The Fall

w.290 | Private Credit, Crypto Collateral, Bank Profits, SNAP & School Choice

Dear Friends,

Pardon the delay. I got to professional inbox zero earlier this week, and it feels like a real accomplishment.

I did not even have to resort to ‘email bankruptcy’, i.e., telling everyone that you are starting over and simply can’t get through the backlog.

Either approach works, but I must say it is nice to have this clean slate.

Today's Contents:

Sensible Investing

Weeklies: Selfie & Song

Sensible Investing

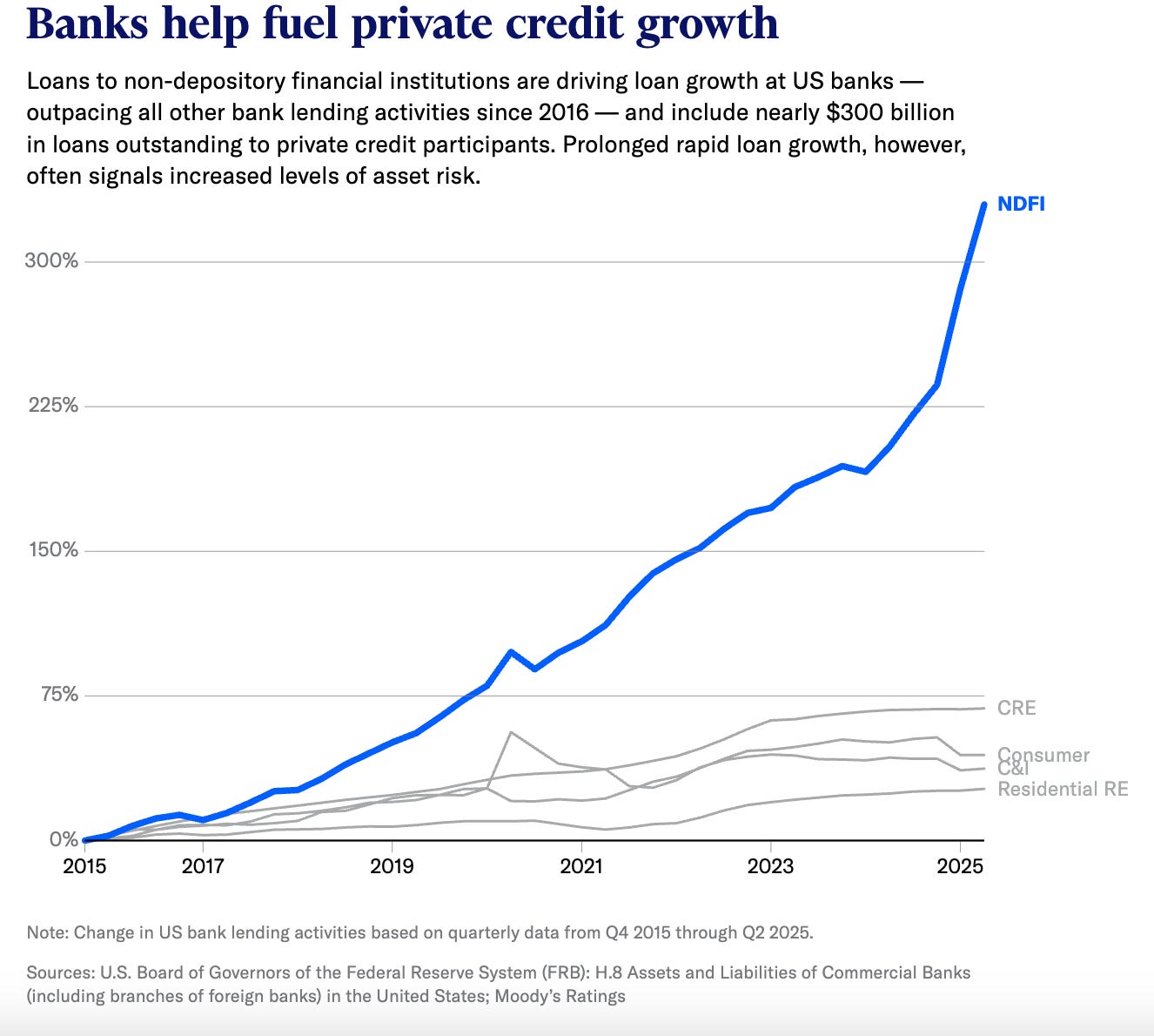

US Banks’ Private Credit Loan Exposure Nears $300 Billion. Report from Moody’s with cool graphics.

Risk is rising, especially for smaller banks: Aggressive growth and competition could weaken underwriting standards and elevate credit risk.

Concentration risk is a concern: Banks tend to have concentrated exposures to a small group of private credit managers, according to a 2024 Moody’s Ratings survey of banks’ private credit exposures.

The true risk of exposures can be hard to assess: Many private credit instruments are illiquid and opaque and have only internally managed valuations.

Transparency in banks’ loan exposure is improving, but new light exposes gaps: New reporting rules offer more granular data on banks’ NDFI lending, but the disclosed categories are still fairly broad and indistinct, and the data is not reported at the consolidated, holding company level.

JPMorgan to Allow Bitcoin and Ether as Collateral in Crypto Push. Only institutional investors for now. But notable.

Bank Profits Face Possible $170 Billion AI Hit as people automatically move their cash to higher-interest accounts. Another reminder to move your assets to a high-interest savings account. Maybe the Tether business model isn’t so crazy.

Consumers hold $23 trillion out of a total of $70 trillion in accounts with close to zero interest rates, while the remainder is held in accounts that often pay relatively low rates, according to the research.

Customer use of AI agents could lead to a 9% profit drop for banks, some $170 billion, if they do not change their business models. That could push average returns for banks below their cost of capital, the consultants said.

SNAP (Food Stamps) Funding Expiration Set to Hit 40 Million People. The US Government shutdown is now the 2nd-longest ever. We are now starting to see more pressure mount on systems well beyond air traffic control.

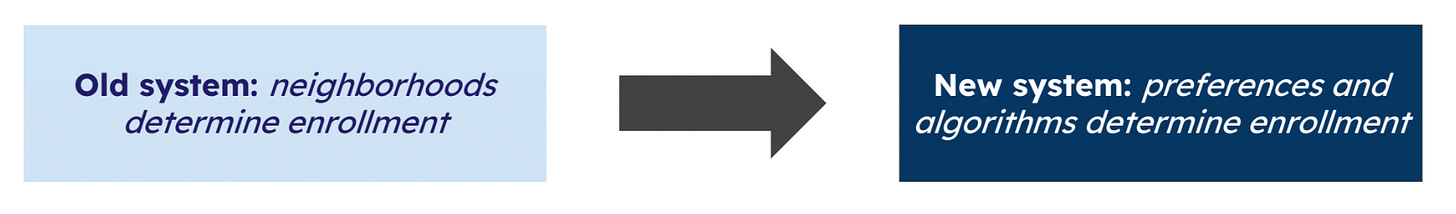

Families Aren’t Waiting for Schools to be Fixed: A new report (link to PDF) on Arkansas’ ESA (Education Savings Accounts) program shows families aren’t dabbling with school choice. They’re defecting and not looking back.

As you know, I’ve been long this avalanche for years, and the inflection point is finally here. Texas starts implementing an extensive ESA program next year, and Odyssey - one of my earliest portfolio companies in Avalanche Fund 1! - just won the two-year contract to orchestrate the whole program.

School choice shouldn’t be controversial, but it is hotly contested by the status quo actors who don’t want competition. Transitions in extensive public infrastructure are complex, and implementing a new system is tricky. Public trust doesn’t come easily.

The truth is that a variety of choices and ample competition are critical for accountability and quality improvement. It’s the key to moving from a one-size-fits-all model to one where each student can thrive in a tailored program. Also, school choice implementations have forced public schools to up their game and offer programs that parents want and that produce results.

The cultural and system shift is accelerating and opening up three opportunities:

New schools and formalization of support for homeschooling, micro-schools, and pods (the new alternative education),

School system orchestration software, and

Inside services, or companies selling innovative programs to the traditional public system, that help them improve curriculum options and offer choices within the existing system.

These choice programs are not new. Over 80 countries offer some form of coordinated system, but in the US and globally, these systems are going to digitize and grow.

This is on my mind this week because I spent time with Chris, the CEO of Tether (see below).

Weeklies: Selfie & Song

Selfie: Chris Neilson, Academia, Enrollment Systems

Professor Christopher Neilson has it all worked out. If he succeeds, every human capital development program from pre-K through college will use his software to manage enrollment, admissions, and selection.

Chris and I met with partners and investors this week for his company, Tether Education, a school enrollment and choice orchestration platform, for which I am an early investor and part-time contributor.

Chris has spent most of his career ‘crushing it’ in academia (he’s a Professor of Macroeconomics and Global Affairs at Yale). He is also one of the only academics who is focused externally on implementing and tweaking in real time. He tells me he has 10+ ‘top 5s’, e.g., papers published in the top 5 economics journals, something he can accomplish because he has access to better data than everyone else (through the Tether Platform).

In Silicon Valley, they work 9-9-6 or something. Chris never stops. Never. He writes paper after paper. He’s on planes traveling to talk to governments globally about their choice systems. He’s with his team, challenging them to build better software, faster.

He is also a true ‘educator’ (a profile I’ve long admired). Educators curate talent, find opportunities for up-and-comers, and invest in people’s careers. Chris has to have one of the strongest networks in economics, always on the lookout for talent and for matching strong performers with opportunity.

This company is playing on hard mode. There are easier spaces to get traction. His chosen one has ‘hard to serve’ customers who move slowly and require a lot of hand-holding. Governments don’t pay on time. Getting people to see the vision of a future that doesn’t yet exist, that you are trying to build, feels insurmountable.

But there are so few people who are qualified to realign education systems from a ‘trust and altruism’ analog system to one of ‘choice and competition’ aided by digital systems that are easy and informative for parents and reflect notions of societal values. I believe we will be rewarded for our efforts in the long term.

Even though it’s difficult, I greatly enjoy working with Chris. Chris and I both like difficult things. We both like working really hard. We both see the future the same way. We both like being right when others are wrong.

And that day is getting closer and closer.

Song: The Fall

Here on YouTube.

More folk! “The Fall” is about the fragility of life and the beauty found in both struggle and acceptance.

It’s not one of Gregory Alan Isakov’s most popular songs, but it is well-regarded and most distinct.

“The Fall” by Gregory Alan Isakov

All eyes on you now, on you

We’re still holding our breath

We all break a little when we fall

And everybody keeps saying, “Get up, get up”

The fall, the fall, the fallThanks for reading, friends. Please always be in touch.

As always,

Katelyn

I believe the best way to garner public support for alternative education is to show its true value over its competition.

Alt ed won't win on merit alone, people already know that the current education system is.. poor, and people want a solution.

QoL during their kids schooling would convince 98% of parents to change course. I believe there also needs to be far more ads, from a neutral non-politicized stance, on why public schools are not serving as an institution for children's betterment.

I believe the public is fertile ground for that narrative