I Ran (So Far Away)

w.276 | Blend, Business Transition, Stripe, Alpha School, Value vs. Growth, & These Memories Do Not Belong To Us

Dear Friends,

I hope you are surviving the global heatwave. It has become a ‘two showers a day’ situation here, but still nice to be outside and enjoy the sun.

Today's Contents:

Sensible Investing: Trends

Friends and Culture

Song of the Week: I Ran (So Far Away)

Sensible Investing: Trends

Indexing the AI Economy, a report from Stripe.

We’ve observed three key trends shaping the rapid growth of the AI economy:

AI startups are hitting important revenue milestones much faster than previous generations of tech startups

AI companies are expanding internationally right from the start, quickly becoming global businesses

Innovative business models and monetization strategies are emerging quickly, driving accelerated revenue growth and adoption.

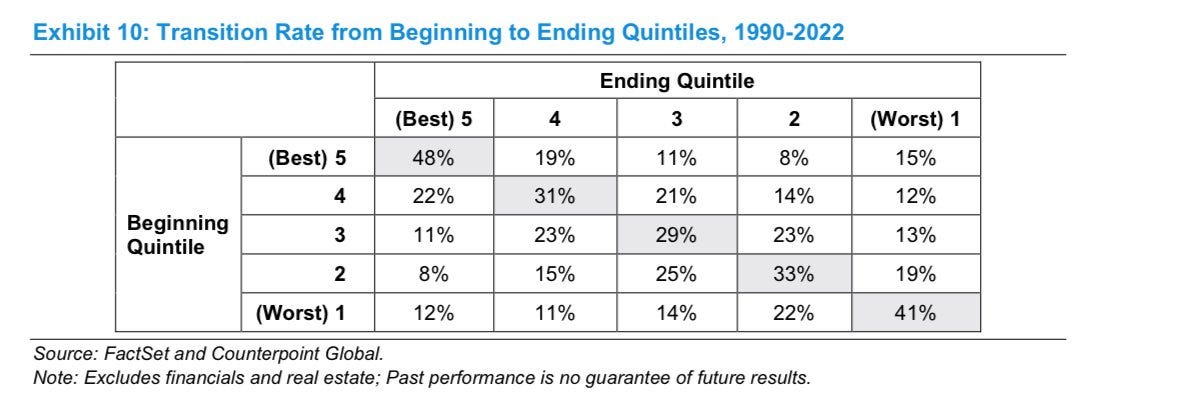

Your "Bad Business to Good Business" Thesis Probably Won't Happen. Great to still great is the best hunting ground. Found on X. From Morgan Stanley Report in 2023. A good reminder; it’s possible but not probable to move up significantly relatively.

Interesting Split: Growth sectors are outperforming in the US, while Value sectors are leading the rest of the world. Our story of the Magnificent Seven vs. the S&P 493 has a similar split, and this layers on the value of the Dollar, too.

Blend Labs ($BLND) Turnaround of a Lifetime. A digital tollbooth on the flow of money between institutions and their customers. My good friend Rush wrote this excellent analysis post for his new substack, Security Analysis AI. He’s smart, thoughtful, and early to great public equity investing ideas. I highly recommend you sign up :)

The $500B Forecast For Crypto Mortgages and Prediction Markets. Thought this was an interesting piece on the catalyst factors for this emerging sector. Regulatory hurdles have been overcome, unlocking key benefits.

On Wednesday, the Federal Housing Finance Agency issued a directive that reshapes mortgage qualification standards in the US. For the first time, Fannie Mae and Freddie Mac must consider proposals that treat cryptocurrency holdings as qualifying assets in single-family mortgage risk assessments. Liquidation of crypto before loan approval — a requirement that triggered capital gains taxes and eroded long-term holdings — is no longer the default condition.

Crypto mortgages meet a basic need: keeping digital wealth intact while expanding into physical assets. Prediction markets meet a systemic one: pricing uncertainty with speed and precision. Together, they form a core of the new financial stack being rebuilt with blockchain and AI for velocity, transparency, and composability.

Your Review: Alpha School. This article is an excellent overview of the private school chain in Austin that has been making waves with its ‘two-hour learning approach.’ Everyone who knows my history in education investment always asks me about it.

This review from an Alpha parent mirrors the ones I hear from my friends with children attending; they all moved to Austin for the school. Arvind’s reflections on the article are also worth reading.

One of Our Resident, Tenured Economists Strongly Commented on the "Your Brain on ChatGPT" Article from Last Week, which is a reminder on the need for experts to vet source materials:

The "MIT" paper you cite is bullshit. Not saying that ChatGPT is good or bad for the brain, but that it's a bad hype paper from the typically shoddy researchers at the Media Lab.

Friends and Culture

One part of having capital is the responsibility to will the future into existence and bet on the people and ideas you want to shape the future.

These Memories Do Not Belong to Us. Five years ago, I wrote in this newsletter about my friend Yiming Ma and my admiration for him Taking A Risk and Betting On Yourself. Yiming was the first real hire that I made while leading Pearson’s corporate venture capital unit. He was a McKinsey all-star in the New York office who could both crush financial models and had a deep drive to write and contribute to culture. He’s an incredibly talented polymath and a lovely and thoughtful friend.

Almost 12 years later, his debut novel will be published in the US (HarperCollins) in August. Only about 60 debuts are published or funded every year by the Big Five Publishers in this genre.

It’s a literary Black Mirror, set in a world where memories are bought and sold, and a renamed China has taken over the world.

To help him make the bestseller lists, I need your help. If you are interested in reading this book, I’ll reimburse the 20 people who pre-order a hardcover copy. One per DS reader, please. Amazon, Barnes & Noble, Indie Bookstore. Just send me the receipt and your Venmo/Zelle/whatever.

In a far-off future ruled by the Qin Empire, every citizen is fitted with a Mindbank, an intracranial device capable of recording and transmitting memories between minds. This technology gives birth to Memory Capitalism, where anyone with means can relive the life experiences of others. It also unleashes opportunities for manipulation: memories can be edited, marketed, and even corrupted for personal gain.

After the sudden passing of his mother, an unnamed narrator inherits a collection of banned memories from her Mindbank so dangerous that even possessing them places his freedom in jeopardy. Traversing genres, empires, and millennia, they are tales of sumo wrestlers and social activists and armless swimmers and watchmakers, struggling amid the backdrop of Qin’s ascent toward global dominance. Determined to release his mother's memories to the world before they are destroyed forever, the narrator will risk everything—even if the cost is his own life.

Amazon, Barnes & Noble, Indie Bookstore

Song of the Week: I Ran (So Far Away)

Here on YouTube.

If you take the lyrics at face value, it's about an alien abduction.

It is also prominent in a lovely scene in La La Land when Emma Stone's character requests the song "I Ran," much to the chagrin of Ryan Gosling's character. He is upset because "I Ran" infamously features very basic, long key presses, and he's a talented jazz pianist.

I thought we’d continue with the 80s synth from last week, and I'd rewatched the movie on my flight.

“I Ran” by A Flock of Seagulls

And I ran

I ran so far away

I just ran

I ran all night and day

I couldn't get awaySelfie of the Week

This section risks quickly turning into a version of ‘Where in the World is Carmen Santiago?’ Can you guess before the picture?

The country is both Asian and European.

The city was once called Constantinople.

This country shares a land border with Iran…and Iraq and Syria. And six other countries.

While this was a brief early-morning blitz of the historical sites, I’m in town spending time with the amazing Tugce Ergul, founder of Hypernova Capital, a hybrid fund of funds that co-invests alongside its managers - which includes me! - and discussing the investment landscape and opportunities with her extensive network.

What tidbits do I have to share with you?

There is a conspiracy theory going around the elite that the Iran - US - Israel military action is a coordinated inside job to boost the ratings of the leadership of all three countries and save face on any concessions. You can choose how you’d like to interpret that. Stranger things have been true.

Turkey has a vast, largely inward-facing ecosystem comprising numerous large, family-owned businesses and substantial wealth. I mainly stayed in the ‘Beverly Hills’ of Istanbul, and it was peaceful—way more miniskirts than head scarves, but that’s a minority across the country.

The tech winners here have been mostly gaming companies (Peak Games), some crypto, and those targeting the consumer sector. A few have global reach (Insider). Many VCs have done incredibly well in Turkey (notably Cem Sertoglu).

Much of the traditional industry includes transportation, energy, construction, and advanced manufacturing. These conglomerates evaluate products and partnerships globally, including the US, Europe, Japan, and China, and have their pick.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

Great post a wealth of gems - preordered a copy of the book; super intriguing premise. Also for the photo, someone like Rainbolt or other geo guessers probably could’ve gotten it without any hints ;)