Never Gonna Give You Up

w.275 | Trend Breaks, EMW, Marks Memo, AI Rollups, Circle, & End of Search

Dear Friends,

Happy summer solstice! It’s officially the longest day of the year.

Hope you were able to get out and enjoy it.

Today's Contents:

Sensible Investing: Trends

Song of the Week: Never Gonna Give You Up

Sensible Investing: Trends

Trend Breaks Aren't Always Real. Shocking trends often draw attention - but are as often likely to be artifactual than signals of real things worth worrying about.

I enjoyed this piece from Cremieux and his X thread, which included a series of examples, e.g.,

Many people continue to believe in the life-giving power of the lifestyles people have in "Blue Zones". But Blue Zone longevity is... - Not exceptional on closer inspection - Explained by fraud. Take Japan's 110+ people as examples: their families just want pension checks!

The increase in autism diagnoses over time is just that: increasing diagnoses. When people claim otherwise, they're falling into a number of traps. They're getting confused about how diagnoses could increase for, say, a certain severity level of autism.

Coatue East-West 2025: I appreciate firms that put out research and look to advance the conversation. Here, again, there are lots of good charts.

Summary: Bullish on AI (no surprise) and Crypto. We’ve already covered the main risks they identified (as a reminder: we’re in an expensive market, the end of US exceptionalism, and ballooning deficits).

Coatue believes the AI revolution will be so massive and bring so much productivity gains that, in the long-term, it outweighs risks.

Here’s a nice summary of career learnings. Simple and sort of obvious, but always worth learning from the experience of others.

More on Repealing the Laws of Economics - Howard Marks Memo. He discusses how concepts like rent control, tariffs, and fire insurance in California suffer from various Economics 101 distortions. Then he discusses the US federal deficit - another concept we’ve extensively covered - and how it’s politically infeasible to take any of the actions necessary to remedy the situation. He makes the case for a free-market economy approach to government policy.

Why AI Labs Are Starting to Look Like Sports Teams - With compute more abundant, talent is the new bottleneck in AI. Star players are signing pay packages that resemble those of professional athletes. Timely article from Sequoia.

USFS and BLM Lands Eligible for Sale in the Senate Reconciliation Bill - Apparently, this is causing concern on both sides of the aisle. Yes, I’d rather keep it public land - but this shows the pickle we are putting ourselves in with respect to tough choices as we declare so many other avenues unaddressable, too.

Your Brain on ChatGPT: Accumulation of Cognitive Debt when Using an AI Assistant for Essay Writing Task. See the 206-page research paper from MIT.

TL/DR: GPT use produced the weakest brain activity, and students engaged less deeply. Ayush Agrawal posted a nice analysis on LinkedIn.

These findings are in line with what you’d expect. The best learning requires work and happens in a state of flow. GPT use is probably too cognitively easy in some ways unless you redefine the learning outcome you are seeking to achieve (productivity over depth, for example).

AI Roll-Up Deals Accelerate as Top VC Firms Edge Towards Private Equity. Fresh details on roll-up plays by General Catalyst, Slow Ventures, and 8VC. The article is behind a paywall, but someone shared the chart online.

Time will tell how these perform, but they will require strong execution and operational expertise to succeed. These are ‘great’ businesses for a specific type of asset accumulator that can lock up investor capital and charge fees for a long time without much risk of a total write-off.

Circle & the GENUIS Act. Nice analysis on the implications here. The legislation has passed the Senate but not the House, so it is still not law; however, the information has already been absorbed by the market. The post-IPO bump of Circle (currently up 675%) is remarkable. When the trend hits in crypto, it really can produce extraordinary short-term gains. Sadly, I didn't buy the IPO, but I did flag this trend and the progress of the act early!

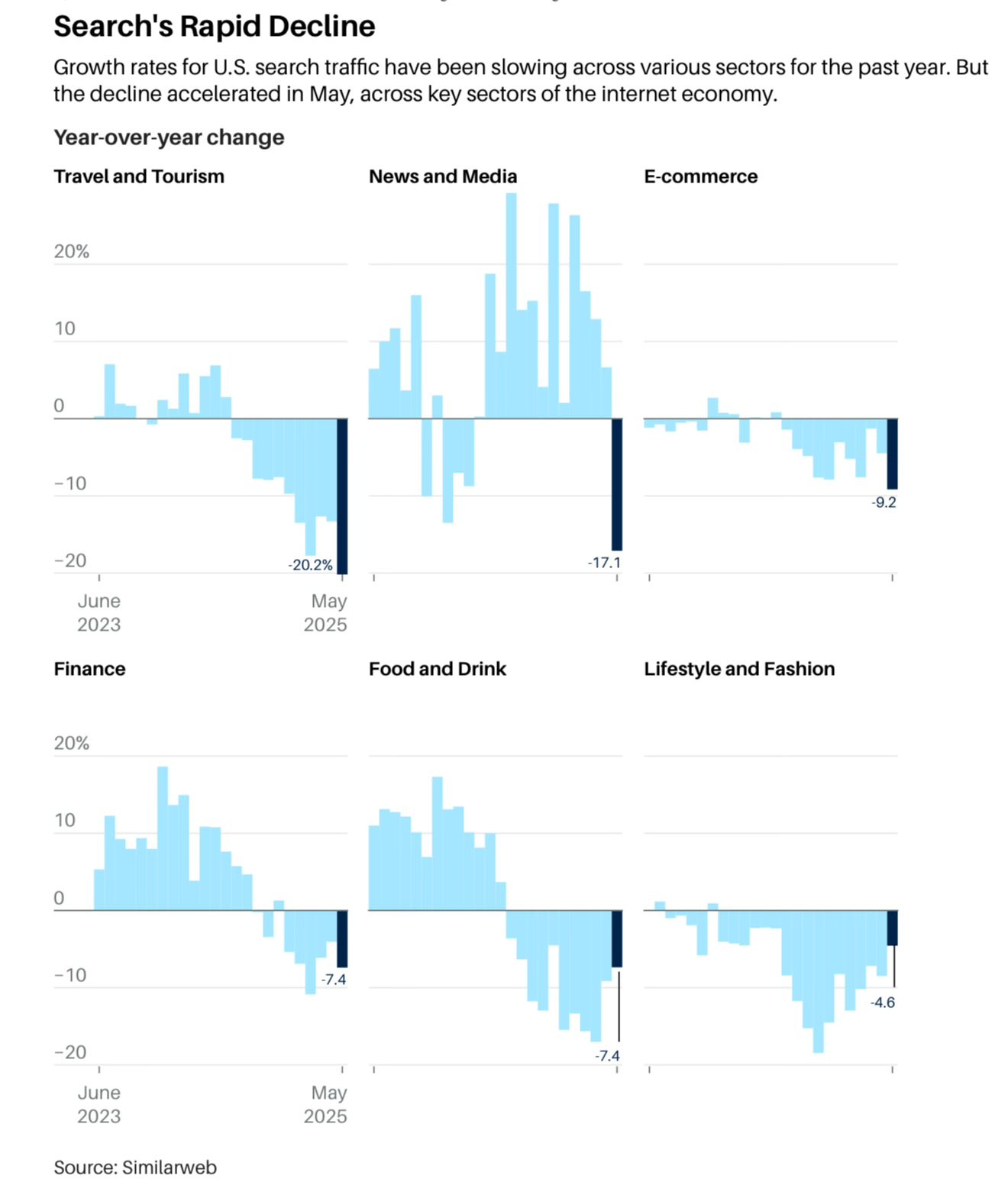

Google Search Is Fading. The Whole Internet Is at Risk (behind a paywall, sorry). The lifeblood of the Internet is drying up, and what the decline of search means for users, companies, and stock. As you’ve read the word “paywall” multiple times in this newsletter, the economic model of creating and distributing information appears to be speeding towards a change from search-based ads.

Song of the Week: Never Gonna Give You Up

Here on YouTube.

People call this song ‘the national anthem of the Internet,’ and at 1.6 billion YouTube views, that might be deserved.

Someone asked me this week ‘What’s the Rick Roll of venture?’ and I didn’t understand the reference. That led to an unexpected deep dive into The Story of The Legendary Song That Became the Rick Roll; this is a 30-minute YouTube movie produced by Vice, which I highly recommend.

What is the meme? The Rickroll is an Internet meme involving the unexpected appearance of the music video to the 1987 hit song "Never Gonna Give You Up", performed by English singer Rick Astley. The aforementioned video has over 1.6 billion views on YouTube. The meme is a bait-and-switch, usually using a disguised hyperlink that leads to the music video. When someone clicks on a seemingly unrelated link, the site with the music video loads instead of what was expected, and they have been "Rickrolled".

One of the interesting lessons in this is the serendipity in the creative process and the ah-ha moment that you have to capture super quickly. And then there is the nature of virality and art that immediately resonates across audiences, leading to the initial hit and then the revival through the meme.

“Never Gonna Give You Up” by Rick Astley

Never gonna give you up

Never gonna let you down

Never gonna run around and desert you

Never gonna make you crySelfie of the Week

Another one of my favorite people!

Don’t worry about blurry eyes, as coming off an overnight from the US, my friend Jules and I did a spin through some of the top museums in Spain. Jules is an entrepreneurial investor and often super early - dare I say, sometimes too early! - to where the market is going. She founded VC3, an investment DAO (decentralized autonomous organization), during the COVID-19 and web3 boom, which was the most sophisticated instance of an investment DAO and required incredible skill and determination to convene.

Jules is friends with everyone and is a great travel companion. I signed up to attend a small curated investor/founder un-conference with her this weekend, which did not disappoint (welcome, new friends!).

Jules and I met and bonded almost ten years ago through Kauffman Fellows, a fellowship for venture capitalists and investors in the innovation economy. Kauffman has just named 66 new fellows to its latest class (profiles here). One of my hacks is that I always sign up to interview for the next class to meet some fantastic folks.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn