What It's Like

w.296 | Luminar, Market Outlooks, Crypto, Duolingo, Buffett, Future of Doctors & Market for LLMs

Dear Friends,

Merry Christmas, Happy Hanukkah, and enjoy the holiday season however you happen to celebrate.

It’s nice how sometimes the calendar falls just right, and the holidays align with weekdays, making it easy to keep your routines going.

Below are a few end-of-year reads, too.

Today's Contents:

Sensible Investing: Trends

Weeklies: Selfie & Song

Sensible Investing

Luminar Files For Bankruptcy. Following up on this from when it was highlighted in DSw.256. A story from the SPAC era.

How Warren Buffett Did It. The most successful investor of all time is retiring. Here’s what made him an American role model by Seth Klarman. One last Buffett read, I promise.

The Role of Doctors Is Changing Forever. Some patients don’t trust us. Others say they don’t need us. It’s time for us to think of ourselves not as the high priests of health care but as what we have always been: healers. A thoughtful reflection in The New Yorker.

2025 LLM Year in Review by Karpathy.

The Decline of Duolingo Should Be a Warning of the Failings of AI. I hate to pick on Duolingo again, but I‘m going to. It’s just the ‘enshittification’ thesis.

In a market that demands constant economic growth, Duolingo did what every other once-hot business did, even as its loyal users revolted: it made its platform actively worse. The exhausting and futile fight for perpetual profit, for ever-growing customer bases and opportunities for growth beyond reason, requires an active contempt for your consumers. It expects you to willingly swallow whatever slop is flung your way because they believe you’ll stick around no matter what. You put in all those months of lessons, and that damn owl has berated you into maintaining an impressive streak, and you wouldn’t want to lose it, would you?

On that note, here is the latest EdTech Market Overview from Oppenheimer.

2026 Food Industry Predictions. Not my space, but interesting to read.

13 2026 Market Outlooks from leading financial institutions. Compiled by Brett Caughran.

This is the list from Apollo, which I think is broadly correct. #5 is the most significant risk for startups that saw hypergrowth in 2025.

1. The 45-Million-Person Headwind Student loan payments restarted. Nearly 20% of the population just saw their disposable income shift. The "spend-at-all-costs" era is cooling.

2. A Widening K-Shaped Economy We're not in one economy - we're in two. Asset owners thriving on record highs. Lower-income brackets are hitting savings exhaustion.

3. Student Loan Delinquency Spike. It's not just about payments. It's about default risk rippling into auto loans and secondary credit markets.

4. The "One Big Beautiful Bill" Starting Jan 1, 2026: 100% immediate deduction on capital expenses. Projected to boost GDP by 0.9% alone.

5. AI Adoption Plateaus Hype cycle over. Adoption rates flattening as companies shift from talking about AI to the grind of actually integrating it.

6. The 60% Capex Concentration Mag 7 now spending 60% of operating cash flow on AI infrastructure. The entire market is betting on AI ROI.

7. Zero Growth in Non-AI Capex outside the AI arms race? Flat. Traditional industries are getting capital-starved as every spare dollar chases GPUs.

8. The S&P 7 vs. The S&P 493 Margins are expanding for tech giants. Declining for everyone else. If you're not an AI provider, you're facing a squeeze.

9. Data Center Construction Slowdown Physical limits reached. Power grid constraints and land scarcity are slowing builds. Power generation is the new bottleneck.

10. The 2026 Maturity Wall Massive wave of corporate debt coming due. A refinancing supercycle is moving billions from banks into private credit.

11. The Death of 10-Year Duration "Higher for longer" is here to stay. Investors are fleeing long-duration bonds for floating-rate private credit and short-duration paper.

12. Institutionalization of Sports No Longer "Alternative." Sports is now a $2.5T institutional opportunity with recession-proof cash flows.

13. Foreign Demand for US Yield Despite trade tensions, foreign capital is flooding US private markets. The US remains the safe haven for AI-linked tech and quality yield.

14. Brief Stagflation Risk The Fed is watching a 1970s-style scenario: tariffs keeping inflation sticky at 3% while growth slows. Active management > passive indexing.”

Crypto is Dead essay on X. I broadly agree with this take.

“Crypto” as a self-contained world is dying.

The technology is about to dissolve into everything else, and the people who mistake the old bubble for the end state are going to get left behind.

So why am I still bullish?

Because that death is the gateway to something bigger than the industry we’ve been defending.

Weeklies: Selfie & Song

Selfie: Nerd Dinners, AI & Marketplaces, Dota 2

It’s been a California week for me, and I spent time with my dear friend, Andrey Fradkin “Dr. Drey”, and joined one of his dinners on Economics and AI. Our theme for the evening was the labor productivity effects of AI - in particular, when and how we might see telltale signs of hyper-productivity in software development. We had an initial discussion of this paper on coding agent productivity effects using Cursor data, which shows that more experienced developers were more productive using Cursor than those less experienced.

My contributions to the discussion were about the continued risk of de-skilling and the declining opportunity for people to ‘learn and earn’ as they develop their careers, and instead, the expectation of immediate productivity. Both are hard to fix and have long-term consequences.

I’ve been friends with Dr. Drey for almost two decades; we were Economics majors together in college and have been friends ever since. He hasn’t left the profession and is now a tenured professor on sabbatical with Amazon. He is the leading thinker on digital marketplaces and AI and has a popular economics podcast called Justified Posteriors. It’s dense material even for nerds.

His recent paper has ‘blown-up’ for its astute framing and initial data on the competitive dynamics for various LLMs (see below) and was re-tweeted by the Chief Scientist at Google.

The Emerging Market for Intelligence: Pricing, Supply, and Demand for LLMs. How much does intelligence cost? How concentrated is the AI market, and is it winner-take-all? When prices fall, how does demand change, and is there a Jevons effect? These questions matter, but actual market data has been hard to come by. We use data from Microsoft Azure and OpenRouter to find out.

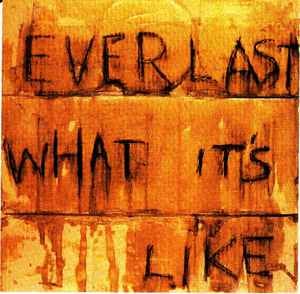

Song: What It’s Like

Here on YouTube.

A hit song from the late 90s about having empathy for people experiencing different hardships. Thought it was a nice holiday message without being an explicit Christmas song.

“What It’s Like” by Everlast

I’ve seen a rich man beg, I’ve seen a good man sin, I’ve seen a tough man cry

I’ve seen a loser win and a sad man grin, I heard an honest man lie

I’ve seen the good side of bad and the down side of up and everything between

I licked the silver spoon, drank from the golden cup and smoked the finest greenThanks for reading, friends. Please always be in touch.

As always,

Katelyn

I greatly appreciated the "crypto is dead" post as I enjoy how it focuses on the industry's evolvement instead of crypto market (bitcoin's) downturn FUD, which can be seen in this post https://x.com/nic_carter/status/2002223319022776605?s=20

Someone's takes (don't know him) I frequently agree with are Sam Lessin's/Slow's thesis on AI https://youtu.be/R_aHzJGrBN0?si=aNchKa_iqG2lDA3w, I think crypto is far easier to implement with real disruptive use cases (biased). Tokenized RE is my thing (didn't go so well in its first iteration into a REIT on ETH, would be easier now) so I'd be curious if he'd go longer form on this/Anatoly would speak on it: https://youtu.be/MCo9keKMQYg?si=vpNfF-oAKMsec6Go

I'm really intrigued with prediction markets relation to the $2.5t sports industry, and believe they have a lot of room to grow. I would pay to learn why the NYSE invested in Polymarket over Kalshi, theorizing it's due to Polymarkets true tokenized platform.

I forgot about "What's It Like"!