What Becomes Of The Broken Hearted

w.300 | Donn's Depot, American Resilience, Carney, More of the Same, & Metals

Dear Friends,

On a reconnaissance mission, I wandered alone into Donn’s Depot in Austin on Friday. Donn’s Depot is a legendary live music venue in town. From the Austin Film Society’s review:

It is a dance hall. It is a honky tonk. It is a piano bar… even a wedding chapel. It has been a gathering place for generations to celebrate live music, milestones, and to leave a troubled world behind. Babies have taken their first steps here. Lives are remembered here.

Bartenders, staff, and musicians have tenures that have lasted decades. The Donn’s community is an unforgettable cast of characters.

I sat upfront at the piano bar with a group of regulars who filled me in on everything I needed to know. We sang along to the Eagles, slipped Donn a $20 for a song request, and I bought our crew a round. Donn himself was playing in a six-person band that included his adult son.

For me, the night was a reminder of how nice it can be to take a break from the Internet and to connect with your neighbors - even if strangers at first - in real life.

Reflections headed into the ice storm; hope everyone’s safe and sound.

Today's Contents:

Sensible Investing: Trends

Weeklies: Selfie & Song

Sensible Investing

US Resilience Resilient, a 2026 outlook published by Goldman Sachs. I’ve very much enjoyed this extensive report, which submits that US preeminence endures due to the country’s unparalleled economic, human capital, and financial market strengths. And despite all the noise - and there is a lot of noise - there is still a system of checks and balances. GS also details the risks of conflict and trade wars with China.

A remark by one political analyst during their webinar was to remember that Donald Trump thinks more like an executive producer of The Apprentice and less like a long-term policymaker, which is a lens for interpreting his public appearances, including the news and events leading up to and during the recent WEF meeting.

GS believes strongly that gold and other metals are ‘unproductive’ assets (p49 & 50), and that they are not great inflation or currency hedges. For what it’s worth, I believe GS may underestimate the potential for the US dollar to be debased.

Also, they believe the rule of law in the US is intact (p34-37) and provided a long list of assurances, many of which are compelling. Regardless of reality, the perception of the rule of law in recent years (not just one party to blame, either) seems to be at stake.

What people believe to be true and what is ‘actually true’ are two different things, but the importance of collective belief cannot be underestimated. Senior people at top institutions (Economists at Harvard, MDs at Goldman, Ministers in Egypt) sometimes underestimate how public opinion can be self-fulfilling and that once strong institutions can fall.

When the rule of law breaks down, it’s replaced by rule by force. Yes, the rule of law is always implicitly backed by force. But direct signals from the government and the market highlight intentionality here; President Trump proposed a $1.5 trillion defense budget. While this is not yet approved by Congress, it would be up $600 billion from the previous year, which is unprecedented. Europe, prompted directly by President Trump and reacting to the perception of weaker assurances of US protection, is also increasing investment, and Mark Carney (PM of Canada) announced this week his intention to double their defense budget.

We will be part of how all this unfolds. For me, I’m still long America and believe the central points of the US resilience thesis stand, although I’m not selling gold or my international equity exposure :)

The report includes imagery of the American Bison, a symbol of resilience and the national mammal of the United States, as well as the bald eagle.

America’s Statistical System Is Breaking Down (BBG). Canceled surveys, missing datasets, and staffing cuts are leaving the US with growing blind spots — and weakening trust in official numbers. Much as most news is now behind paywalls, we may be hurtling towards a future where we also pay for proprietary data sets.

“Principled and pragmatic: Canada’s path.” Mark Carney’s remarks this week went viral. It was a serious speech, an honest reflection of the state of play among various nation-states and a policy proclamation for his country:

For decades, countries like Canada prospered under what we called the rules-based international order. We joined its institutions, praised its principles, and benefited from its predictability. We could pursue values-based foreign policies under its protection.

We knew the story of the international rules-based order was partially false. That the strongest would exempt themselves when convenient. That trade rules were enforced asymmetrically. And that international law applied with varying rigour depending on the identity of the accused or the victim.

This fiction was useful, and American hegemony, in particular, helped provide public goods: open sea lanes, a stable financial system, collective security, and support for frameworks for resolving disputes.

This bargain no longer works.

Let me be direct: we are in the midst of a rupture, not a transition.

…

We are doubling our defense spending by 2030 and are doing so in ways that builds our domestic industries.

I take him at his word, but this is probably the right take, too: Canada Doesn’t Have the Cards:

Carney has marketed his deal with China’s Xi Jinping as a significant pivot. For now, it’s mostly symbolic. Canada’s “agreement in principle” with China is not a comprehensive trade deal but a narrow swap: Ottawa will allow up to 49,000 Chinese electric vehicles per year under its most-favored-nation rate of 6.1%, down from the 100% duty Canada imposed in 2024. That’s about 3% of annual new-vehicle sales. In exchange, China will cut tariffs on Canadian canola seed from approximately 84% to 15%, with limited relief promised for other agricultural exports.

Whatever pose Carney strikes, Canada’s balance sheet still points south. In 2024, the United States bought 76% of Canada’s exports and supplied 62% of its imports, with Canada running a $102 billion goods surplus in the relationship. China sits on the other side of the ledger: Canada ran an almost $60 billion deficit with Beijing that year, even though the relationship is far smaller in scale. China accounted for 12% of Canada’s imports but took only 4% of its exports. In other words, China sells into Canada far more than it buys from it, making it a source of intensive competition for Canadian producers without offering them a substitute for U.S. demand.

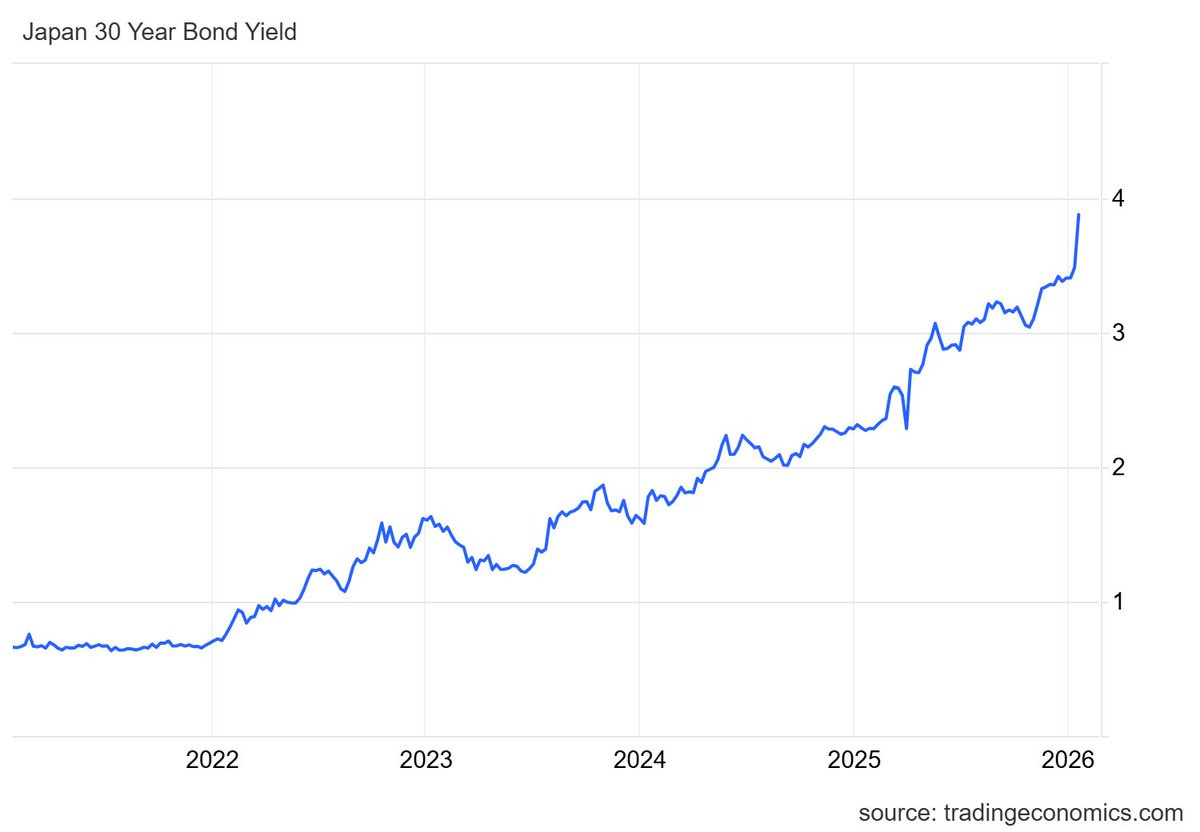

Also, Japanese 30-year bonds are worth keeping tabs on. Not a great trend line. After a long time, this happened all at once; these bonds have not been above 3% since before 2000 and had not eclipsed 2% since 2012.

2026: More of the Same, Increased Intensity

In the last two years, I published a list of Obviously the Future predictions, but I decided not to go into depth on a new list this year. Mostly because I stand by all 18 trends highlighted before and believe we will see more of the same, with increased intensity. I’m also skipping all AI predictions because you can read plenty of those elsewhere; my belief is that the same themes of increased intensity and a ‘Year of Implementation’ remain.

To share a few more thoughts, though:

The Overton Window continues to open, and maybe this becomes a perception with the rule-of-law issue.

K-Shaped Economy is More Pronounced. The wealthy drive most consumption, and those at the bottom buy based on cost or government subsidies. Asset inflation and weakening the dollar also benefits those with assets to start with.

In venture capital, there is too much capital chasing too few good deals, and that’s likely to be a drag on returns for the sector, although there are always a select few firms, funds, and companies that can outperform. This interview with an allocator at Carnegie Mellon makes this point and expresses excitement about a lower-mid-market buyout instead. Ironically, Equal Ventures illuminates the VC asset class conundrum with more detail about Seed and Series A firms like itself in their State of the Venture Market and advises founders to seek resilience. Two points for honesty.

In K12 Education: Money following students is the biggest driver of potential systematic change

Public schools are reporting continued declines in attendance and enrollment. Since most school districts are funded based on school attendance, this has a dramatic impact on their budgets, particularly because most of their costs are fixed (e.g., buildings, teachers). Several factors are at play here, e.g., immigration enforcement, demographics, and preferences for private options.

Funding students through Education Savings Accounts (ESAs) or other mechanisms is the biggest driver of system change in recent memory and has significant potential to impact education technology buying.

The learning impact (or lack thereof) of AI. While access to AI tooling is now strong, its implementation is more muted, and its impact on learning is mixed. There is always a backlash against EdTech hype, and the tools still have a lot of potential, but they’re not a silver bullet for most kids (strugglers). Better software for running systems is always appreciated, though (e.g., vertical SaaS 3.0).

Workforce:

AI-augmented work

AI is becoming embedded in everyday workflows, automating routine tasks and changing job content rather than fully eliminating roles, especially in clerical, customer service, and industrial jobs.

Demand is rising for workers who pair domain expertise with AI fluency, data literacy, and cybersecurity skills, making “AI plus human” roles a major growth area. Professional services will be a key area of change here.

Skills-first labor market

Employers are increasingly emphasizing skills (certifications, portfolios, experience) over formal degrees, partly to address shortages and expand talent pools.

This shift benefits workers who reskill or upskill through short programs and apprenticeships, but does not fully erase pay gaps between degree- and non-degree holders.

Ownership:

The creator economy is becoming the ownership economy as creators are full-time entrepreneurs, and that is a long-term career path. Audiences trust creators more than brands. Outlets have named 2026 as ‘the year of authenticity,’ and consumer brands are co-founding companies with creators, as built-in distribution.

The circular economy for used clothes and durables will continue to grow. You can read more on 12 Vintage & Secondhand Fashion Predictions for 2026.

Weeklies: Selfie & Song

Selfie: Broken Pieces, Fixing Anew, Bison Spirit

For a couple of years, I’ve been tracking a ceramic artist duo obsessively. I procured a couple of their minor pieces through their occasional online drop sales that sell out in minutes, but I had missed out on the last few.

In December, they were hosting an open studio in LA that just happened to be very close to my friend’s childhood home. He got up early, waited in line, and grabbed eight prime pieces for me. Amazing! What a hero! Thank you, Michael!

However, it was up to me to figure out how to get them home, and in a series of bad decisions regarding packaging and shipping that are mine and mine alone to bear, I arrived home to Austin to a slurry of shattered pieces.

As I was in the depths of heartbreak, Neil, a professional solver of other people’s problems, bought museum-grade epoxy and glued all pieces back together. We haven’t quite gotten to the Kintsugi stage, but we’re on the path.

(For those new to the space, like me in the last two weeks, Kintsugi is the Japanese art of repairing broken pottery by mending the cracks with lacquer mixed with gold, silver, or platinum. This technique not only restores the object but also highlights its history and imperfections, celebrating the beauty in brokenness.)

I hope to feel the ‘beauty in brokenness’ soon.

Lucky for me, the good people of Buffalo, NY gifted me (and appropriately packaged & shipped) a ceramic Bison last fall, which is now prominently displayed in our home and an apt reminder to charge on.

Song: What Becomes Of The Broken Hearted?

Here on YouTube.

This is such a great, classic song. It’s also a song of resilience. Despite the overwhelming sadness, there’s a determination to seek peace and carry on.

So, let’s be like the American Bison and face the storm. Also, my life advice? Find a guy who can put Humpty Dumpty back together again.

“What Becomes Of The Broken Hearted” by Jimmy Ruffin

Now what becomes of the broken hearted?

Who had love that's now departed

I know I've got to find some kind of peace of mind

I'll be searching everywhere

Just to find someone to careThanks for reading, friends. Please always be in touch.

As always,

Katelyn

My predictions surrounding gold parity have definitely underperformed in recent months, with Bitcoin continuing to circle around $90,000 and gold topping $5,000, as currently our hovering price would be approx. $108-110,000. Interestingly, it appears that family offices abroad view Bitcoin as having an endowment bias, which is not ~untrue~.

The joy of intense snowfall is akin to Blade Runner 2049's end scene of Joe looking up at it falling, there's an interesting lack of sound deadening that only seems to happen with snow.

It seems Cowork has eliminated a ton of AI investments that have happened over the past few months, as it seems VC has invested in AI for (X) especially in the B2B space. I also saw a clip from Brian Chesky on TPBN where he stated that people should make AI for consumer.

I believe the consumer is largely "tapped out" for their average $1,100 yearly spend on subscriptions, and I am very bullish on Anthropic's extensive enterprise focus will easily beat out wrapper startups. We see consumers "tap out" with Altman's tweet supporting ads, because users want to "use a ton of AI without paying for it".

If users cannot justify $20 for ChatGPT, they will definitely not justify $20 for AI for (X). I largely think Apple/Google will beat out Microsoft/OpenAI by focusing on on-device AI instead of cloud compute.

I use a "one in, one out" rule for subscriptions, (https://www.gq.com/story/true-confessions-of-a-subscription-hoarder) so I've enjoyed trying Codex 5.2 but cutting it and using Claude. T3.chat is a good way to gain exposure to most models for $8/mo, it's like a charcuterie board for AI models.