Southern Man

w.265 | Tariffs (Obviously), Trade Deficits, Global Supply Chains, AI 2027, & NeuroTech

Dear Friends,

Welcome to the final sprint until April 15 and filling the government’s coffers. For me, it’s the time of year when I learn that a $150.00 investment long-ago in a company via Wefunder has now gone to zero yet generated a 44-page K-1 filing.

Oh, and tariffs! Have you heard about this thing that happened?

Since we are all diversified, long-term thinkers who invest without excessive (any?) leverage, there is no reason for short-term panic or emotional knee-jerk action, right? Let’s dig into the early returns, recognizing no one knows what next week will bring.

Today's Contents:

Tariff Thoughts

Sensible Investing

Song of the Week: Southern Man

Tariffs Thoughts

We are in uncharted territory, but here are a few initial thoughts:

Take the Trump Administration seriously when they say they will do something, especially when he has said it for forty years.

Luckily, we’ve been listening to Treasury officials and taking what they said seriously, including Treasury Secretary Scott Bessent's interview on the All-In podcast. Neither we nor the market knew the insane formula the administration would use to calculate tariffs, i.e., using the bluntness of trade deficits. Below is a chart of the big picture.

Even the AEI says ‘President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error.

Every economist will tell you this is bad economic policy, but that doesn’t matter to this administration.

That said, Bessent's interview with Tucker Carlson released yesterday makes the point that they believe that, in the long term, this is good policy for America.

Everyone on this newsletter is long US equities in some form or fashion. Many Americans are not, though, and that’s a problem.

Many people point to this Hudson Bay Capital-Stephen Miran paper, A User’s Guide to Restructuring the Global Trading System, as an inspiration behind this policy.

There is a lot of uncertainty.

Stock market prices will fluctuate, and the future is unpredictable. Many projects, financings, and deals will be stalled for weeks and months as investment committees and management teams adjust to the new reality and update their projections, financial models, and budgets. I’ve heard of several transactions paused or pulled over the last ~72 hours. Uncertainty is always the worst part. Change is the only constant.

The stock market was historically expensive and may still a way to go (down) given high price-to-earnings ratios. We discussed this a few weeks ago, and Buffett had already trimmed his exposure to US equities.

Industries like local government, education, and healthcare delivery are local and primarily immune, at least in the short term, as they don’t directly rely on international supply chains. Yet volatility impacts everyone’s confidence, especially given the questions it raises around what the administration might do next.

What do we say? Keep a long-term mindset, don’t bet against America, and inform yourself through primary sources. This newsletter is pro-free(er) trade, pro-peace, pro-thoughtful immigration, and pro-economic opportunity for all.

Below are a couple of reactions and pieces:

Singapore PM Lawrence Wong warns of the need for caution and being mentally prepared for the risks of a trade war.

Gavin Baker: These tariffs, as constructed, essentially guarantee that America will lose “AI” by making it the most expensive place on earth to build AI data centers.

Ben Golub: Uncertainty poisoning supply networks, degrading many relationships at once.

America’s Growing Trade Deficit Is Selling the Nation Out From Under Us. Here’s a Way to Fix the Problem - And We Need to Do It Now. By Warren Buffett in 2003.

Fed's Powell Steady on Tates, Warns on Inflation as Trump Demands Cut

Sensible Investing

AI 2027: Several AI researchers who believe AGI is imminent put together a series of scenarios on how it may play out.

Internet.io: This is a fun AI platform to try. You can prompt the seven major models all at once, compare your answers, and save the queries. My new favorite - check it out.

Neurotech:

Evolution of the Human Brain: The Past, The Now, and Our Future. Andy Coravos started writing and sharing her thoughts post-startup.

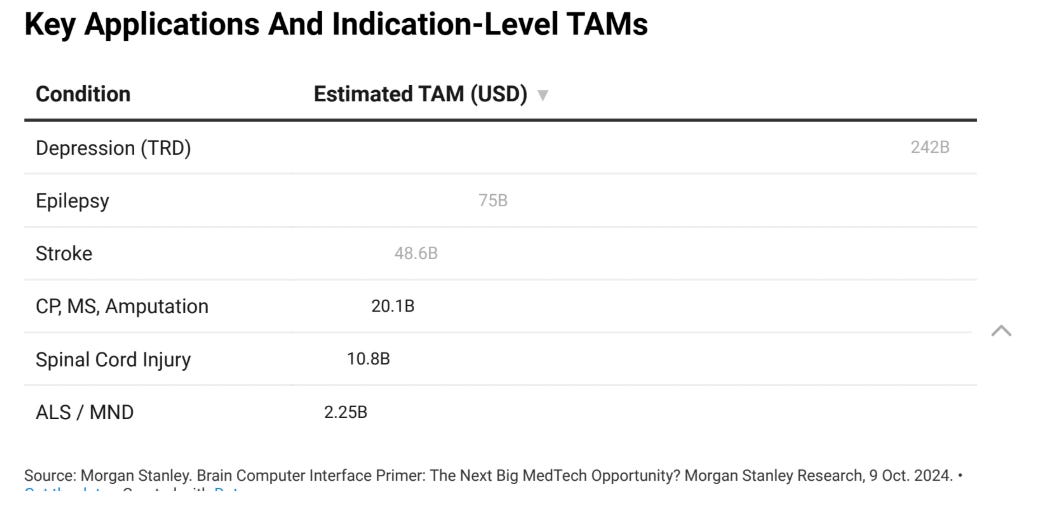

Brain Computer Interfaces. Who’s Leading, What They Own, and How IP Will Decide the Future. PatentVest report. Neuralink, Science, etc. Interestingly, the TAM for depression and epilepsy is dominant.

Song of the Week: Southern Man

Here on YouTube.

The piano on this rendition is incredible. Akshin Alizadeh is an electronic music producer and composer from Azerbaijan who grew up playing violin and piano. The song has only two original lyrics from Neil Young and universalizes the messages to promote integrity and acceptance of all. Given the history of the song, it’s fun that this amazing remix was done by a guy in Central Asia.

This is a cover or sample of “Southern Man,” released by Neil Young in 1970. The lyrics describe racism toward Black people in the American South. Young was very sensitive to the song's message of anti-racism and anti-violence.

Many considered the song a provocation and too harsh at the time.

In response to Southern Man, Lynyrd Skynyrd wrote Sweet Home Alabama (a more famous song). The lyrics:

Well, I heard Mr. Young sing about her

Well, I heard old Neil put her down

Well, I hope Neil Young will remember

A Southern man don't need him around, anyhow

“Southern Man“ by Akshin Alizadeh cover of Neil Young

Southern man better keep your head

Don't forget what your good book saidSelfie of the Week

Happiest of 40th birthdays to my dear friend Bianca! Sad not to be in Sao Paulo for the celebrations.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

I love your positivity. I’d like to think you are correct but I have more trouble betting on this America.