Ndokulandela (I Will Follow You)

w.271 | Crypto, Enterprise Software, Yields, Standardized Tests, AI Implications, & South Africa

Dear Friends,

If you are in the US, I hope you’ve had a lovely Memorial Day weekend.

Before diving in, a question: Do you have a ‘gifted’ child? Ayush, founder of Pencil, is looking for families who want to trial his beta AI-tutoring product. He’s a product builder (GOOG, FB) with all the credentials. Yes, I’m an investor. You can express interest here.

I’ve also been enjoying The Home School Substack that recommends a smart shapes book (math for toddlers) called Which One Doesn’t Belong?

PS. Corrected link from last week: Sir Chris Hohn - In Good Company.

Today's Contents:

Sensible Investing

Song of the Week: Ndokulandela

Sensible Investing

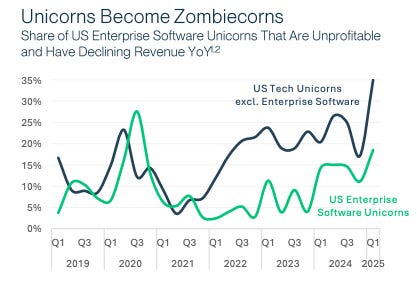

State of Enterprise Software: Overview of Trends in the VC-Backed Sector from SVB. Being a ‘unicorn’ is becoming rare again.

Solana: Accelerate or Die. This week, I attended the ecosystem conference for Solana, the layer one cryptocurrency. It was the first time it was held in the US. For context, Solana is the six largest asset in cryptocurrency by market cap ($89B vs $2.1T for Bitcoin and $303B for Ethereum).

Why is the crypto & blockchain space interesting to spend time in again?

First, the GENIUS Act is serious legislation in the US Congress to create a legal bridge between blockchain-based decentralized finance and traditional financial institutions. A large number of policymakers (Senators, Representatives, and staffers) attended the conference.

Second, the use cases are becoming clearer as stablecoins allow people and businesses to hold dollars in volatile economies and are increasingly accepted as a form of payment.

Third, the technology and ecosystems are getting more robust as it is more thoroughly tested, and fraudulent actors are exposed and pushed out.

Four, institutional adoption is accelerating fast. Many large law firms and consulting firms sponsored the conference. Speakers included Franklin Templeton, Fidelity, Apollo, JP Morgan, etc.

Main takeaways:

The scale and breadth of institutional adoption of crypto and blockchain keep growing

There is a significant interest and inflows from a diverse range of clients

Stablecoins are at the center of Wall Street’s adoption of blockchain

Tokenized financial assets and money market funds are next

Real World Assets (RWA) may follow fast. Robinhood has pushed this agenda forward with the SEC.

The cryptobull case relies on the consistent inconsistency of old-world traditional government institutions. From what we see in the US, it seems this is becoming more and more of a reality. This is not far from the plot of Snow Crash.

Charting the Global Economy: Long-Term Bond Yields Soar Around the World. The bond market noted the spending bill advancing through the House of Representatives and concluded that the US cannot control its deficit spending - which is likely to have knock-on effects for everyone.

Interesting stat: Eight members of Congress have died in office since November 2022. All were Democrats. Their average age was 75 at time of passing.

‘New Measures of Merit’ (or sometimes just old ones). Standardized tests are probably the best predictors of academic success. I had this conversation several times this week. This has been proven again in research studies. “Standardized test scores predict academic outcomes with a normalized slope four times greater than that from high school GPA, all conditional on students’ race, gender, and socioeconomic status,” the researchers wrote.

The same goes for the MCAT for doctors: These data demonstrate that MCAT scores add value to predicting medical student performance and progress and that applicants from different backgrounds who enter medical school with similar ranges of MCAT scores and UGPAs perform similarly in the curriculum.

Are the AI models about to spiral out of control? AI alarmist Eliezer Yudkowsky says we should shut all development down for at least six months.

What AI Thinks It Knows About You. What happens when people can see what assumptions a large language model is making about them? By Jonathan L. Zittrain, professor of law, public policy, and computer science at Harvard University.

He provides a few observations from his forthcoming book. These implications are highly relevant as we move to an AI-facilitated world.

The models will give answers and recommendations based on their knowledge of our demographics. It doesn’t sound that different from ad targeting today or even the biases humans themselves might make:

Or, to put it plainly: assumptions and, it seems, correlating stereotypes based on whether the model assumes that someone is a man or a woman. Those beliefs then play out in the substance of the conversation, leading it to recommend suits for some and dresses for others. In addition, it seems, models give longer answers to those they believe are men than to those they think are women.

…

People are already trusting today’s friendly, patient, often insightful AIs for facts and guidance on nearly any issue, and they will be vulnerable to being misled and manipulated, whether by design or by emergent behavior. It will be overwhelmingly tempting for users to treat AIs’ answers as oracular, even as what the models say might differ wildly from one person or moment to the next

Trend Watch: Deteriorating Consumer Credit. This is a fun X thread of a ton of people sharing their Lending Club losses.

Song of the Week: Ndokulandela

Here on YouTube.

Bongeziwe is a South African artist who sings in his native language, Xhosa. This song sounds beautiful and has achieved global virality. The lyrics speak about following and trusting someone through life's ups and downs and the human need for connection and safety in a world that can be unpredictable and scary.

I’m sure it’s quite the performance to witness live. Though maybe not as dramatic as the visit of South Africa’s president, Cyril Ramaphosa, to the White House this week.

Ramaphosa is renowned in his home country as a calm, measured politician who is hardly ever emotional.

He made his name in some of the toughest, highest-profile political negotiations his country has ever faced. Ramaphosa was the African National Congress party’s chief negotiator during the talks in the early 1990s that ended the apartheid system of white minority rule that had forced racial segregation on South Africans for nearly a half-century.

South Africa is one of my absolute favorite countries in the world. I led Pearson's first institutional investment into the first technology-enabled private school chain called Spark Schools. We invested when there were 150 kids in 4 classrooms. There are now 16,000 SPARK scholars at 26 schools. Then, I came back with Delivery Associates to build a delivery unit in the Western Cape. In the DS community, we have close lifelong friends, including an Afrikaner farmer and an ANC freedom fighter and later minister.

I don’t know anything about the current events and politics in South Africa, but this was a prompt for me to think about the beautiful country and my friends there.

”Ndokulandela“ by Bongeziwe Mabandla

(I Follow You)

Ndokulandela

(In front of everyone)

Phambi kwabantu bonkeSelfie of the Week

My friend Nick Ducoff is a former EdTech founder turned crypto degen, turned VC, now head of institutional adoption at Solana. He’s living his best life these days.

We talk a lot about personal investment strategy. ‘Mostly Bogle it and then make a few big bets. ’

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn