Prayer for the Dying

w.288 | Fraud, Zihilism, Dollar Debasement, Demographics, & Stablecoins

Dear Friends,

Hope you’re enjoying the fast times of the fall season — AGMs, Q4 rush to meet ‘25 goals, the endless push for EOY planning, and a little government shutdown fun.

The sudden drop in crypto on Friday was exciting. Fortunately, we had already conducted an analysis that showed gold to be the superior de-dollarization play, so it continues to march on at ~1% per day. What it means doesn’t feel that great, though.

Summarizing, crypto alt-coin markets lost billions of value very quickly. Apparently, people are using up to 50 times leverage; suffice it to say, that is crazy. Everyone should heed a few wise words from Charlie:

Today's Contents:

Sensible Investing

Books, Reading, Thinking

Weeklies: Selfie & Song

Sensible Investing

In the credit world, there is a saying, “There is no hedge against fraud.” Found on X in relation to the Tricolor bankruptcy. A notable truism, particularly in the era of the grift economy, and one that may be even more relevant as we increasingly see market front-running (e.g., the Nobel Peace Prize on Polymarket and the Bitcoin short sell being the latest examples) and probably more pain ahead in the private credit and shadow banking sectors.

Too Much AI, Too Soon. More of the same on GPUs depreciating faster than expected and AI valuations priced to perfection. Well-researched and well-written, which is the reason for including here.

Everything Nice. How Music Criticism Lost Its Edge. TL/DR: too much downside, not enough upside for any meaningful analysis.

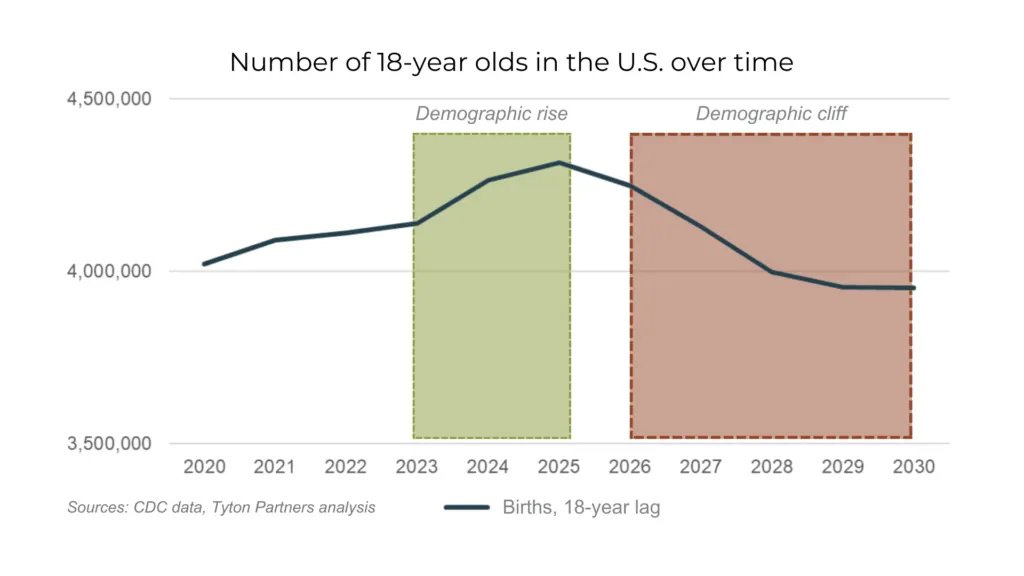

Demographic Crises for Colleges, in one chart:

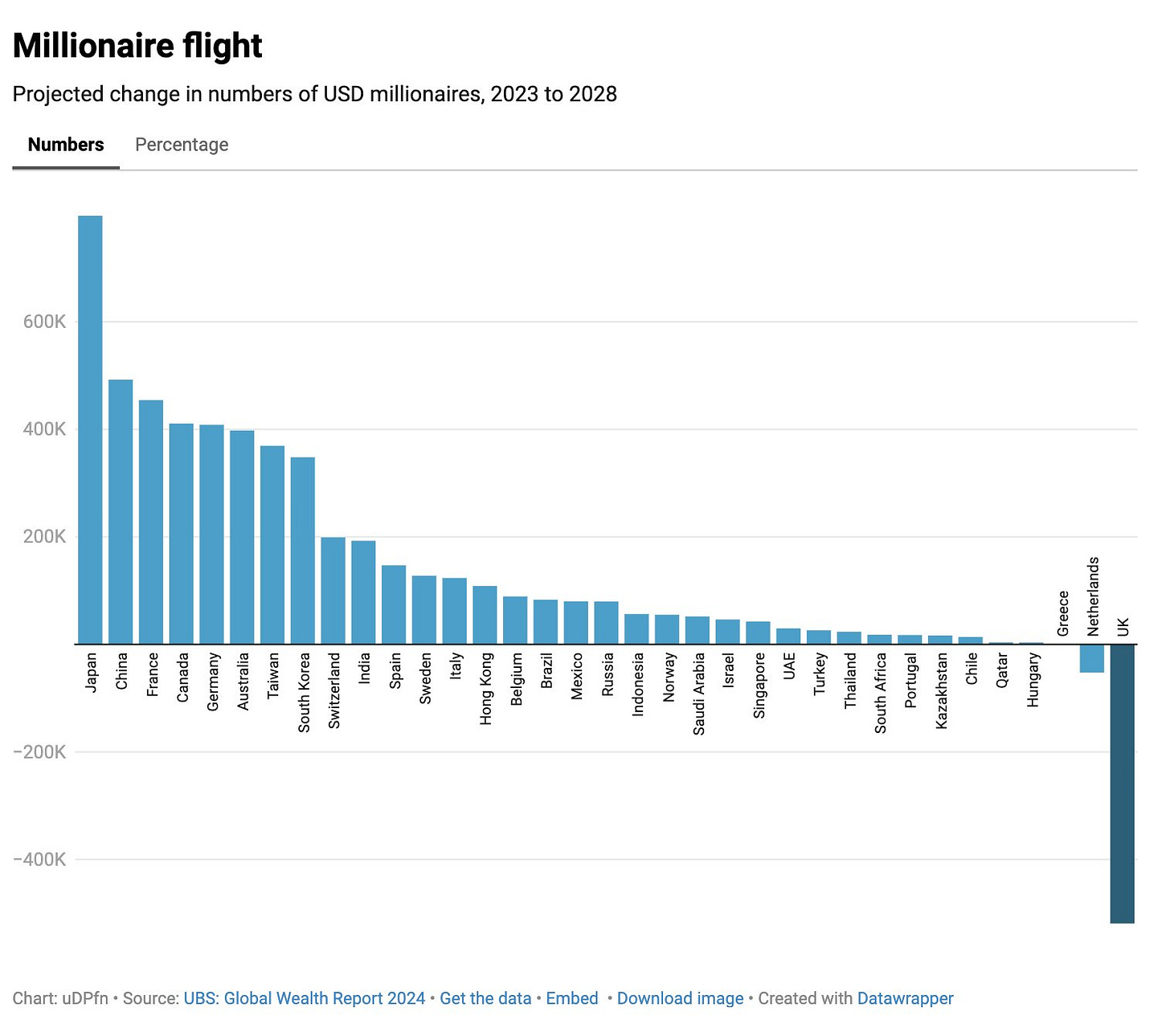

Taxpayer Crises in the UK, again in one chart:

“Zihilism”, and Why Young Men are Choosing the Roulette Wheel. This is a fascinating read into the new career mentality of Gen Z from my new friend, Anderson. It is particularly important to read this after the crypto drawdown and the wipeouts that have resulted from excessive leverage. He writes about the way Gen Z views careers, which happens to perfectly align with my ethos and conclusion that ‘career pathways’ are nonsensical, non-profit speak, yearning for a bygone world, and that ownership is the primary driver for a productive future.

The Old Game: Climb ladders someone else built. Wait your turn. Follow rules designed before you were born. Trust that patience pays. Accept that the house always wins. Trade your time for tokens that buy less each year. Compete for scarce positions in hierarchies you didn’t create.

The New Game: Build your own systems. Create asymmetric upside. Play games where being right compounds. Design status hierarchies based on competence not credentials. Form small cells that ship products not resumes. Replace extraction with creation.

The Old Game is zero-sum by design. Your gain requires someone else’s loss. The ladder has limited rungs. The positions are scarce. The rewards diminish. The house always wins.

The New Game is positive-sum by construction. Your success makes the system stronger. Intelligence compounds. Reputation builds. Networks strengthen. Everyone who plays seriously wins differently.

In 2008, Anderson was a five-year-old living in South Florida. His parents lost both their jobs and left their house. They had to live out of their car for a week before a relative took them in. At that time, he began detailing other people’s luxury cars and boats to make a living in Miami, and he slowly found himself drawn early into Bitcoin and crypto (in his own words here).

‘I learned the hard way that if you don’t own where you live, what you earn, or what you create, you’re just renting your life from someone else. That realization didn’t come from reading about economic theory or studying market dynamics. It came from watching paper systems break families, middlemen stall survival, and ownership become a myth for most people.’

This gets us to the devaluation of the dollar, cryptocurrency, and stablecoins. This newsletter has recently discussed the deteriorating macroeconomic conditions and international central bank moves towards gold. Because if this is true, then it will be one of the most significant economic inflection points of the decade. And the evidence keeps on accumulating. For this reason, I read:

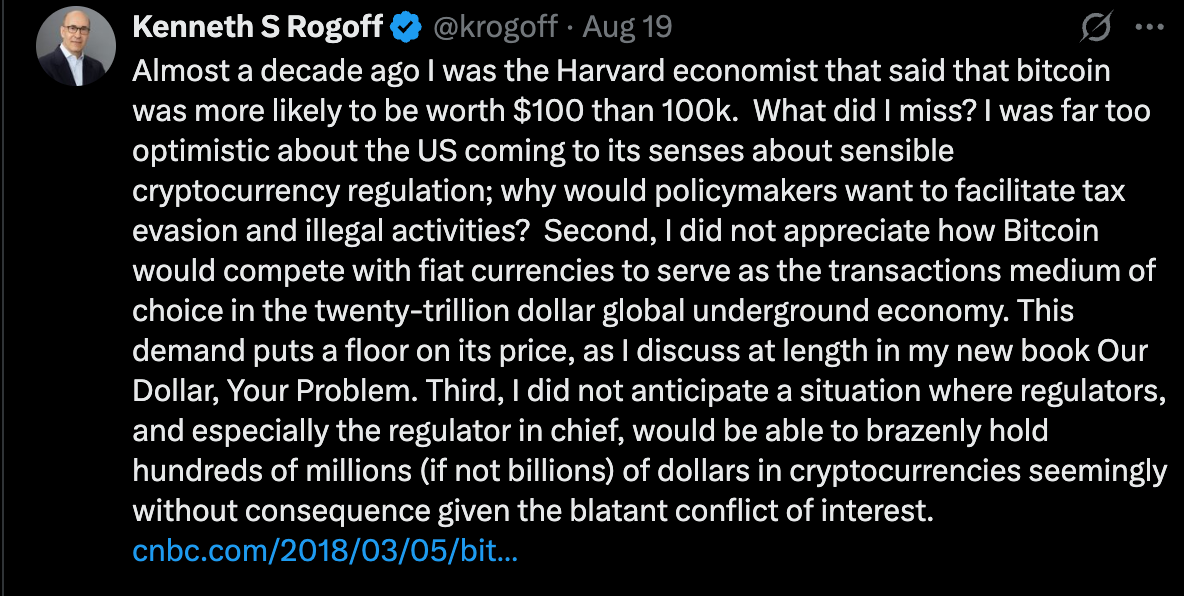

Our Dollar, Your Problem: An Insider’s View of Seven Turbulent Decades of Global Finance, and the Road Ahead by Ken Rogoff.

Most academic economists are poor at predicting the future, in part, because they lack an intuitive understanding of the real world. This book provides a comprehensive historical overview of various currency regimes and their challenges (or lack thereof) to the dollar, but it lacks much in terms of forward credible predictions. The author himself acknowledges his blind spots below. I doubt he spends much time with Gen Zers like Anderson.

If you build on what he missed and take it to the next level, that is a more accurate future forecast.

I keep thinking about Matt Levine's take on Tether.

Man alive, this is the best business in the world:

Tether Holdings SA, issuer of the world’s largest stablecoin, is in talks with investors to raise as much as $20 billion, a deal that could propel the crypto firm into the highest ranks of the world’s most valuable private companies. ...

Depending on the stake offered, the deal could value the company at around $500 billion, putting it into the same league as OpenAI. Open AI is trying to build artificial superintelligence. SpaceX is trying to go to Mars. What is Tether? One simple model is that Tether is an asset management firm with unusual economics. The economics are:

People give Tether money — currently $172 billion — to invest.

Tether invests that money with absolute discretion, though for various reasons it invests mostly (not entirely) in US Treasury bills and other safe short-term assets.

Tether keeps 100% of the investment returns for itself as a management fee.

The first two features are not that unusual. The third is wild! The Vanguard Federal Money Market Fund has approximately $362 billion in assets — roughly twice the size of Tether’s assets — and invests in U.S. Treasury bills, charging a 0.11% annual fee. Tether charges, in round numbers, 40 times as much.

The El Salvador-based group is expected to hoover up even more Treasuries in the near future. Treasury Secretary Scott Bessent has signalled that large stablecoin operators will become a key source of demand for the deluge of US government debt required to fund the administration’s spending plans.

If Tether ends up owning a trillion dollars of Treasury bills, collecting 5% per year, paying 0% to the people who deposited the trillion dollars and having a 99% profit margin, then … I don’t know how to end that sentence?

That will justify a $500 billion valuation, sure. (That’s like a 10x P/E ratio.) But also … what? I feel like I write a lot about all the complex and sophisticated ways people have found to make money with other people’s money, and Tether is just like “why don’t you give us all the money and we’ll collect all the interest” and it works.

Well, it works for now. But eventual stablecoin holders will demand that the yield be passed through. The only reasons I can think of for this not happening are lack of competition and/or that crypto is still mostly for underground transactions, and those users aren’t concerned with receiving their risk-free rate because they are playing a different game with more significant stakes (tax avoidance, dirty money, etc).

Competition is rapidly entering this space. The Stablecoin Duopoly Is Ending was a good read on the future of this space.

Weeklies: Selfie & Song

Selfie: Visit to Proto Town, Lockheart, Texas

People often ask me ‘What’s the venture/startup scene like in Austin?’ and I reply that we are in cowboy country and there is no cowboy convention. Founders don’t want to attend your gossipy in-crowd dinner event; you need to go and meet them in the field.

I took a recent visit to Proto Town, a ~500-acre ranch in Lockhart, Texas (~1 hr drive from Austin), which is a low-key WeWork for hardtech/deeptech startups to prototype and experiment. It’s currently a ‘if you know, you know’ sort of situation, much like this newsletter. My friend Blake runs 021.vc, a fund that invests in companies building within this ecosystem, and he created a promotional video. We are thinking of organizing a tour.

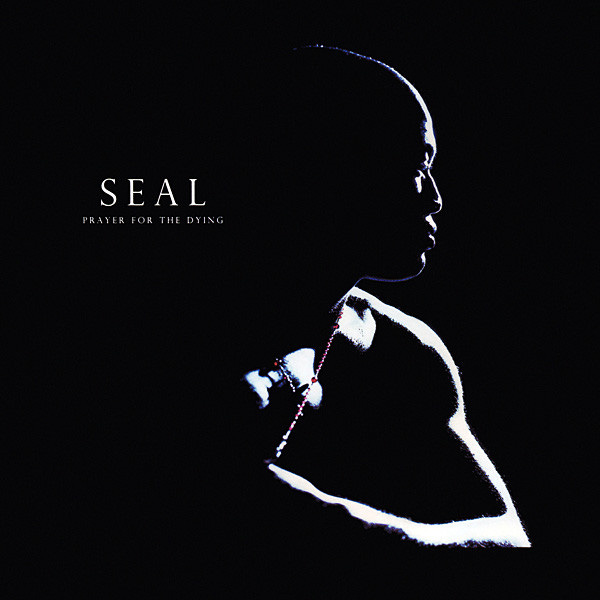

Song: Prayer for the Dying

Here on YouTube.

This is a lesser-known but still beautiful song from Seal’s massive hit album, Seal, which featured “Kiss from a Rose.” It’s a message of hope and perseverance and one of my favorites from the childhood album.

The chorus, “Life carries on,” is a central motif of the song. It emphasizes the idea that life persists despite challenges and hardships. It’s a message of resilience, encouraging the listener to persevere and move forward, even in the face of adversity.

The line, “Crossing that bridge with lessons I’ve learned,” speaks to the idea of personal growth and transformation through life’s experiences. It acknowledges the mistakes and risks taken but also suggests a willingness to learn from them.

The metaphor of “playing with fire and not getting burned” is a powerful image. It symbolizes the idea of taking risks in life without suffering irreparable harm, implying that one can face challenges and come out stronger on the other side.

“Prayer for the Dying” by Seal

Crossing that bridge with lessons I’ve learned

Playing with fire and not getting burned

I may not know what you’re going through

But time is the space between me and you

Life carries on, oohThanks for reading, friends. Please always be in touch.

As always,

Katelyn