Stay Alive

w.191 | Silicon Valley Small Businesses, VC Reset, GPT-4, YC Cuts Its Growth Team

Dear Friends,

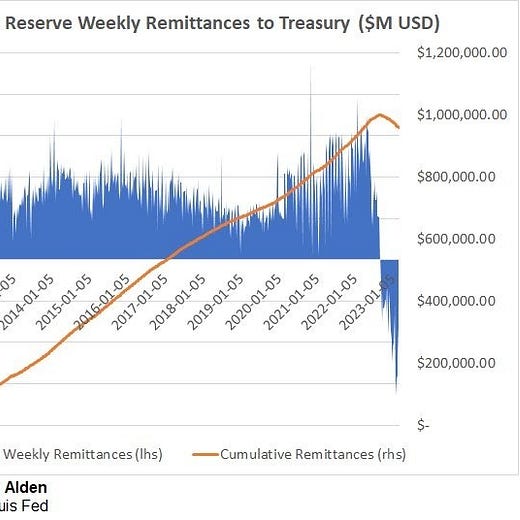

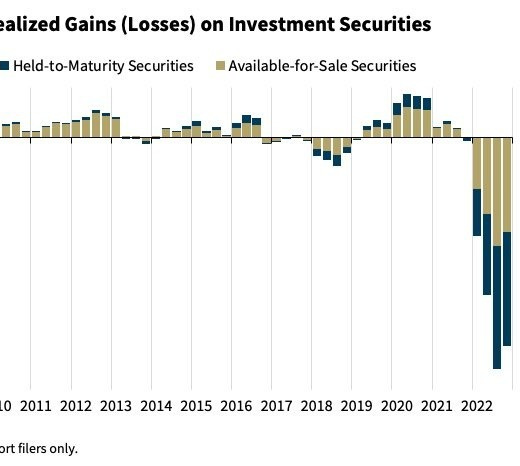

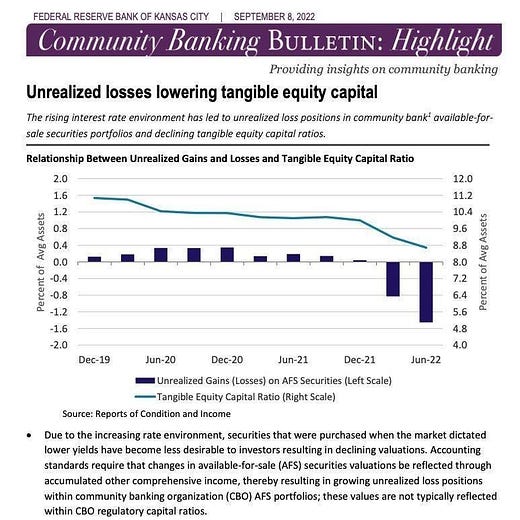

I - like I’m sure many of you have - watched the dialogue around the banking sector this week with the sentiment of “I’m not sure exactly what is going on, but it doesn’t look great.” UBS moving in to buy Credit Suisse as an emergency backstop this morning isn’t exactly confidence inspiring, although that is what it is supposedly purposed to do. My non-take is that at this point it’s so out of my control, I don’t have access to any unique information, and whatever is going to happen is already baked in. Put another way, this is a good time to read Matt Levine. Maybe Warren Buffett will clean up the mess. Who knows.

On a more personal note, my Twitter experiment is going well. I experienced my first viral tweet this week! I’ll reflect more about the event next week. The life of a viral tweet starts with smart challenges from your friends and ends with ad hominem attacks from strangers. My stats for March are going to look great!

Ironically, the best tweets are constructed with a series of spaced out declarative statements. The simpler, more stark and more provocative your copy, the better. AND make sure you don’t link to anything because the algorithm doesn’t like that. That takes people off of Twitter.

The reason I started writing this weekly newsletter, now almost four years ago, was that I thought engaging in long-form conversation, citing primary sources, and having ample space to explain deeper thinking was preferable. I still believe doing that work is worthwhile, but experimenting with the attention economy is fascinating as well.

Today's Contents:

Good Reads: Sensible Investing

Trends & Week Debrief

Song of the Week: Stay Alive

Good Reads: Sensible Investing

The Rise of the Silicon Valley Small Business: What you need to know about the next big startup archetype.

Below is more information on the writer’s definition. I’ve been interested in this archetype for a while because many of the companies I see in the verticals that I play often resemble this profile. After the reset of VC, we might realize that what she outlines as SVSBs are preferable, although the underwriting and terms are going to need a complete overhaul away from SAFEs. However, we are going to need a better acronym than SVSBs, which is now too close to SVB and SVBB (Silicon Valley Bank and Silicon Valley Bridge Bank).

The Silicon Valley Small Business, the SVSB, is a hybrid of sorts—it intertwines small business values and discipline with big-tech know-how and ambition.

Founding teams may look like that of a “traditional” Silicon Valley startup.

Teams stay small and run fast for as long as they can.

They’re growth-oriented and going for efficient scale.

They try to bootstrap to profitability instead of relying on venture capital.

YCombinator Cuts Its Growth Team. This is a huge testament to the point that people are realizing that it’s a complicated to be a VC. If YC, which says that 6 out of 100 companies that go through its accelerator go on to be ‘worth’ over $1B, can’t make its growth fund or what other VCs call ‘opportunities’ fund worthwhile, that’s a huge statement. You’d think there would be no better pipeline and information advantage than YC for growth.

All-In Podcast on the Great VC Reset. I agree with this week’s episode that there is a lot of resets and clean up to be done in startup land. They cite Tiger Global writing down its portfolio by 33%. But, as David Sacks, says it’s better to be an investor today than it was a few years ago.

Trends and other things

Both Duolingo and KhanAcademy announced AI tutors this week. How quickly education companies / organizations can ship product improvements is a good indicator of the extent to which they are technology companies.

Meet Marine Tanguy, the Art Entrepreneur You Should Know About: From socialist upbringing to industry-disruptor.

Marine is the long-term partner of my friend William. I liked her immediately. She is the perfect mix of elegant-French girl, super smart, and obviously ambitious about her vision of the world. I’m glad she is continuing to charge ahead with her art talent management company despite the cyber bullying.

Eric Lavin and I Discuss the Big News of the Week. Below on YouTube or here on audio with a transcript. We discuss the on-going Twitter debate between Balaji and Nasim Taleb (see below), our advice to founders (here), Open vs Closed AI, and Roon's law of equivalent grift for technology exchange.

Song of the Week: Stay Alive

Here on YouTube.

I’ve always liked this song and been a fan of the movie The Secret Life of Walter Mitty, where Ben Stiller plays the protagonist on an inner journey to find adventure and be confident enough to ask out his crush.

I thought it’d be an apt song of the week as much of the advice of getting through any crisis that feels systematic is to just ‘stay alive’ both in a business sense and emotionally.

“Stay Alive” by José González

There’s a rhythm in rush these days

Where the lights don’t move and the colors don’t fade

Leaves you empty with nothing but dreams

In a world gone shallow

In a world gone lean

I will stay with you tonight

Hold you close ‘til the morning light

In the morning watch a new day rise

We’ll do whatever just to stay alive

We’ll do whatever just to stay alive

Selfie of the Week

Picture is from Olympic Sculpture Park in Seattle. It felt like spring this week and today there isn’t a cloud in the sky. The sculpture in the background is called Wake by Richard Serra.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn