Distinto

w.281 | Figma, AI Bubble (?), CapEx, Profitability, & Conscientiousness

Dear Friends,

We’ll start this week with a brief housekeeping item. For unknown reasons, Gmail has flagged at least some responses to this newsletter as spam. I caught this week (luckily, because a few dear friends had written!), but I don’t know how long it’s been going on. If you emailed me a response and I did not answer, please send it again - and sorry!

I hope you are enjoying August. We are still in stone fruit season here in Texas, and white nectarines have become a daily delicacy in our kitchen.

Today's Contents:

Sensible Investing: Trends

Song of the Week: Distinto

Sensible Investing: Trends

Figma’s IPO was Fine, Actually. IPOs are the worst listing process — except all the others, in FT Alphaville.

Matt Levine also brings some common sense to the discussion about the secondary market for OpenAI and the basics of supply and demand. This sort of discussion is much more intellectually enriching than numbers on how many times early venture investors made back their funds, because of the obvious oversimplification (though it’s still great for those funds and their LPs, of course!). To quote:

Only 7% of 93% of Figma’s stock was offered in the IPO; the other 97% doesn’t trade yet.

Of that 7%, most was sold to “certain long-term institutional shareholders,” whose distinguishing feature is that they were not planning to flip the stock for a quick profit.

So only, like, what, 2% of the stock is freely available to trade?

Everyone on Robinhood wants some, but they have to pay.

And so one analysis could be something like “the 98% of Figma that is locked in the hands of long-term institutional investors and still-restricted employees is worth $20 billion or so, but the 2% of Figma that is freely available to everyone trades at like a 200% premium.” That is not particularly correct or rigorous — there’s only one actual market for Figma’s stock, you can’t really separate it like that, and probably the free float is considerably above 2% — but it’s a useful way to think about it. The price of Figma’s traded shares is relatively high, because they are relatively scarce.

Figma, after its first day of trading, became the most expensive U.S. tech company by Forward Price/Earnings valuation multiple (602x). And it’s already down 36% from its IPO pop (which is still up significantly from the IPO price).

If you bought PLTR or NET at IPO, you’d still be very happy today, although today is ATH day, so we’ll revisit 1- and 5-years from now and see how the story unfolds.

Dividend Growth Investor had a nice analysis about buying Cisco in 1999 at high P/E and taking 25 years to grow into fundamentals. Buyer beware.

Cisco Systems $CSCO managed to grow earnings from $0.29/share in 1999 to $2.57/share in 2025 The share price has registered zero capital gains in the past 25 years however. That's mostly because the stock was massively overvalued in 1999 and 2000, selling at a triple digit P/E ratio.

One of my ATX VC friends shorted the pop on the thesis that FIG isn’t an AI company and the AI-native entrants (Lovable, etc.) will slow growth and take market share. She was happy this week, but time will tell.

Before we get into the AI bubble, we’ll set expectations with the lopsided Net Income Growth that comes from the top 10 performers in S&P over the last five years and the lack of meaningful growth from most of the index (this graph is modulated by inflation). Important to note that in 2019, Nvidia wasn’t in the top 10, so this is very much a retrospective chart, and no one can predict the future.

The AI Bubble is So Big it's Propping Up the US Economy (for now) by Blood in the Machine.

Microsoft and Nvidia are benefiting from bona fide historic levels of investment. Chris Mims cites the analysis of investor and programmer Paul Kedrosky in his most recent column in the Wall Street Journal:

spending on AI infrastructure has already exceeded spending on telecom and internet infrastructure from the dot-com boom—and it’s still growing… one explanation for the U.S. economy’s ongoing strength, despite tariffs, is that spending on IT infrastructure is so big that it’s acting as a sort of private-sector stimulus program.

Capex spending for AI contributed more to growth in the U.S. economy in the past two quarters than all of consumer spending, says Neil Dutta, head of economic research at Renaissance Macro Research, citing data from the Bureau of Economic Analysis.

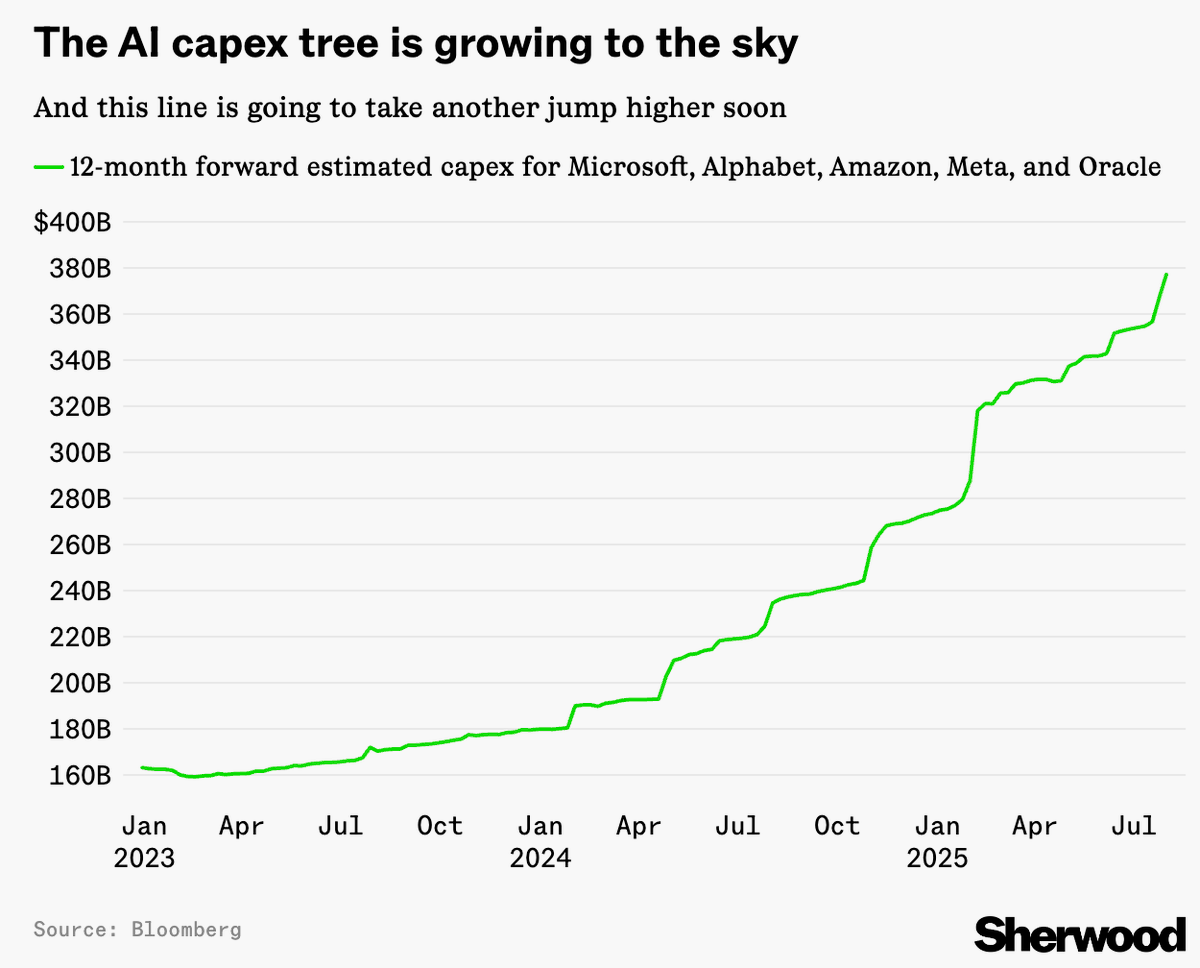

Chart of the same thing, but includes Oracle and makes a 12-month estimate instead of quarterly expenditure.

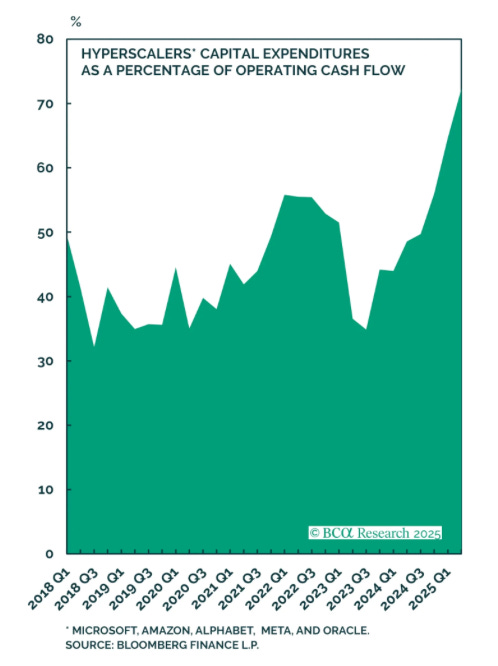

So far, most of this expenditure has come from operating cash flow, but that is now changing. Meta, for example, is working with PIMCO for $29B data center expansion project.

Conversations I’ve had several times this week are that much of the startup activity or incentive schemes in the current era are those that find revenue in the capex spend of the Mag7. Which often means the following:

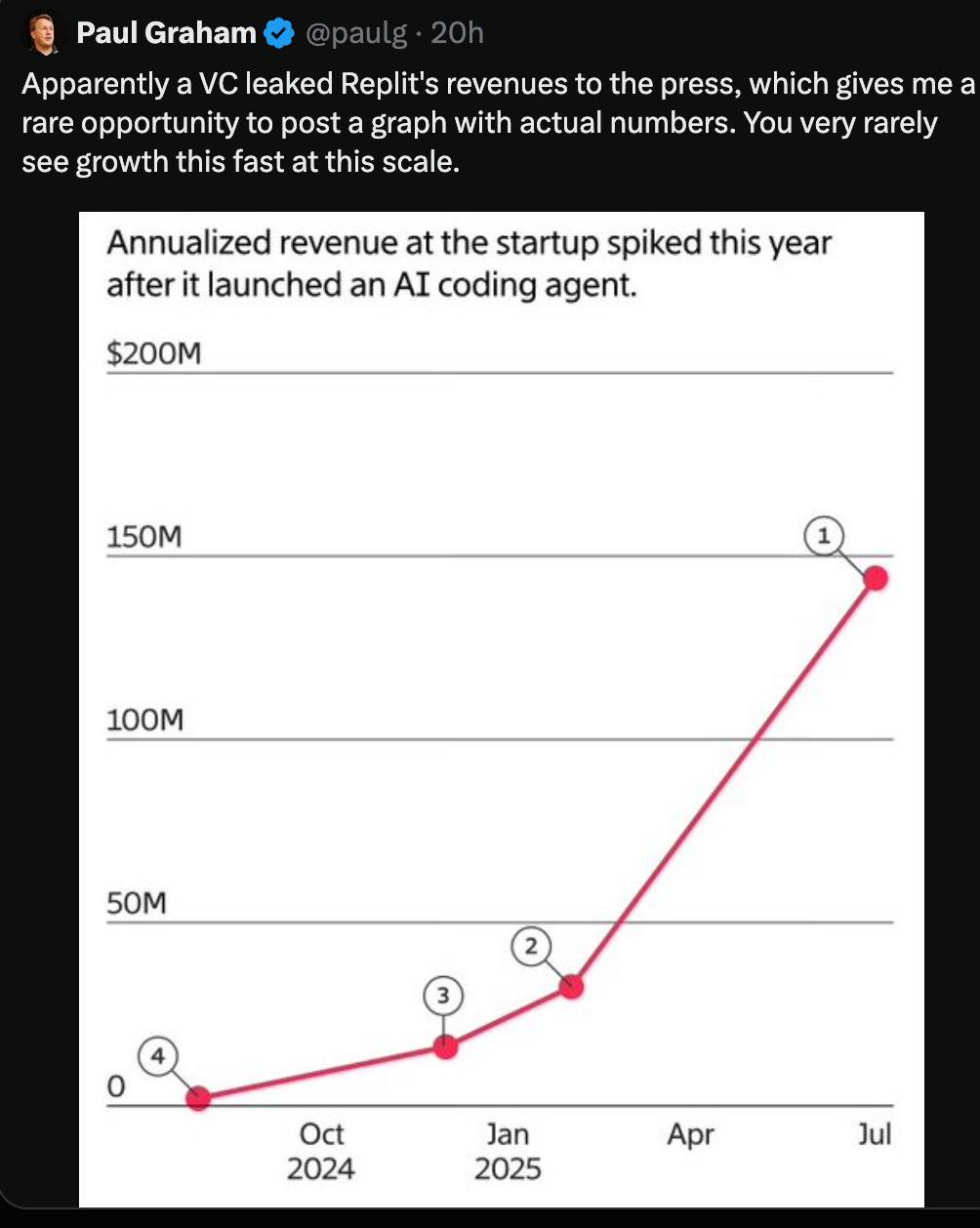

The other consideration to track in all of this is the profitability (or lack thereof) behind much of the inflection growth numbers. How it all pans out is to be seen:

The discussion below (and linked here) captures the profitability dynamic.

In visual form:

Also, the competition comes from those with existing distribution.

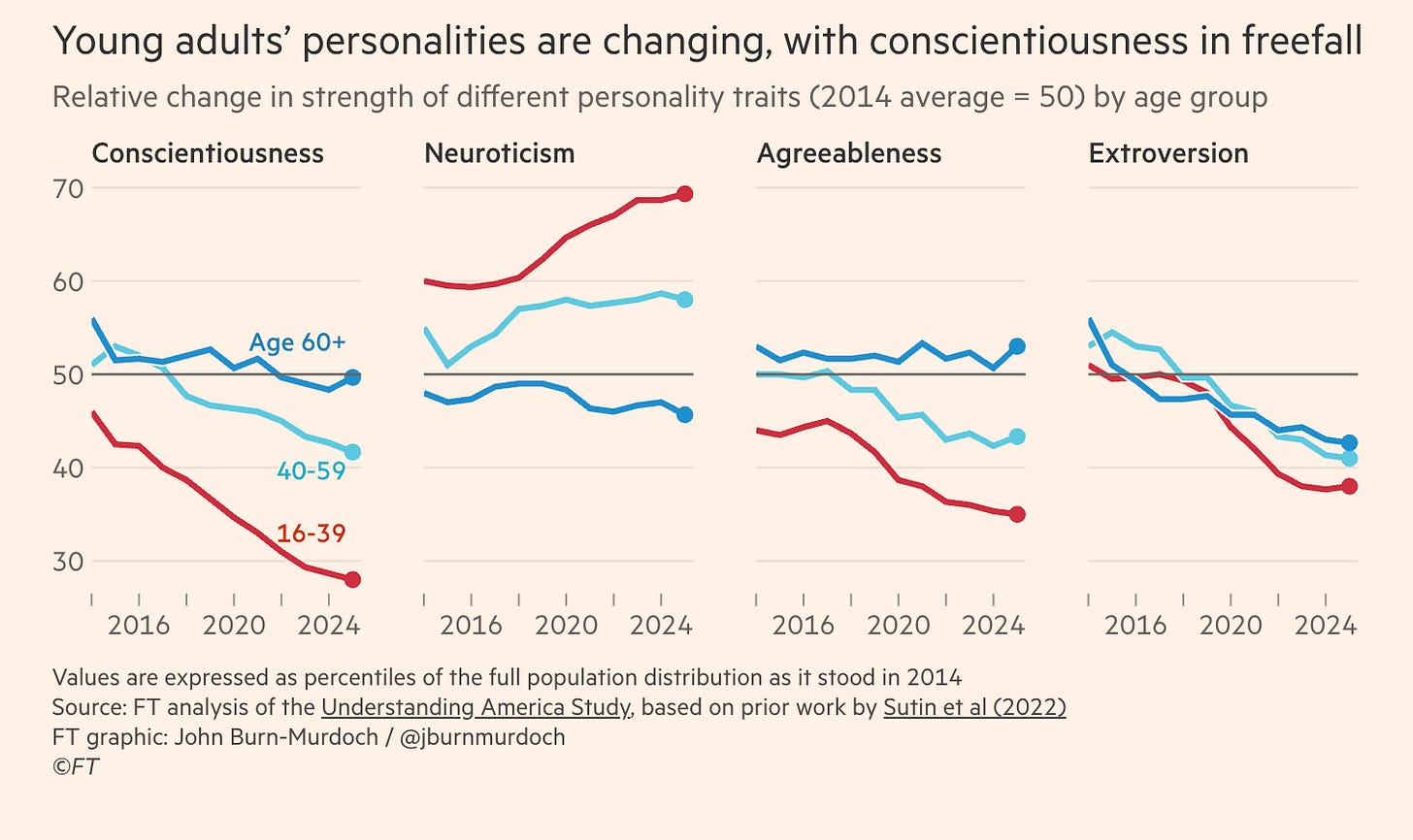

The Troubling Decline in Conscientiousness presented data from Understanding America in the FT. Sharing one person’s point-of-view, I spent my Saturday evening with a group of friends on a porch, eating and sharing stories; one brought their three teenagers along, including a rising freshman at Texas A&M who was more than happy to engage us all in conversations. Here’s hoping there are more out there like him.

Song of the Week: Distinto

Here on YouTube.

Orishas is a Cuban hip hop group. In 1999, Fidel Castro threw a party for them and had a meeting with all the musicians - the first time the Cuban government showed support for hip hop music.

"Distinto" by Orishas is a song that celebrates the uniqueness and distinctiveness of the Cuban hip-hop group. The lyrics convey a sense of confidence and pride, highlighting their style, flow, and musical offerings. The song also encourages listeners to embrace their individuality and find joy in their personal experiences. This is always a good message :)

It’s on their El Kilo album (from when those were still a thing) and is my favorite of their five albums; it was a college album for me (debuted in 2005). El Kilo, the single, is also worth your time and is about the consequences of deception in society (relevant to the grift economy).

“Distinto” by Orishas

Bajo pa´ zona la pandilla ya llegó

Acaso no ves que es distinto de flow

De style, de estilo, dilo acaso no ves

Que es distinto, dis, dis, distintoSelfie of the Week

Over the last six months, I’ve gotten back into hot yoga, inspired by the presence of a studio called Pure, which is walkable from my apartment and is run by a couple who are completely committed and super intense. 105 degrees. 26 postures x 2. Makes 97 feel like a crisp breeze.

When I started in February, I thought you’d have to be a lunatic to do this in the summer, but um, why not? Like many things in Austin, it has cultish vibes but in a good way.

The best part, though, is that after it’s all finished, you exit in an immediately meditative state. Your mind is clear. There is nothing left to think.

You’re invited anytime.

Only one person has taken up this offer so far. You could be the second. Mardy and Jeff will give you a pin for completing your first class.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn