Heart of Gold

w.260 | BPO, GenZ, Industrial Reboot, BERK, Stripe, Independence, FII Priority, & Pakistan

Dear Friends,

I'm sorry that I was off last week. My nonagenarian grandfather gave me an earful because his favorite newsletter was not delivered as expected.

I’ll do better! And press send early this weekend, too :)

Today's Contents:

Sensible Investing

Debrief: FII Priority

Song of the Week: Heart of Gold

Sensible Investing

College Students and ChatGPT Adoption in the US. A look into state-by-state adoption and how gaps might impact workforce readiness. Report by OpenAI.

Avalanche Venture Wishlist: I did an interview with Miles Lasater and the team at PurposeBuilt about trends I’m interested in investing in.

Pure Independence. Latest from Morgan Housel. An aspiration that I share: “No price is too high to pay for the privilege of owning yourself” from Nietzsche.

Unbundling the BPO: How AI Will Disrupt Outsourced Work. From a16z. AI taking over BPO jobs is obviously the future. It’s just a matter of when.

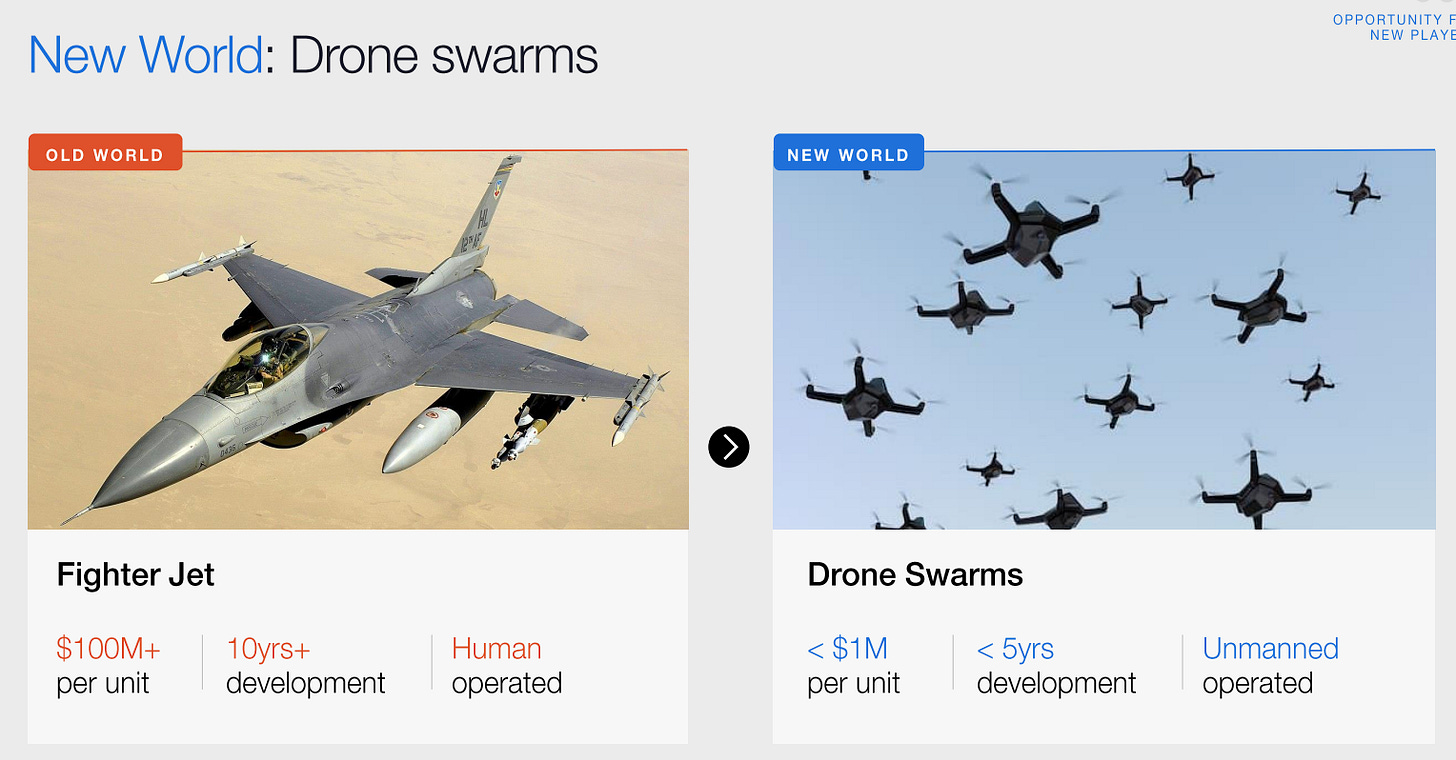

America’s Industrial Reboot: A Massive Tech Opportunity: PPT report from Coatue. Solid analysis slides make the narrative story for an opportunity that we’ve all seen building over the last couple of years if you’ve followed the space. If you are interested in the future of defense, this deck is for you!

Gen Z and the End of Predictable Progress. How AI, volatility, and changing institutions are shaping young people's economic reality by Kyla Scalan.

2025 Portfolio Allocation Benchmarking Study: Insights from Very High Net Worth Investors.

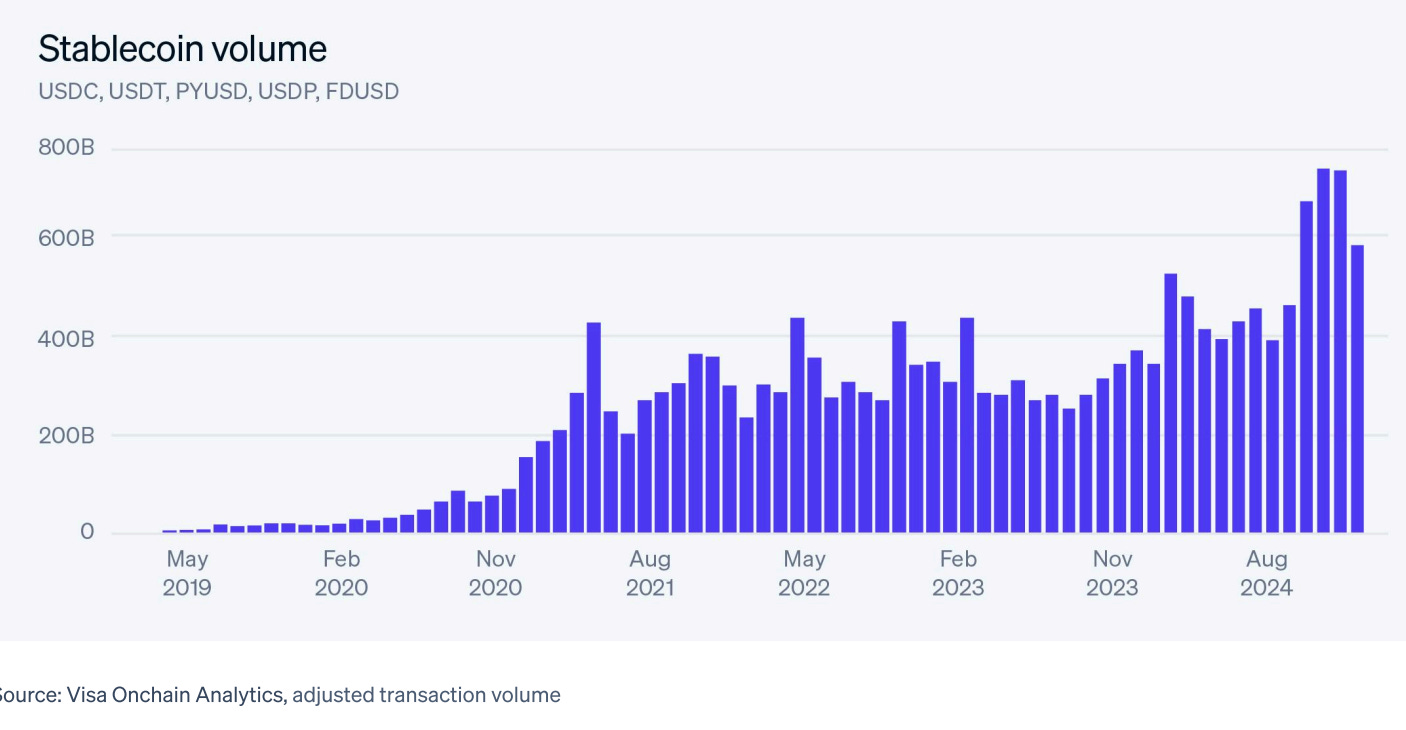

Stripe 2024 Annual Letter. AI-growth, SMB-enablement, Stablecoins, Europe Stagnation. This letter hits a ton of mega-trends. Worth reading in full.

Berkshire Hathaway 2024 Shareholders Letter. In a world full of fakers and frauds, it’s reassuring to still have Warren Buffett. Summarizing:

Record profit, though 53% of businesses had lower earnings

Cash reaches $334.2 billion, no stock buybacks. This is a huge position in US Treasury bonds.

Nice reflection: “Mistakes fade away; winners can forever blossom.”

Love this, of course: “One further point in our CEO selections: I never look at where a candidate has gone to school. Never!” “I’ve observed, however, that a very large portion of business talent is innate with nature swamping nurture.”

BERK is the largest corporate taxpayer: “To be precise, Berkshire last year made four payments to the IRS that totaled $26.8 billion. That’s about 5% of what all of corporate America paid. (In addition, we paid sizable amounts for income taxes to foreign governments and to 44 states).”

Snub to Private Credit: “Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities – mostly American equities although many of these will have international operations of significance. Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.”

Never bet against America: “The American process has not always been pretty – our country has forever had many scoundrels and promoters who seek to take advantage of those who mistakenly trust them with their savings. But even with such malfeasance – which remains in full force today – and also much deployment of capital that eventually floundered because of brutal competition or disruptive innovation, the savings of Americans has delivered a quantity and quality of output beyond the dreams of any colonist.”

But also maybe bet on Japan :) “A small but important exception to our U.S.-based focus is our growing investment in Japan. It’s been almost six years since Berkshire began purchasing shares in five Japanese companies that very successfully operate in a manner somewhat similar to Berkshire itself. The five are (alphabetically) ITOCHU, Marubeni, Mitsubishi, Mitsui and Sumitomo.”

Will I see you in Omaha the first weekend of May?

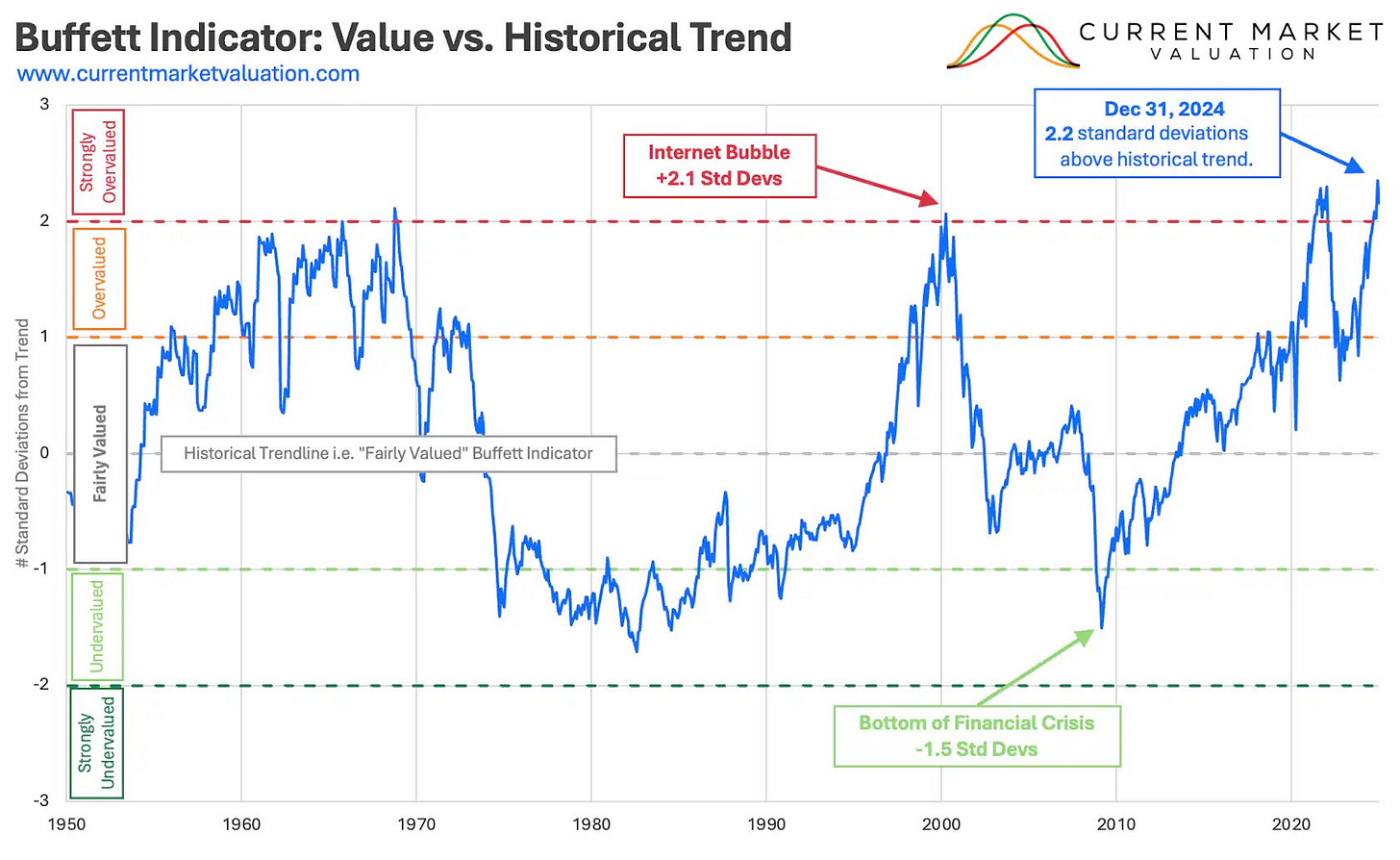

Below is a chart of The Buffett Indicator (Total US Market Value/GDP), which is a ballpark measure of how expensive stocks are at any one point in history. One point to note is that US companies are now much more global than they were historically, so potentially, the ratio is not as dramatic as it may seem.

FII Priority - The Great Realignment.

First, as a reminder, this is a pragmatic newsletter.

In investing and life, it’s critical that you delineate between the world that you wish existed and what exists today. Between what you hope happens and what is most likely to occur. Between the information sources you might be inclined to consume to verify your pre-existing beliefs and the reality of the primary source material. Never before has it been so easy to live in a thought bubble of your creation with a worldview reinforced by algorithms trained for engagement and, more often, enragement.

This newsletter believes that the government's actions and political narrative are intertwined with the economy and all investment opportunities. To seek an understanding of the way the world is changing and what the implications are is critical to being successful. Thus, what I share in this newsletter is not a political conversation about ideology and what we wish to see in the world; it’s the analytical proposition of declarative statements used to declare, make known, or explain. I do not aim to outrage, provoke, or influence.

Second, last fall, I decided to simplify what I do here and more generally to ‘make friends and share insights’ and to show up as smart, fun/funny, and generous. This mindset has served me well. I am both searching for avalanches and building the foundation to string up the dynamite on the mountain.

In this context, last week, I attended FII Priority, one of the premier global investing conferences; the theme was ‘Invest with purpose.’ FII’s largest sponsor is Saudi Arabia’s Public Investment Fund, a nearly $1 trillion sovereign wealth fund. This event was the smaller US summit related to the one I went to in Riyadh last fall.

President Trump's opening speech on Wednesday cemented the status of FII and signaled the importance of the US-Saudi relationship during this administration. Sitting in the front row were Eric Schmidt, Elon Musk, and Yassar (Head of the PIF). Both the Trump Administration and the Saudi government signal a ‘domestic agenda first’ inclination while also recognizing the importance of settling international conflicts. War and conflict are bad for business.

I waited 3.5 hours for the president to appear in a relatively small room. Fortunately, the company was great. To my right was Dr Vivek, a Graphene entrepreneur, dubbed ‘Manchester’s Answer to Elon Musk’. He has a large off-take agreement with the city of Neom in Saudi Arabia (the line in the desert). These are his pictures. To my left was a British international man of mystery.

Sometimes, you need to be in the room where it happened. To feel the energy. To understand the full context and the reaction. Epiphany and insights come from listening, watching, and digesting with others who just saw what you saw.

President Trump spoke for an hour and a half. It was an entertaining performance. He mostly reads from the teleprompter but stops to emphasize key points and make jokes. The crowd mostly laughed along with him. At the end, the conference organizer, Richard Attias, asked him about five questions, which the president answered off the cuff. Key elements of the speech included the DOGE agenda, solving international conflicts, and shoring up the domestic energy and industrial base. The performance ended with a standing ovation and a little dance to YMCA.

The new administration has shifted its international alignment. The US relationship with the Middle East and Saudi Arabia, in particular, is of top importance. Relatedly, most of the European attendees now spend most of their time in the Middle East, seeing more exciting commercial opportunities than in their native lands.

Other mega topics at the event included the rise of sports for a healthy living agenda and some waryiness on the short-term macroeconomic transition — particularly from Steve Cohen:

“I’m actually pretty negative for the first time in a while,” Cohen said. “It may only last a year or so, but it’s definitely a period where I think the best gains have been had and wouldn’t surprise me to see a significant correction.”

Cohen said US economic growth is likely to slow to 1.5% from about 2.5% in the second half of the year. He was also downbeat on the Musk-led Department of Government Efficiency, calling it an austerity initiative, and said tariffs will hold the economy back.

“Tariffs cannot be positive. It’s a tax,” Cohen said. “And you can imagine tit-for-tat if the US implements a tax on somebody, they’re going to perhaps raise the stakes and raise their tax back.”

I believe we should expect an ‘implementation dip’ for any major reform or change program. Economic indicators go down before they go up, and too often, people are unwilling to think and plan long-term when short-term pain is necessary.

Song of the Week: Heart of Gold

Here on YouTube (live version).

This is a song about searching for romantic love but also realizing that one has to understand one’s own flaws and find a heart of gold within oneself.

Here is a fun Bob Dylan story about the song:

“Heart of Gold“ by Neil Young

I've been to Hollywood, I've been to Redwood

I crossed the ocean for a heart of gold

I've been in my mind, it's such a fine line

That keeps me searchin' for a heart of gold

And I'm gettin' oldSelfie of the Week: Old Friends

As exciting as being in a room with big names and world-changing personalities can be, it is better to meet up with old friends and reminisce about life-changing experiences and memories.

I met Saad in the New York Office of McKinsey roughly 15 years ago. He told me about a project he’d just been staffed on to work in his home country, Pakistan, to reform the education system. The senior partner on the project was a crazy British knight who had developed a method to help governments get results at scale. There was another spot on the team; did I want to join?

Although the San Francisco office beckoned, it was an easy yes. One of the things I’ve always enjoyed is helping other people achieve their ‘quests.’ Coming from the suburbs of Minneapolis, the more frontier and potentially protracted, the better.

I thought this project would last eight weeks, and I’d be back in tech land, figuring out what was next. Well, two months turned into eight months of living in Lahore, which then turned into five years of living in London. This led to us co-founding and building Delivery Associates based on the massive success of the education reforms in Punjab.

Michael Barber would later say that the bar to work for his early team at Pearson was doing a stint in Pakistan. I still say - you never know what chance encounters will completely change your life!

This work is some of the best of my career, and I was lucky to find ‘hearts of gold’ to work alongside on the Punjab project and the quest to improve government effectiveness worldwide using data systems and accountability.

Bonus pic: Saad, Michael Barber, Aslam Kamboh (the Secretary of Education in Punjab when we started the reforms), and me. Secretary Kamboh said he ‘was the biggest skeptic’ of the program but became a massive believer. He also said the number of death threats he received was one of his KPIs for success.

Below is an excerpt from The Good News From Pakistan, which I was re-reading. I see many parallels between the work in those early days and some of the work that the most optimistic version of DOGE aspires to complete.

Between February and April of 2011, the team, under my direction, took these objectives and turned them into hard numbers. On each of the key indicators, there would be a provincial target for 2013 and also a target for each of the 36 districts. Using the patchy and uneven data available, Katelyn Donnelly, working with the relevant officials in the Education Department, calculated for each district not just a target, but a trajectory from the present through to the achievement of the target in 2013. This required analytical capability of the highest order and deep insight as well as immense commitment. The plan was that the EDO – the official in charge of education in each district – would then be held to account for progress against these trajectories. The Secretary-Schools, Aslam Kamboh, built on this idea and produced a district ranking every quarter which revealed both the top performers against these trajectories – who could be rewarded – and the poor performers who, if necessary, could be removed.

Management theory might suggest that the EDOs should have been consulted about these targets and trajectories. We judged otherwise. Pakistan had an education emergency. Progress had been minimal over recent years. The Chief Minister was impatient and I personally wanted to demonstrate, as fast as we could, that the Roadmap would make a difference. Too often the pursuit of “buy-in” from “key stakeholders” becomes an excuse for slower, shallower action and sometimes for inaction. We decided boldly that we would prioritise changing the facts on the ground and let “buy-in” take care of itself.

In April 2011, the EDOs were summoned to an event in Lahore at which the Secretary and I shared their targets and trajectories with them. Saad Rizvi and Katelyn Donnelly from my team had literally stayed up all night printing individual data packs for every EDO so that each would know precisely what their targets were for 2013 and what the trajectory would be for each of the targets. Katelyn remembers the smell of the printer and the endless stoppages. At one point, Saad found himself repairing the photocopier in order to deliver on time. By contrast, all I had to do was describe the mission and the Roadmap approach before the Secretary explained the ranking system, accompanied by some tough messages issued in passionate Urdu.

There was some bewilderment. Few at that point knew what the Roadmap was; fewer still believed that any attempt at reform would work. As Secretary Kamboh told me later, up to that point even he – never mind the EDOs – simply believed that this was yet another donor initiative which would be here today and gone tomorrow.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn