Save This City

w.292 | AI Bubble, AI adoption, Berkshire, Private Credit, Charts & Prop Q

Dear Friends,

It’s good to be back! Sorry for the skip week between editions. There’s always a lot to think about and discuss. Thanks for reading and responding, as always, and welcome to all the new folks!

Today's Contents:

Sensible Investing: Trends

Charts

Weeklies: Selfie & Song

Sensible Investing

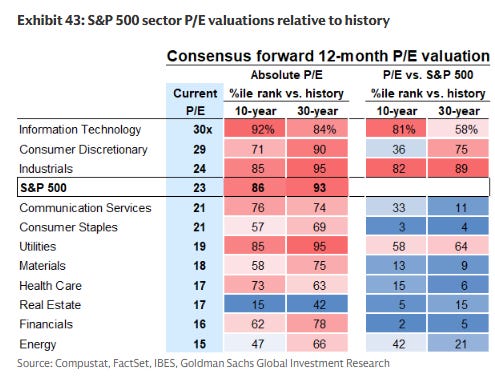

AI Bubble: Don’t Throw the Baby Out with the Bathwater. Watch individual stocks and sell if they are too aggressively valued. Opinion piece in the FT (link is PDF).

I attended the SALT Conference in London last week. It’s for allocators interested in alternative assets. This time, it was sponsored by the crypto ecosystem, so it focused heavily on digital assets, blockchain, and related topics.

One of the sessions had the CEO of one of the large ‘VCs turned Asset Managers’ with rumors of an upcoming IPO. He asked the room ‘Who here thinks we are in an AI Bubble?’ Out of 300 people, only one other person raised their hand (along with yours truly).

I take this as an indication of the room’s discretion rather than a consensus opinion. A financial bubble is defined as an economic situation in which the prices of assets rise rapidly to levels that are unsustainable, often driven by excessive speculation and investor enthusiasm. We have definitely seen a rapid rise in asset prices; the question is just which are unsustainable and on what timeline.

At the event, the CEO continued: ‘hmmm, less than expected’ and then without answering his own question, he says ‘Well, bubbles are good. They build critical infrastructure that moves society forward…’

Which is true. But it conveniently misses any relevant discussion of the best place to allocate TODAY to realize gains from the opportunity. The article linked to above makes the case to be led by valuation - and so, like many, is in Amazon and Microsoft and has sold off Nvidia and Meta. Another angle is to seek underpriced opportunities where there will be productivity gains (he cites healthcare and consumer staples).

You can pay a VC aggregator their 2-and-20 to hold Anthropic or OpenAI directly, or (probably worse) be in hard-to-diligence and zero-control SPVs. Alternatively, you can invest in Microsoft (which has exposure to OpenAI), Google (which owns ~15% of Anthropic), or Amazon (which owns between 12% and 20% of Anthropic). Each are also far more liquid and in the indexes.

Exclusive: Here’s How Much OpenAI Spends On Inference and Its Revenue Share with Microsoft. This Ed Zitron piece is circulating. TL/DR: OpenAI spends a lot (more than most people expect), and this contributes to Microsoft’s revenue. The devil is in the details, and if you are interested, you are welcome to use that link to explore further.

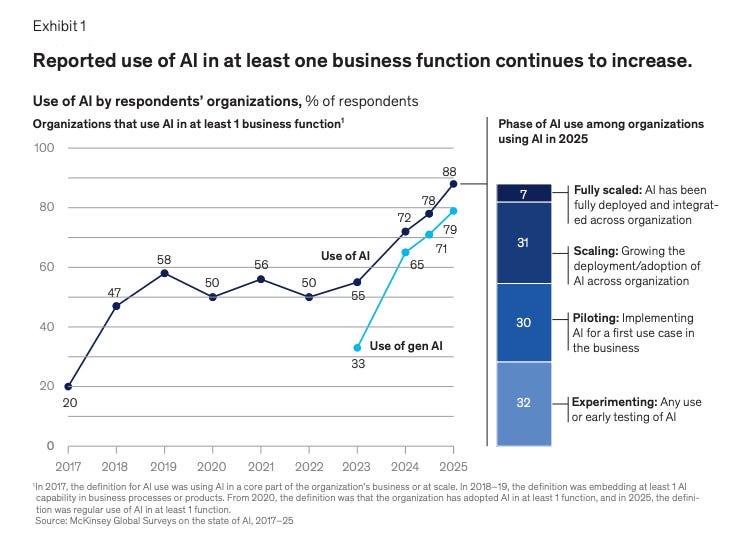

McKinsey’s 2025 State of AI. Report shows enterprises are using AI, but most have yet to scale the technologies.

Warren Buffett’s Thanksgiving Letter. He’s going quiet except for his annual Thanksgiving Letter, which imparts folksy advice.

A key question for many of us is whether we should still hold (or buy) Berkshire Hathaway. The answer is no longer certain. Berkshire has underperformed the market rally this year, but that is to be expected given its high cash position and focus on value. When I asked this question of a long-time Berkshire shareholder and financial advisor, they said that what made Berkshire unique was Warren Buffett’s ability to strike highly advantageous private deals in creative structures and unique situations, and that no one else at Berkshire has shown an ability or aptitude to do the same.

Berkshire’s appointed leaders so far have seemed not to be original and/or bold thinkers and doers (my words and conclusion), so I’d expect average performance in the long-term. However, they may have a good run through this cycle if there are jitters in the equities market.

Cockroaches in the Coal Mine. The latest Howard Marks memo discussing the fraud in private credit.

When asked about private credit, I answered that the investment environment had been mostly benign over the years since 2011, meaning – to echo Warren Buffett – the tide had never gone out on private credit (i.e., it hadn’t been tested). Now, with two high-profile bankruptcies in short order, people thought they might be starting to see cracks.

The tone turned more serious when it became clear that not only were there failures, but also there might be something sinister behind them. There are allegations that First Brands – which had both public and private debt outstanding – used the same receivables as collateral for multiple loans. Tricolor turns out to have made loans to buyers lacking credit scores or driver’s licenses and had been previously cited by regulators for practices such as selling cars for which it lacked titles.

…

He goes on to call the fraud systematic, not systemic. Only time will tell for sure!

Charts

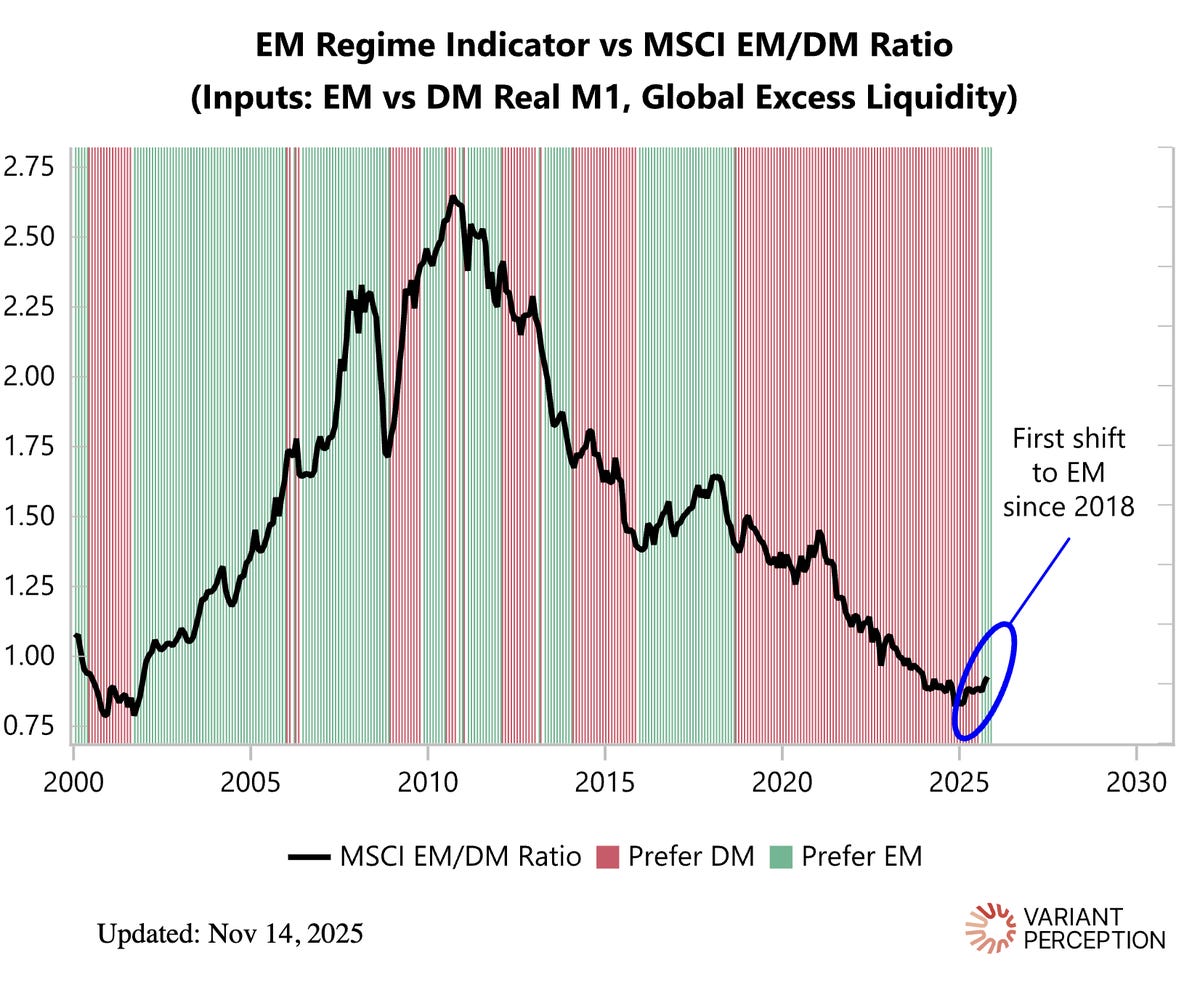

Perhaps now is the time for increased exposure to emerging markets?

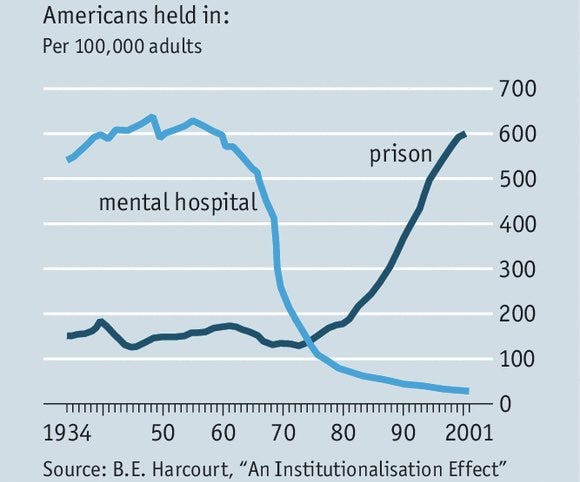

Prisons vs Mental Hospitals: A chart that’s been making the rounds and its discussion on X.

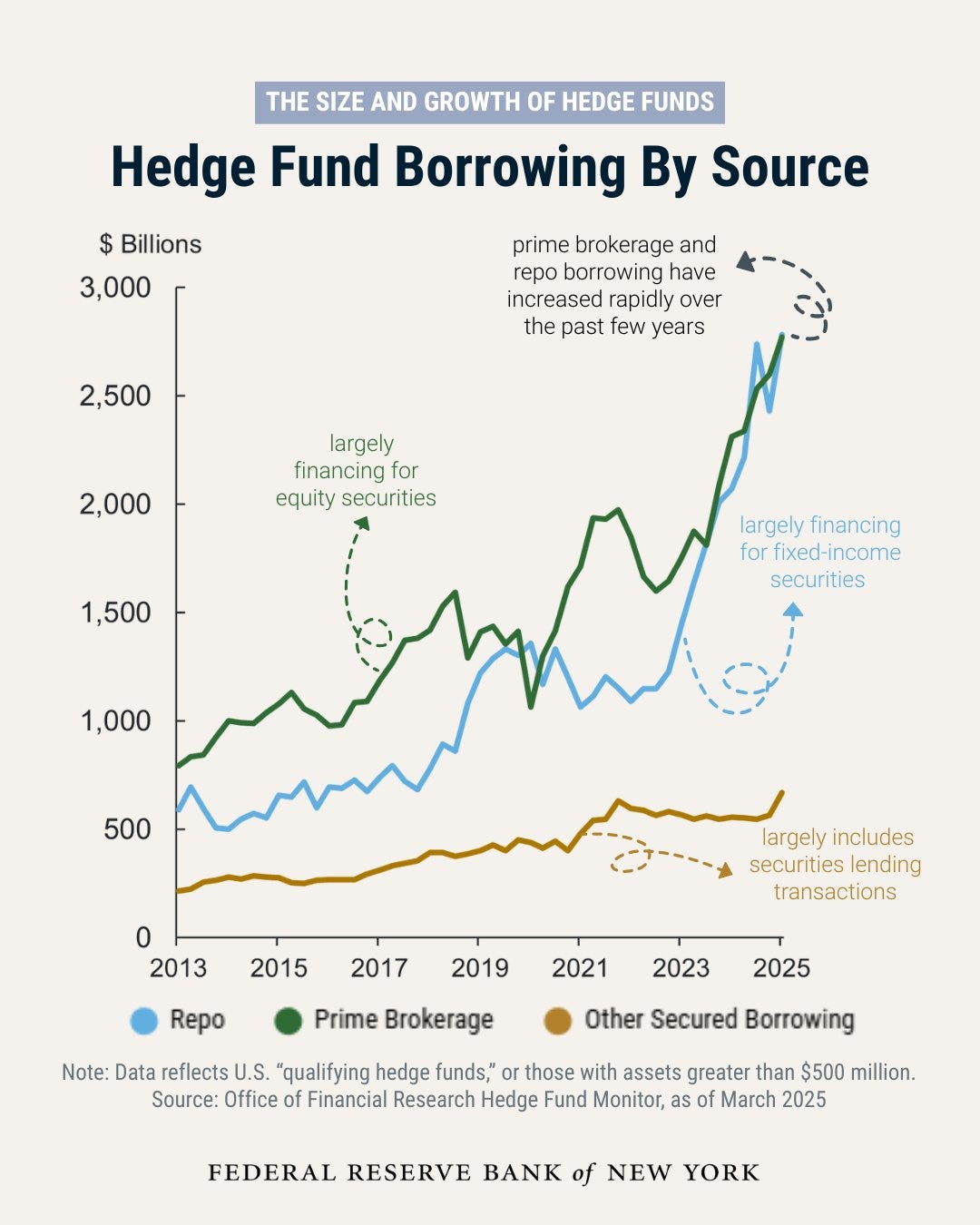

NBFIs in Focus: The Basics of Hedge Funds: analysis piece from The Fed.

Weeklies: Selfie & Song

Selfie: Mayfair, Friends, Joanna, & Institutional Investing

I was in London last week for various purposes, including the 30th anniversary summit of Kauffman Fellows, a lifelong learning community for venture capitalists with over 1,000 global members from top firms, such as Emergence, KP, and Creandum.

I started my fellowship in 2016, almost ten years ago, when I was running Pearson’s corporate venture fund, and Kauffman has been an incredible network of mentors, collaborators, and lifelong friends. As part of the program, you are placed in a small group (called a forum) to go deeper on a human level. I was lucky to have been part of our entire class of amazing people, particularly because Joanna Rupp (right side) was in my forum.

Joanna has had a long and successful career in finance, including early stints at Goldman Sachs and the Security Capital Group. She has most recently served as the Managing Director of Private Equity at the University of Chicago endowment for the past 24 years, building out their buyout and venture portfolio and serving as an advisor and mentor to many emerging managers as they approach institutional investors. Joanna is high integrity, incredibly analytical, and always thoughtful. And, more than her professional accolades, she is kind, patient, and genuinely committed to creating a better world.

Joanna left the endowment this summer and has quickly been snapped up in various advisory and consulting engagements (mostly by top managers she’s already worked with). Still, I think she’d add even more value on the allocator side, where manager selection is paramount and stewardship is critical. We’ll see what she does next!

Song: Save This City

Here on Suno.

OMG. Our first song from Suno. I know, I know. Artistically speaking, I prefer this instrumental Egyptian Dance Party. Some is just super dumb, though, like one of the most popular songs - with 3M views - called ‘Cat’, which repeats the word ‘cat’ over and over.

This is a sign of the times, though, because one of the biggest current hits in country music right now is fully AI-generated and called Walk My Walk by Breaking Rust (link to YouTube). It’s…good. Excellent even.

This is obviously the future and here to stay.

Anyway, the point of this song of the week, which has only 9 listens (3 of which are probably mine), was in honor of the defeat of Prop Q (63% to 37%) here in Austin, Texas. Prop Q was a referendum to raise property taxes to fund city services, but what I think is notable is that this time, voters (and a strong bipartisan coalition in town) pushed back hard, forcing the city to examine its spending and focus on delivery.

And, no surprise, I think that’s incredibly exciting and important. Where you live has a huge impact on your life. Many cost-of-living dynamics are persistently local.

Over the last 15 years, our cities have expanded in importance and budget (Austin doubled in 10 years), yet the capabilities of management have not kept pace. The upside of local is that when you start digging into the details (and this is what prompted many in Austin), you can advocate for change quickly and decisively.

There is a huge opportunity to take more informed management decisions that produce outcomes people can see and feel.

It was nice to see this local vote send a clear message to city leaders, and for many around Austin to start getting more involved in the details. And there’s been a lot of Austin love on X this week, starting with Elon.

“Save This City” by Suno & Texas Land Guy

It’s a circus of madness spinning its wheels

Austin’s crying out let’s make this real

[Chorus]

Save this city save it now

Tear the walls of nonsense down

Priorities lost they wear a crown

Save this city save it nowThanks for reading, friends. Please always be in touch.

As always,

Katelyn