Sugar, We’re Goin Down

w.274 | Gurley, Liquidity, Money Stuff, Cash vs Equity, Tariffs, & Rogoff

Dear Friends,

Awareness can be a burden. One of the features (or bugs) of the Internet and hyper-connectivity is that there are so many things out of your control that you could distract yourself with on any given day or week.

The big topic in the investing world is liquidity, and the second most significant topic is all the macroeconomic moving pieces as described below.

Today's Contents:

Sensible Investing: Trends

Charts Worth Thinking About

Song of the Week: Sugar, We’re Going Down

Sensible Investing: Trends

Yale’s Endowment Selling Private Equity Stakes as Trump Targets Ivies. PDF of NYTimes article.

The Gift and The Curse of Staying Private with Bill Gurley - Invest Like the Best podcast episode. Great discussion on the state of venture capital with someone who has experience along the bridge between private and public markets.

“VC has become a massive big money, high stakes, high risk, high burn rate game. And you cannot opt out. It’s the game on the field.”

Bill also references Yale’s sale of its private portfolio as an important signal to watch since they invented the ‘endowment model’, and how those winds might be changing (see article above).

Same Discussion in Money Stuff. This is your semi-regular reminder that this newsletter assumes that you are also a regular reader of Matt Levine and his column Money Stuff. He had great recent discussions on the Liquidity Illusions, and I particularly liked Whose Money Should You Manage? This highlights the importance of incentive alignment.

Cash-vs-Equity Flex Compensation: Dilution Math & Market Benchmarks (Q1 2025 Update) from Thomas Reiner at Altimeter. “Beyond Netflix, a growing list of firms (Spotify, Shopify, Brex, Tesla, etc.) offer cash-vs-equity flexibility. Uptake varies by seniority, risk tolerance, and life stage. Just as businesses segment their customers, flexible comp lets companies segment their employees.”

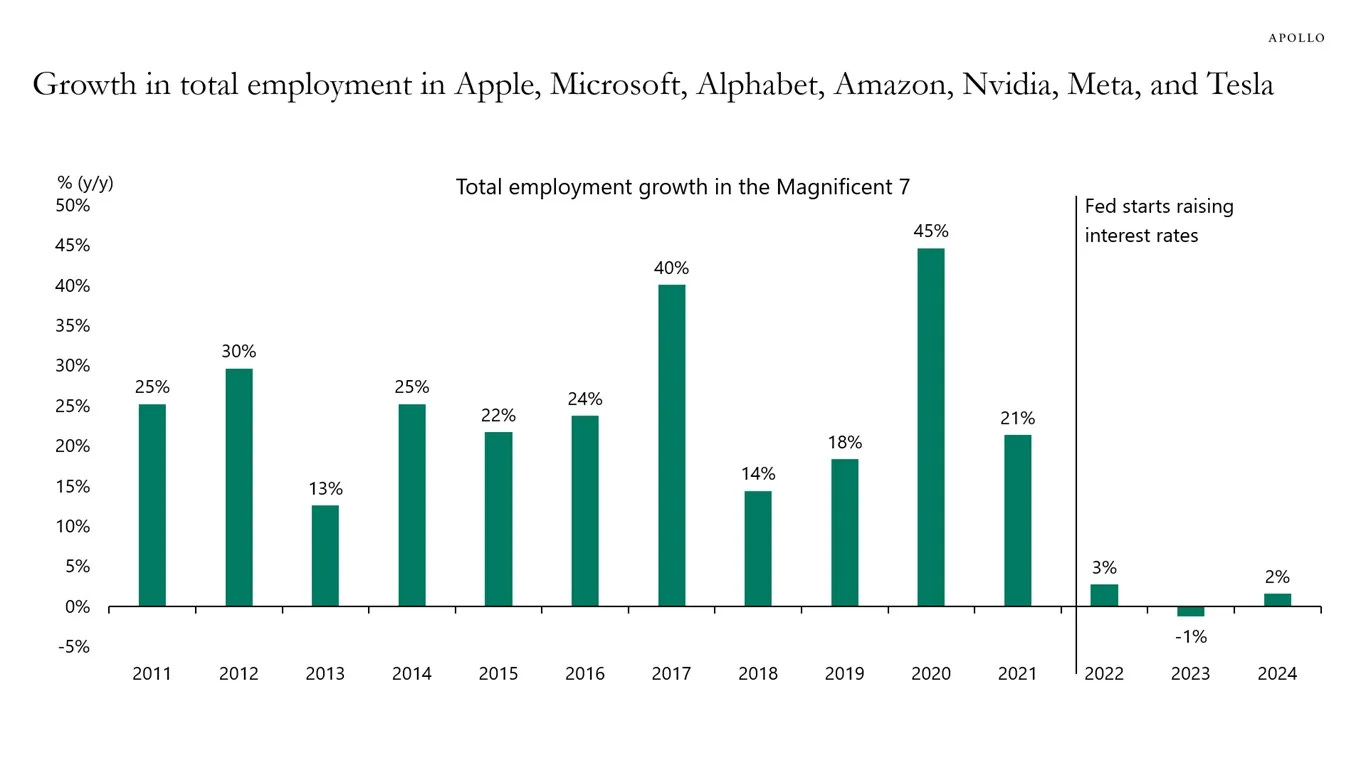

Hiring at Mag7 has been flat for the last four years, so the incentives and compensation for the remaining workforce are crucial.

Meta bought 49% of Scale AI for $14.3 billion, which is notable for several reasons: first, the structure it employs to circumvent potential antitrust objections, and second, the scramble as the rest of the data labeling industry begins to reorganize. I was today-years-old when I realized that Handshake, the platform for college student recruitment, among others, was super active in this space. But in retrospect, it all makes sense.

Ken Rogoff on Dwarkesh Patel: "China is digging out of a crisis. And America’s luck is wearing thin." The former Chief Economist for the IMF describes how this decade is likely to see the US face an inflation crisis, higher interest rates, underperforming US equities, and erosion of the dollar.

He’s promoting his recently released book: Our Dollar, Your Problem: An Insider's View of Seven Turbulent Decades of Global Finance, and the Road Ahead. I haven’t read it…yet.

Charts Worth Thinking About

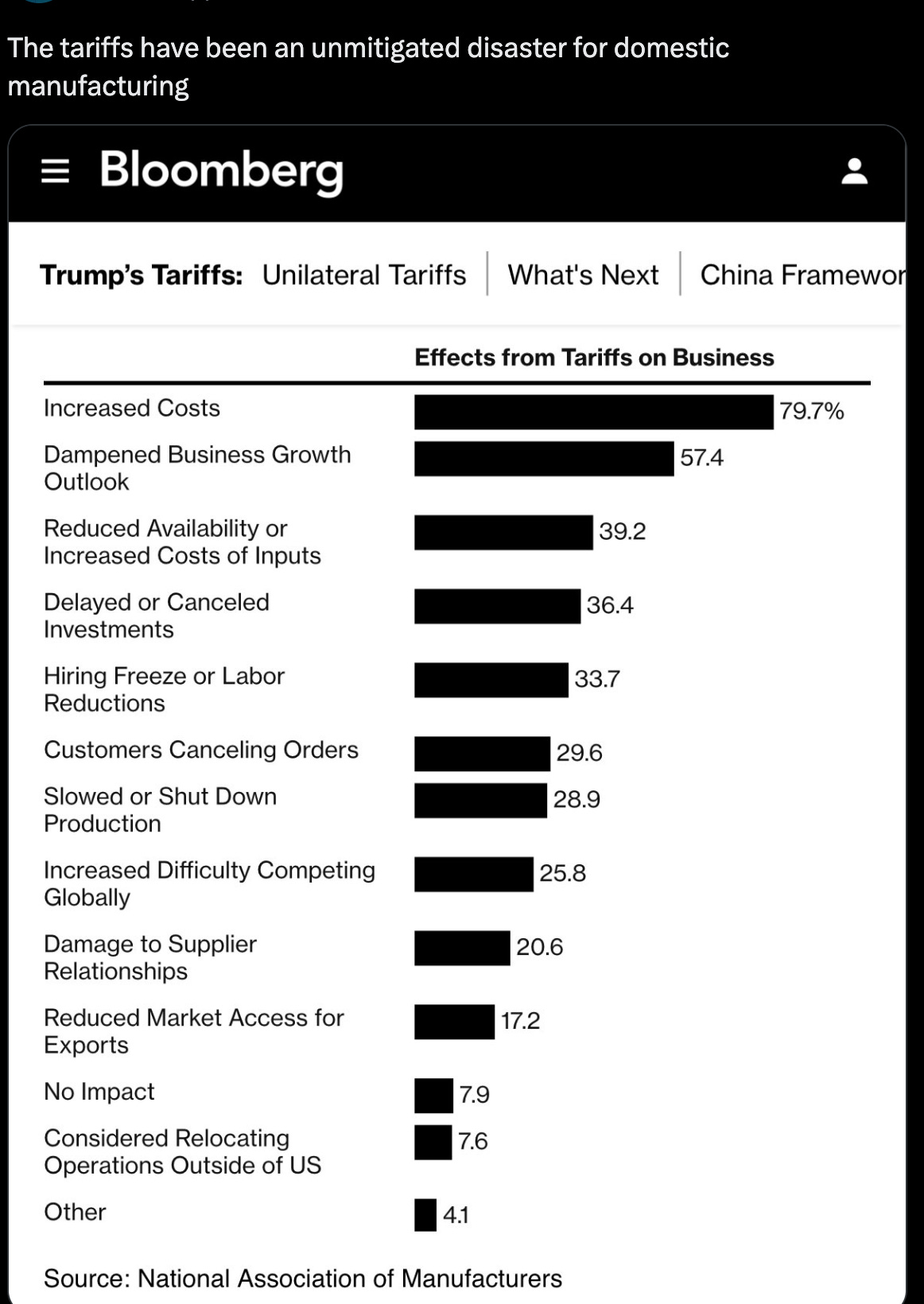

Tariffs (and their uncertainty) have raised costs and made doing business more difficult for almost any industrial and manufacturing company or project.

Song of the Week: Sugar, We’re Goin Down

Here on YouTube.

I’m not a particular fan, but I do remember this song. Someone on the internet said this essay Fall Out Boy Forever was their favorite ever, and I decided to give it a spin. It’s about male friendship told through the lens of shared musical experience. I liked it. It’s from a book of essays called They Can't Kill Us Until They Kill Us.

Taylor Swift told Rolling Stone how Fall Out Boy’s songwriting has influenced her lyrically, possibly more than any other band. "They take a phrase, and they twist it." Swift references these lyrics as her favorite:

Loaded God complex

Cock it and pull it

Bam.

“Sugar, We’re Goin’ Down” by Fall Out Boy

We're goin' down, down in an earlier round

And sugar, we're going down swingin'

I'll be your number one with a bullet

A loaded God complex, cock it and pull itSelfie of the Week

Michael Balaoing is one of my favorite people. He’s also the founder of Candlelion and is one of the most sought-after public speaking coaches across technology, investing, and philanthropy. Michael has helped many senior leaders deliver tough messages in clever ways and structure memorable stories to make sense of markets for investors at annual general meetings (AGMs). How To Set Your Story Apart.

I met Michael at a conference, and lucky for me, he was basically my neighbor in New York, so when we met up for the first time in the Village, he said, ‘Let’s add structure for this conversation.’ I was intrigued.

One of us would speak for 10 minutes straight, and the other would silently listen and not react, and then the reverse. Given the choice, I choose to go first.

I always recommend taking the opening move when playing someone else’s game for the first time. First, you can take the prompt in whatever direction without being influenced by an example, which allows for a wider aperture of innovation (i.e., greater upside); second, since you are first to play the game and have volunteered, you can’t be judged harshly for not knowing or not playing by any unspoken rules.

It was a fantastic format that led to unexpected places and perhaps deeper engagement and insight into a new friend than would have otherwise happened. Michael consistently comes up with thoughtful ideas like this.

Recently, I wanted fresh fish, and I knew Michael would be game and the conversation would be interesting. This time, he pulls a worksheet out from his pocket that he is prototyping for a large storytelling training he is running. It’s a Story Recipe for finding what he calls your “Greatest Stories Never Told!”

I keep telling him that he has to share the secrets and not just with those who can afford to rent out his time privately. Where is the book, podcast, video series? What gives!? So, stay tuned, and we can all level up soon.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn