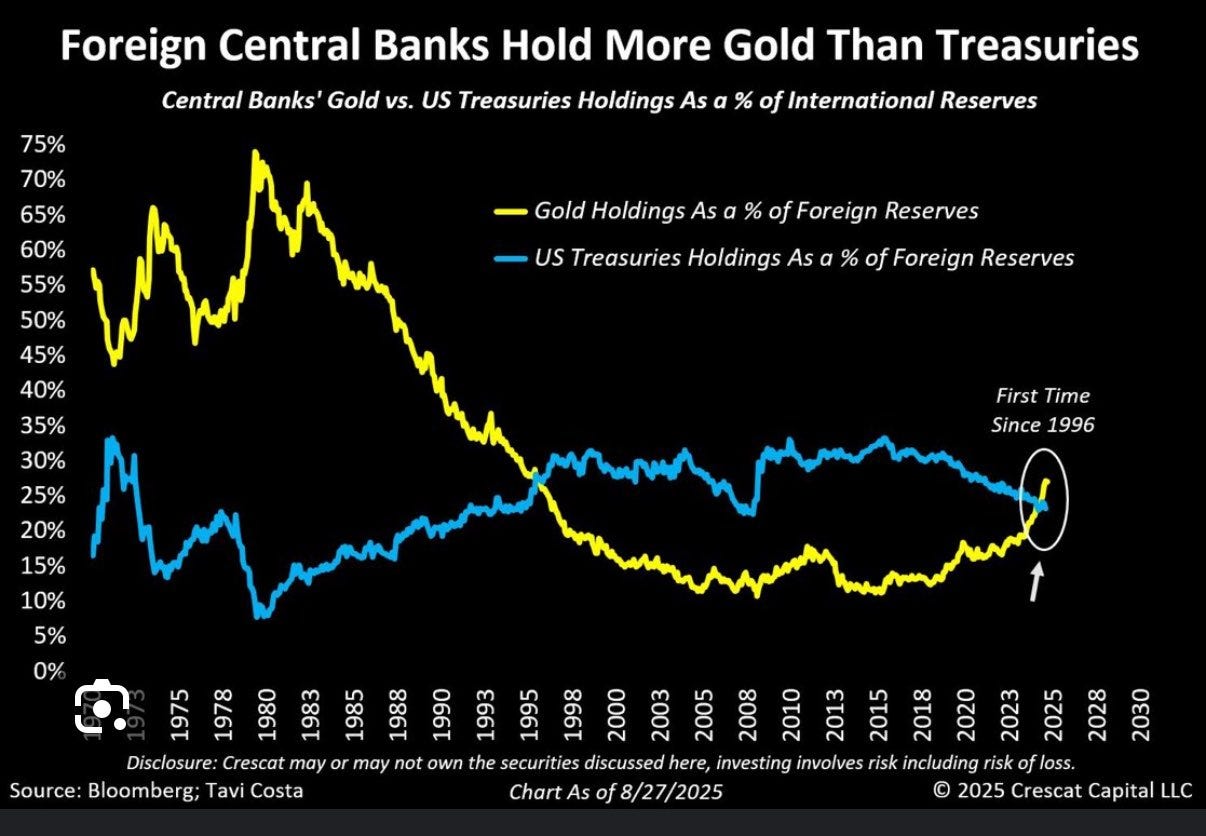

The story of the year is about Gold, which, year to date, is the best-performing asset. Goldman recently predicted that Gold could go even higher if the Federal Reserve’s independence were damaged, which seems to be happening.

We last talked about Gold and Bitcoin in April (DSw267). If you bought, then you’d be up something like 25% on the position.

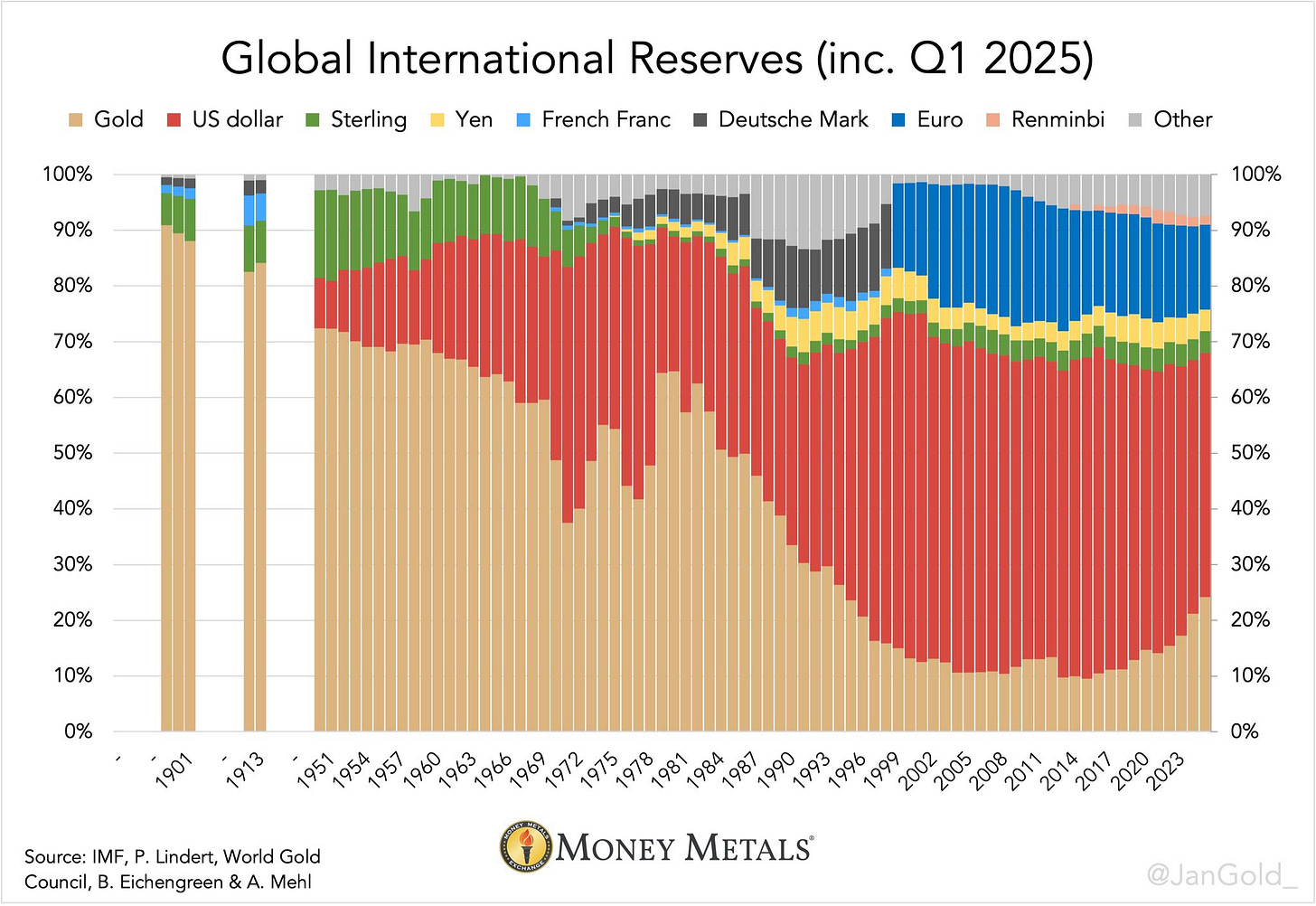

Central Bank Gold Reserves Survey 2025. Central bankers expect to buy more gold. Poland announced that it is moving its target from 20% to 30% of its reserves to gold.

I was at a dinner party recently and spoke with an early Bitcoin guy who still operated a mine and probed about Tether buying Gold and the Gold vs Bitcoin price; he just smiled sweetly and said ‘No comment.’ Sadly, as I was about to press him (‘is that the best you can do?!’), we were called to a group discussion. The thesis underlying both is the same: the decline of trust and reliability in traditional financial institutions, particularly central banks. Nevertheless, it appears that the market believes Gold to be the more reliable and winning asset to express this view.

It’s worth noting that the weaker USD supports bull markets in several ways (this was sent to me by my friends at Frais Capital):

First, as we measure global money supply in USD, any weakness in the USD will be positive for monetary conditions and asset prices.

Second, a weaker US has been especially helpful for commodities, which, of course, are priced in USD. Commodity companies tend to outperform when the USD weakens, too.

Third, a weaker USD is a direct support for US profits. US companies derive around 35% of their earnings from abroad so these earnings will be boosted if the USD depreciates. In the recent US reporting season companies with bigger international exposure have enjoyed the bigger EPS upgrades.

Speaking of crypto-land. There’s an increasing acceleration of large-scale adoption and liquidity seeking in various aspects of what I now like to call ‘the majors’: Bitcoin, Ethereum, and Solana, all the stablecoins, and FinTechs building their own (Stripe).

One area of concern is the increasing scrutiny of Digital Asset Treasury Companies (DATCOs or DATs), of which Strategy (MSTR) is the largest and most well-known for its significant Bitcoin purchases. $ENA (Ethereum Foundation) is also worth examining in terms of tokenomics dynamics. The latest announcement is to set one up to purchase $1B worth of Solana that would help the earliest token backers provide liquidity to their investors for coins locked up.

As these DATs grow, it’s worth looking to the past for clues to the future.

The Tempo announcement from Stripe and Paradigm to build a ‘permission-less’ chain is worth paying attention to, too. I agree with this take on the threat to the payment networks of Visa and Mastercard.

Tempo is a clear shot across the bow that they are trying to build the next-generation Visa network. There are many features here that make it a more practical network for businesses. The “credible neutrality” and “collaboration” are because Stripe may not want to risk appearing to solely build a competing payment network. Which they clearly are, and gaslighting everyone while doing so. They are openly declaring war against everyone building in stablecoins, the payment networks, and the banks.

Other Trends Worth Noting

Psychedelics as Medicine notched a big win this week as AbbVie paid $1.2B to acquire Gilgamesh's lead investigational candidate, currently in clinical development for the treatment of patients with severe depression. One of the first massive wins for this trend as many of the early publicly traded plays, like Compass Pathways, have not recovered from their ATHs five years ago.

Death of the Corporate Job - This was the most popular essay on Substack this week, clearly hitting a nerve. This is the flip side of ‘everyone is an entrepreneur or they will need to learn to think like one.”

Pets as Family is not a mega trend that I’m actively investing behind, although it’s undoubtedly happening. This article on Doodlemania: Goldendoodles, labradoodles and bernedoodles are everywhere. They’re now also a high-stakes, billion-dollar industry (in PDF) is a sign of the times.

Song of the Week: Alright

Here on YouTube.

As self-described: As Tycho, Scott Hansen blends swirling melodies into vaguely triumphant arcs that crisscross between stuttering beats and vocal samples, creating rolling sonic landscapes that extend into the horizon.

This song in particular kicked off his 2020 album Simulcast:

“After 10 years of constant movement and change, Simulcast felt like a resting place after a long journey. A return to a familiar place to rest and regroup. For me, this song is the most clear expression of that idea, a comforting voice reminding me that everything was going to be alright.”

“Alright” by Tycho

InstrumentalSelfie of the Week

Labor Day was a good time to ‘touch grass’ and there is no place better than at the ‘hall of mosses’ in the Hoh Rain Forest inside Olympic National Park, just a four-hour drive from the Seattle airport. It’s a good long weekend trip, particularly if you have business reasons to be in Seattle. Highly recommend.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

Interesting points about Venezuelan oil