Spin The Wheel

w.299 | PE Operator, Market Outlook, a16z, Psychedelics, Citizens & Clean Ammonia

Dear Friends,

Swift start to the year, huh? I’m already losing track of the days of the week (in a good way).

Today's Contents:

Sensible Investing: Trends

Obviously The Future: Revisited

Weeklies: Selfie & Song

Sensible Investing

PE Operator Thoughts on the Commodization of PE. Super long read on X that several people shared with me. I think it’s too long and already known, but it's probably a message worth sharing.

2026: The Year the Market Clears from Sam Jacobs at Pavilion about M&A. Liquidity is returning, but not at yesterday’s prices. What clearing markets, honest math, and longer time horizons mean for founders in 2026.

JP Morgan Eye on the Market Outlook 2026. Their view:

Position for the A.I. revolution - The technology is transformative. Capture the upside while avoiding the risks of over-exuberance.

Think fragmentation, not globalization - A reconfigured economy prioritizes resilience over efficiency. Identify opportunities where security, energy and supply chains converge.

Prepare for inflation’s structural shift - Inflation is higher and becoming more volatile. Plan with intent to maintain purchasing power and diversify into real assets.

a16z: The Power Brokers: a16k word essay on a16z on the day of a15b fundraise from Not Boring. Take this as marketing material, of course, but it’s an interesting set of information placed in a powerful narrative with enough capital and success that it cannot be ignored.

One firm has now raised 18% of all dollars going into the asset class in 2025, which means everyone else needs to be clear about what investment game they are playing and how they are going to win. Worth noting the dynamic of capital concentration is also true in PE as the FT notes: The 10 biggest funds took nearly half of investment capital as concentration increases for established.

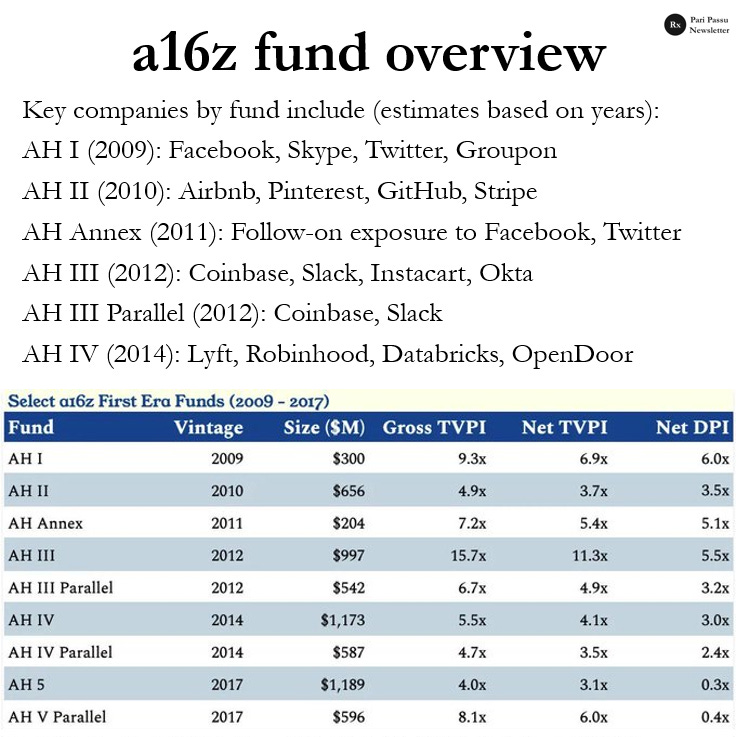

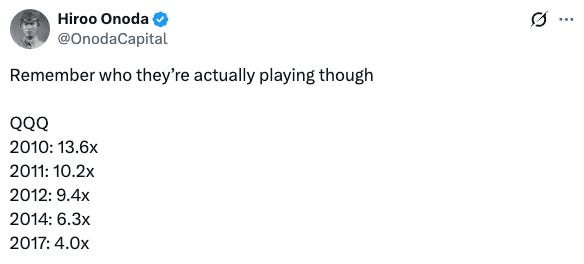

Below is some of a16z's historical performance as reported; it is impressive, but in the context of the broader technology market, you should not feel FOMO. Plus, as we all know, past performance does not guarantee future returns.

Zach Rollins has the right take:

Two things are true regarding A16Z's performance that highlight what they've been able to accomplish and the challenge of allocating to venture over the last decade.

1. It's really hard to get to 3x net DPI in venture. You'll be in business for a long time as an investor if you can consistently deliver this to your investors. Kudos to their team here.

2. AH IV gross performance is roughly in line with the performance of $QQQ over the last decade yielding meaningful net underperformance. They'll need some real value uplift in the portfolio to catch the index on a net basis for the equivalent time period.

Now, what if you aren’t a16z? Someone told me about a long-time VC who is having an epic industry crashout. Not a tier one but top-tier. Here’s what Grok said about them: [name] is a top-tier seed specialist — excellent reputation, strong track record, and very competitive in its niche — but not a classic Tier 1 VC in the broader industry hierarchy.

This person was a successful founder before entering venture 10 years ago and was upset that they hadn’t made money over the last 10 years, that it was a total waste of time, etc. More of these conversations are happening behind the scenes. Much of the industry (particularly large funds!) have to make a case for investment beyond just returns. Maybe it’s networking, taking a view of the future, or diversification for its own sake.

Obviously The Future: Reviewed

Avalanches can take a while to play out, and there are a variety of investing opportunities and entry points along the way. I’ve started this year by refreshing the past, with the goal of publishing updates. In the meantime, here are a few thoughts from the oldest pieces.

Citizens Vote with Their Feet, an essay I wrote in 2020, is mostly about the wealthy's ability and willingness to move across jurisdictions when prompted by government dysfunction.

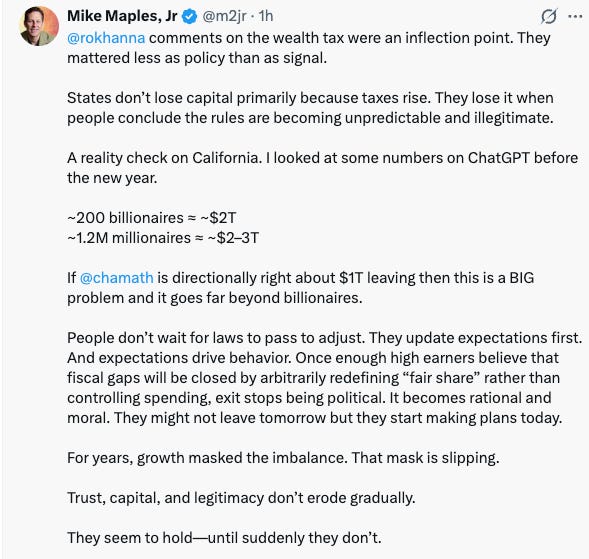

The news of the last few weeks has been the exodus of several of California’s wealthiest residents in response to a proposed wealth tax on unrealized capital gains. More to say here, but I think Mike Maples made a good point about the bigger issue, which is the declining predictability of the rule of law - and not just in California. This trend has been gaining steam across the board and can also be seen in capital leaving the UK and Norway for similar enacted policies:

Psychedelics as Medicine, another essay I wrote in November 2020. At the time, I invested in a venture fund focused on the sector and have since received >1x DPI from their early bet in Gilgamesh.

Today, we may be on the brink of the next revival of this thesis. A lot has happened in five years, and this view has become more mainstream (one million people watched Bryan Johnson livestream a recent Shrooms trip, which is probably a mixed help). Although the political winds in the White House are also mixed (from Psychedelic Alpha), many believe the FDA will support more approvals in 2026.

This time, you might not need to be a private investor to participate. Compass Pathways ($CMPS) and MindMed ($MNMD) are both publicly traded plays that experienced a massive hype bubble five years ago and have risen slowly over the past year.

**Obviously, this is just an idea worth maybe looking into. I’m not advocating any specific action

Weeklies: Selfie & Song

Selfie: Energy Dominance, Carbon Capture, Korea <> USA

This year started strong with a groundbreaking celebration for Wabash Valley Resources, bringing together our major financing, government, and supplier partners. WVR is a clean ammonia renovation project in Indiana. A friend of mine from Morgan Stanley commodities creatively developed the opportunity, and I’ve been an investor since 2018. I increased my stake and role as a board member in 2025 as we were navigating the final approval process for a DOE Loan. Being a sane, trusted investor with enough liquidity and insider knowledge to move fast creates opportunities.

Through this project, I’ve seen firsthand what it takes to work with the government at every level, the details of financing structures, the importance of international partnerships to rebuilding America, and the impact of various policies on inputs and supply chain issues. If you are excited about any of the hardtech ‘atoms over bits’ mega trends - often called names like American Dynamism, Energy Revolution, On-shore Manufacturing, Supply Chain Resilience, Reindustrialization - the details of implementation matter significantly.

Song: Spin the Wheel

Here on YouTube.

I cannot recommend Arcane enough. It’s a two-season show based loosely on characters from the League of Legends game. Riot Games, the producer, spent a ton of money on production, and it shows. Arcane received numerous awards, including multiple Emmy Awards for Outstanding Animated Program and several Annie Awards, making it one of the most awarded animated series. The show has been praised for its animation, storytelling, and character design, solidifying its status as a significant achievement in animated television.

There are a lot of lessons about society building, the distribution and use of technology, and even some psychedelic spiritualism.

Spin the Wheel is one song from season two that flashes through a series of alternative realities based on different outcomes in the past. I like the sentiment about enjoying the journey.

Over the past year, I would often catch up with my friend Arvind about his work with Astra School (he’s now joined forces with Alpha School and is scaling their GT program, which is exciting!) and various ups and downs across the portfolio. And the way to tell the various updates is through the spinning of a ‘wheel of fortune.’ Sometimes you’re up, sometimes you're down, sometimes what you think should be a win turns into a loss, and an outcome you didn’t want turns into a massive win. The key is just to stay alive long enough to keep spinning the wheel and moving upward.

“Spin the Wheel” by Mick Wingert, Arcane

Wait 'til your brothers and your sisters, see where you been

And if you loved the journey more than the end, go ahead

Just turn that hourglass around and count to ten

This ain't goodbye no more

Nah, it just beganThanks for reading, friends. Please always be in touch.

As always,

Katelyn

I just finished arcane season 2. Yeah amazing. Great song. Also s2 episode 6 hit hard as a parent on many levels - and the Chinese song at the climax was really powerful and emotionally resonant.