You Gotta Be

w.261 | Owners, Research Commoditization, PE Report, Consumer Spending, & Altimeter

Dear Friends,

Conference season is in full swing, particularly in Austin. As per usual for me, navigating the chaos is notably better during the second go-around than the first.

Since I’ve had so much social time over the last few days, I only have a few fleeting thoughts so far; broader synthesis will happen for me post-event:

Post YC-demo day valuations are out of control (still)

Private Credit has the false allure of being low risk because it never trades down from par until insolvency

*Science* is always in, but speed and real-world application will drive returns in the short-term and the right for a team to continue to take moonshots

James Norman from BlackOps after a long dinner conversation: ‘I can tell you’re a hitter; don’t overthink it.’ Amen and apropos as spring training is underway and life lessons rooted in baseball return to conversation.

Today's Contents:

Sensible Investing

Song of the Week: You Gotta Be

Sensible Investing

Owners Only newsletter from OWM. I’m a gigantic fan of the mega trend toward greater ownership for all. This one focuses on developments in the way that creators and influencers get paid and how companies that use them for marketing campaigns can manage the compensation.

Data-Driven VC is Over. A provocation about the impact of Deep Research - that it’s turned market analysis into a commodity product. Thus, the outperformance will all be ‘gut-feel’ and human wisdom. “In a world of commoditized research, human wisdom is scarce and a competitive advantage.”

Note: I only sort of agree with this. If you do research work yourself (like I do with this newsletter), you evaluate the source quality and the relative importance of topics. This is what ‘wisdom’ and ‘gut-feel’ are made of. While you can just “read the report,” getting the best primary sources and getting closer to the ‘ground-reality’ will matter for refined judgment.

Bain’s Global Private Equity Report 2025. Things we already know: AUM is up, distributions are down, and fundraising is slowing.

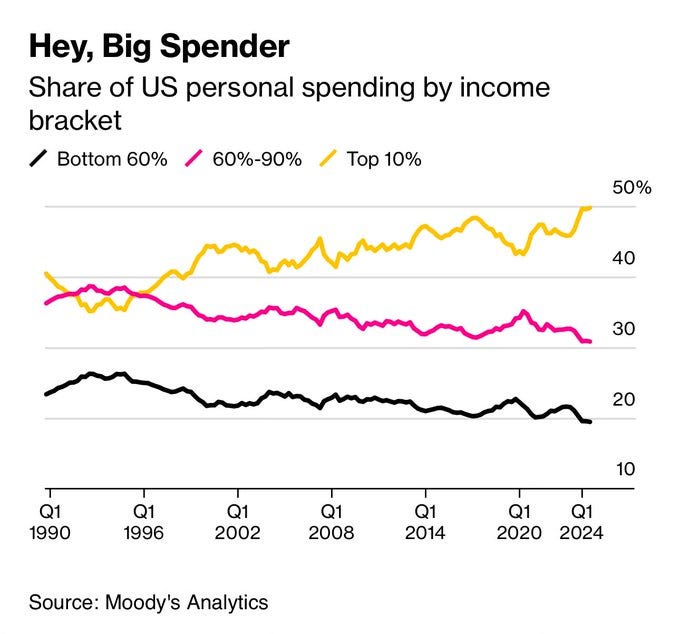

Rich People Are Firing a Cash Cannon at the US Economy—But at What Cost? in Bloomberg. A recent report on the State of U.S. Wealth Inequality from the Fed.

“The wealthiest 10% of American households—those making more than $250,000 a year, roughly—are now responsible for half of all US consumer spending.”

Altimeter returns. Think about this every time you see their marketer tweet.

I liked this take: “Pretty remarkable you can 45x your first fund and will still almost certainly end up losing your average investor (avg $ in) money relative to the index over the long term. What a world.”

And then the response from Raging Capital:

David Swensen: The Biggest Investor Inflows Come Late in the Cycle

“Morningstar did a study of all of the mutual funds in the U.S. domestic equity market, and there were 17 categories of funds. And what they did with this study is, they looked at 10 years of returns and compared dollar-weighted returns to time-weighted returns. The time-weighted returns are simply the returns that are generated year in and year out. If you get an offering memorandum or a prospectus, they’ll show you the time-weighted return. If you look at the advertisements, where Fidelity is touting its latest, greatest funds, the returns that you see are time-weighted returns.

“Dollar-weighted returns take into account cash flow, right? So, in a dollar-weighted return, if investors put more money into the fund in a particular year, that year’s return will have a greater weight in the calculation. So, here we have all the mutual funds in the U.S., 17 categories, time-weighted versus dollar-weighted. In every one of those categories, the dollar-weighted returns were less than the time-weighted returns. What does that mean? That means that investors systematically made perverse decisions, as to when to invest and when to disinvest from mutual funds.

“What investors were doing, they were buying in after a fund had showed strong relative performance and selling after a fund had shown poor relative performance. So, they were systematically buying high and selling low, and it doesn’t matter whether you do that with great enthusiasm and in great volume, it’s a really, really bad way to make money. Very difficult. So, the conclusion for these individuals that operate in the mutual fund market, is that their market timing decisions were systematically perverse.

“I also took a look at the top 10 Internet funds during the tech bubble, something I published in my book for individual investors. And if you looked at the top 10 Internet funds three years before and three years after the bubble, the time weighted return was 1.5% per year. You look at that and you say, 1.5% per year, well, the market went way up and way down, but 1.5% per year, that’s not so bad. No harm, no foul. However, investors invested $13.7 billion and lost $9.9 billion, so they lost 72% of what they invested. How could it be that they lost 72% of the money that they invested, when the time-weighted return was 1.5% per year for six years? Well, they weren’t invested in the Internet funds in ‘97, and they weren’t invested in ‘98, and they weren’t invested in early ‘99. It was in late ‘99 and early 2000, that all the money piled in at the very top. And then, in 2001 and 2002, bitterly disappointed, they sold. So, they lost 72% of what they put in, even though the time-weighted returns were 1.5% per year positive.”

Song of the Week: You Gotta Be

Here on YouTube.

This is a ‘90s throwback to a simpler time. Just a reminder of all the things you gotta be (to stay ahead of AI, etc.).

“You Gotta Be“ by Des’ree

You Gotta Be bad, You Gotta Be bold, You Gotta Be wiser

You Gotta Be hard, You Gotta Be tough, You Gotta Be stronger

You Gotta Be cool, You Gotta Be calm, you gotta stay togetherSelfie of the Week

This week started strong with an institutional allocator conference and SXSWedu. The key to conferences is to roll with a great crew that has a mix of insiders and outsiders.

Michael Billings is an investor and non-profit board member with over a decade of experience managing multi-asset portfolios at a world-class buy-side investment firm and a $10B+ endowment. He is a trusted advisor to a global network of peers and investors - and, I’ll add, looks for original insight and investing thinking outside the norm. He’s also a loyal hype man of this newsletter, which is much appreciated! Warm welcome to all my new friends :)

Limmy, whom you have met before, is the number one online content creator with respect to college admissions and has a large social media following of ambitious college-bound students and their parents. Yes, an Austin mom spotted and stopped him at a restaurant.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn