Lose Control

w.266 | Interest Rates, Nobody Knows, JP Morgan, V-Bottoms, & Reflexive AI

Dear Friends,

It was an eventful week, especially for those of us who spend time on text threads discussing strategy, transactions, and watching the waves of volatility thrash about. As long-term investors who buy-and-hold, there was no trading to do this week, though plenty of people (and models) seemed to be zigging and zagging away.

Best I can tell, the Trump administration decided to limit the amount of bad news via the 90-day moratorium on reciprocal tariffs. Given the increase in tariffs to China, though, the net tariff did not change, which the public markets appeared to realize over Thursday and Friday. We now have more exemptions coming in this weekend, which should support equities next week (Nvidia’s AI servers, Apple iPhones, etc.), though the question on stability will remain.

Watching The Godfather might be an appropriate primer this weekend, or there is always the source material on these tactics in The Art of the Deal.

Today's Contents:

Sensible Investing

Song of the Week: Lose Control

Sensible Investing

Interest Rates Rule Everything. Liquidity worsens in $29tn Treasury market as volatility soars. 10-year US government bond yield rose most this week since 2001.

When there is $9.2T of debt for the US to refinance in 2025 (roughly ~25% of the total national debt) and the majority needs to be refinanced in the first half of the year, these numbers started to matter quite a bit.

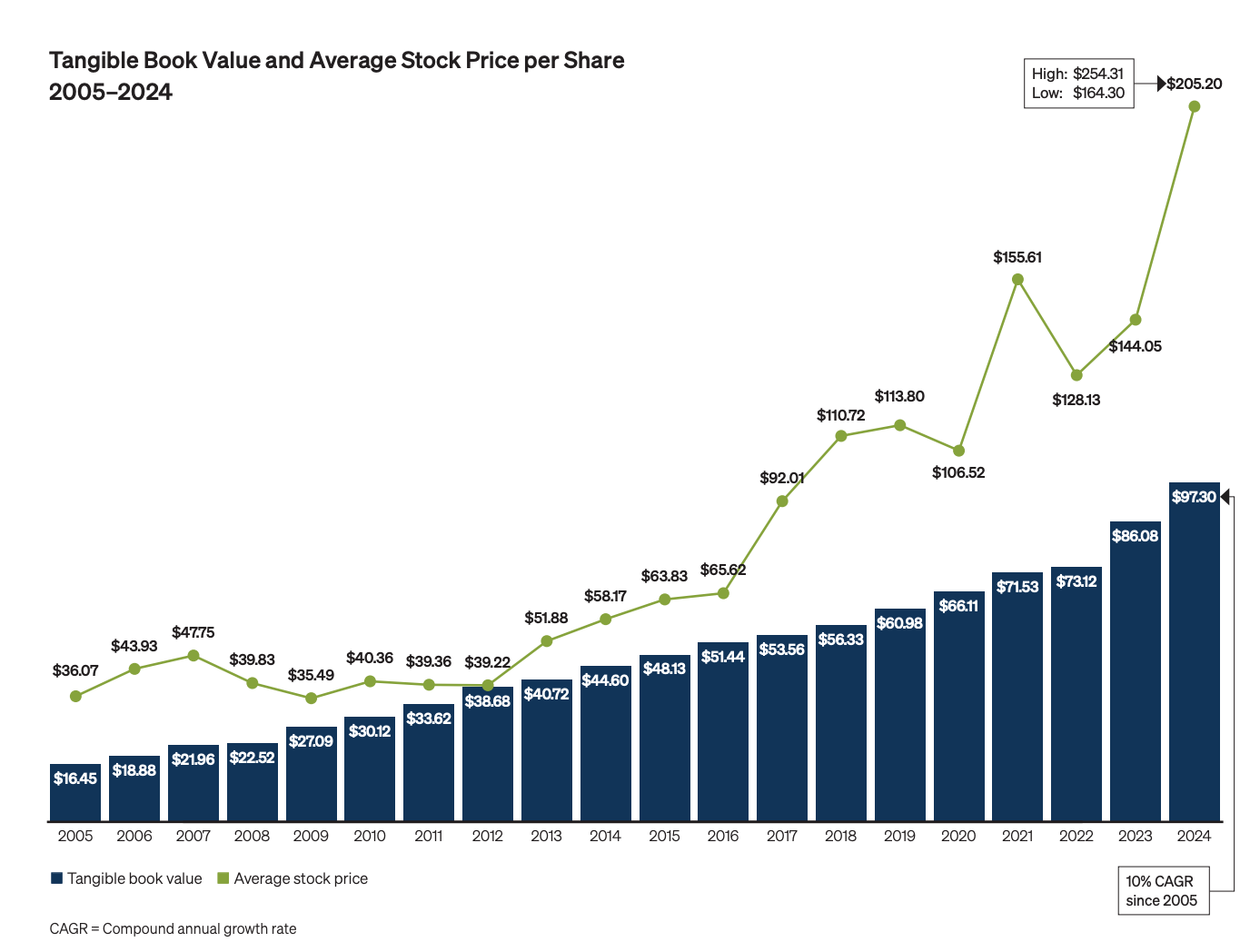

JP Morgan Annual Report. At 372 pages, it’s a commitment to parse through, but it also provides great insight into the state of America and capital markets. I thought the chart below was a good illustration of how 2024 (kind of like 2021) was a year of stock market exuberance. The bank's tangible book value has been increasing steadily - and the 10% CAGR over 20 years is incredibly impressive - but the stock market’s valuation is erratic.

Other notable things:

55-page treastie from Jamie Dimon on the state of the world and the things America needs to do:

2-pages devoted to the bank’s support of Texas (pages 46 & 47). Yes, my Lone Star state is the only one to get a specific call out.

Nobody Knows (Yet Again) - The latest Howard Marks Memo. Extracting a few of the sentiments expressed that felt worth sharing:

In addition to a forecast, you also need a good sense for the probability your forecast is correct, since not all forecasts are created equal. In this case, under these circumstances, it must be accepted that forecasts are even less likely to prove correct than usual.

I love the title of market analyst Walter Deemer's book: “When the Time Comes to Buy, You Won’t Want To.”

But we also have to bear in mind that deciding not to act isn’t the opposite of acting; it’s an act in itself.

Lastly, given Trump’s tactical focus, it’s important to remember that everything is subject to change. It shouldn’t surprise anyone if he extracts concessions, declares victory, or responds to other countries’ retaliation by escalating further.

I consider the tariff developments thus far to be what soccer fans call an “own goal.”

I started each meeting by saying I’m one of the hundreds of millions of Americans who respect Canada and consider it a friend and ally. The reception was stirring. This is a good time for all of us to connect with friends around the world.

Speaking of international friends:

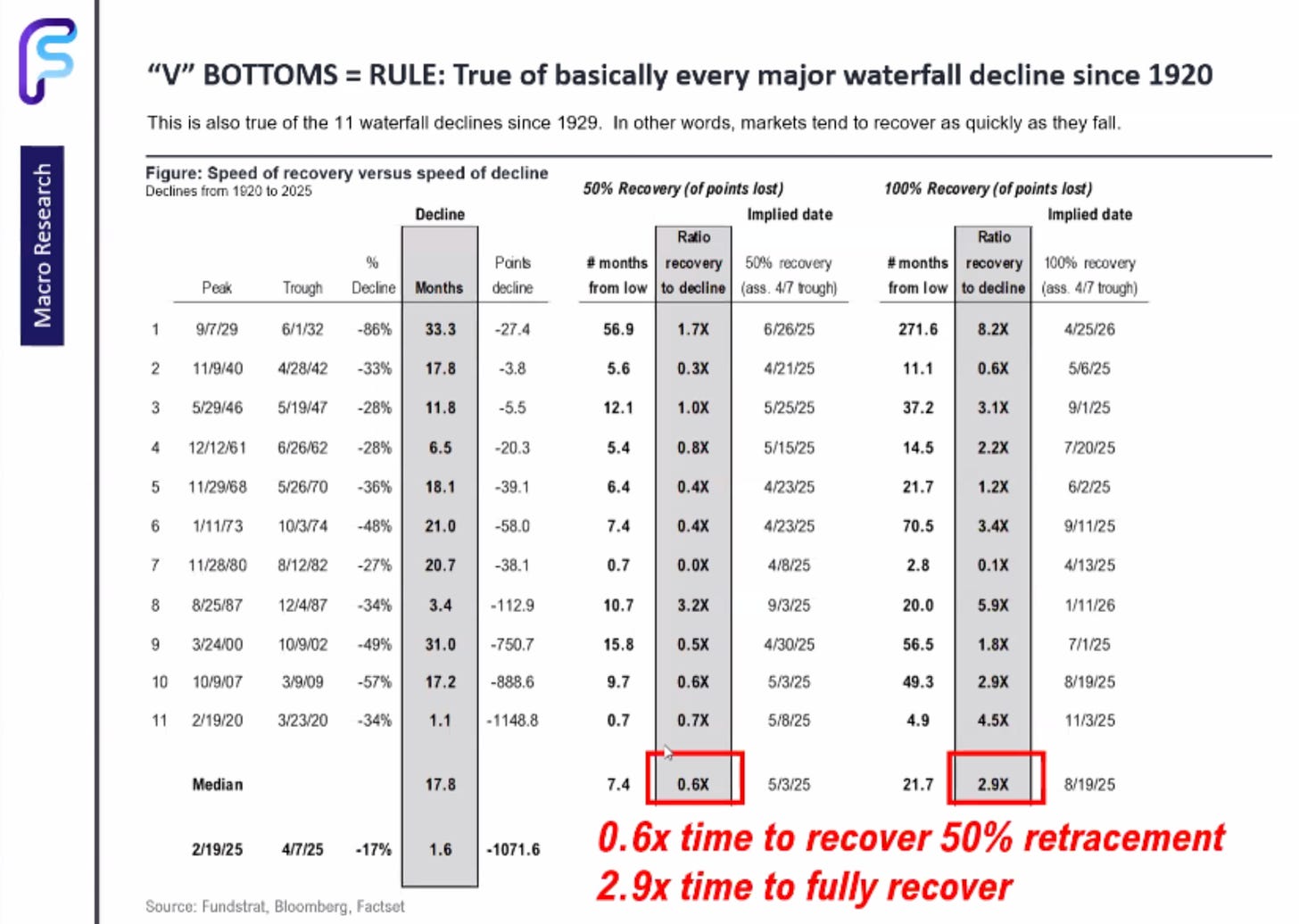

My friends at Frais Capital (Melbourne) shared this chart with me on the V-Bottoms Rule, that markets tend to recover as quickly as they fall. Will this hold true this time? We will see.

Reflexive AI Usage is Now a Baseline Expectation at Shopify - Implementation of learning is hard.

Context: This is a Shopify internal memo that Tobi Lutke (CEO) shared here because it was in the process of being leaked and (presumably) shown in bad faith.

Driving technology and new tool use among adults is hard. Very hard. Before, AI was a slew of no-code, low-code tools. I tried to encourage/force the adoption of better tools (e.g., Airtable over Google Sheets) with limited success and a lot of scar tissue.

I’m not surprised to see the frantic behind-the-scenes pushes for adoption, particularly among those less tech-native in their jobs. This will be a mega trend in the push for productivity gains from AI.

Song of the Week: Lose Control

Here on YouTube.

It's a fun song that was super popular in 2023. I thought it was worth a listen this week, as no one seemed in control.

“Lose Control“ by Teddy Swims

I lose control

When you're not next to me

I’m fallin’ apart right in front of you, can't you see?Selfie of the Week

It was a big week for the Austin ecosystem with regards to energy and powering the future. Base Power announced their $200M Series B to build a decentralized power grid, and Aalo Atomics held their Reactor Factory Pilot Line unveiling. Texas has ambitions to be the energy hub of the world. The government, university systems, and entrepreneurial ecosystem are rallying hard.

There are SO many companies going after the nuclear space right now.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn