Hear You Me

w.291 | Al CapEx, Berk, Corp Zoombies, NYC Fiscal Center, & Talent Allure

Dear Friends,

Congratulations to us all for making it through October without a repeat of 1929, despite much bubble talk. This also mean only three more weeks until Thanksgiving, after which the blackout period begins for (almost) everyone fundraising.

I look forward to the US state & local election implication recap next week. If this pertains to you and you are able to, please read up and vote on Tuesday (if you have not already)!

Today's Contents:

Sensible Investing: Trends

Weeklies: Selfie & Song

Sensible Investing

One of my favorite culture and advertising newsletters is back! Because The Internet (formerly on Substack, but now it’s only IYKYK, and I know, so you can sign up here.) Along with Nowism by Tom Goodwin, who has an excellent recent post here on AI and his other musings.

Surviving the AI Capex Boom: Big Tech’s AI buildout is transforming markets, but history suggests caution. What should investors do? By Kai Wu at Sparkline.

Lots of great graphs! TL/DR:

The AI boom is transforming the Magnificent 7 from asset-light to asset-heavy, given that asset-heavy firms have historically produced inferior returns. Unfortunately, Big Tech appears committed to this bitterly competitive and costly AI arms race. Given their large weight in stock indexes, this is problematic for many investors.

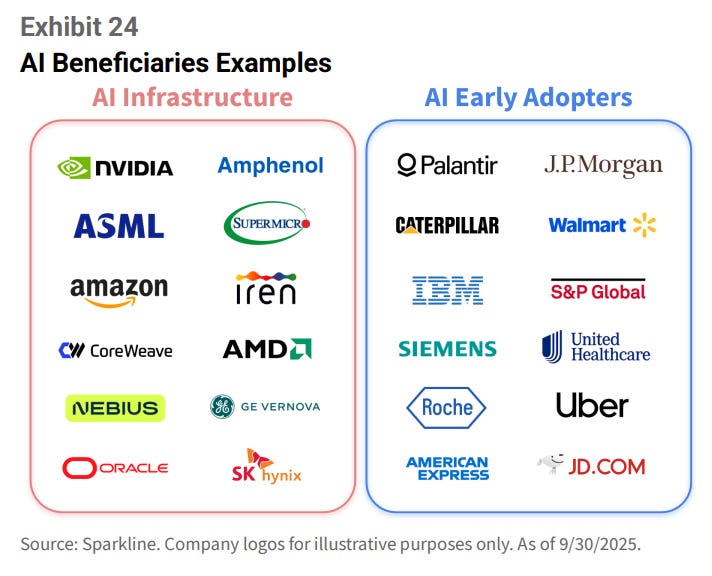

Finally, we are concerned by rising valuations. We propose a playbook using intangible value to navigate the hype cycle. With AI hype rising, the model has gradually rotated away from the big AI infrastructure providers toward a broader set of AI early adopters with lower valuations and capital requirements. This shift is reinforced by the finding that the long-term beneficiaries of past investment booms are often not the infrastructure builders but their customers.

He recommends these AI-early adopter stocks. He doesn’t talk much about the opportunity in private markets. It seems to me that you can more easily achieve early AI adoption in a privately managed company or start-up because change management from within (among companies already at scale with mature, entrenched processes) is too challenging.

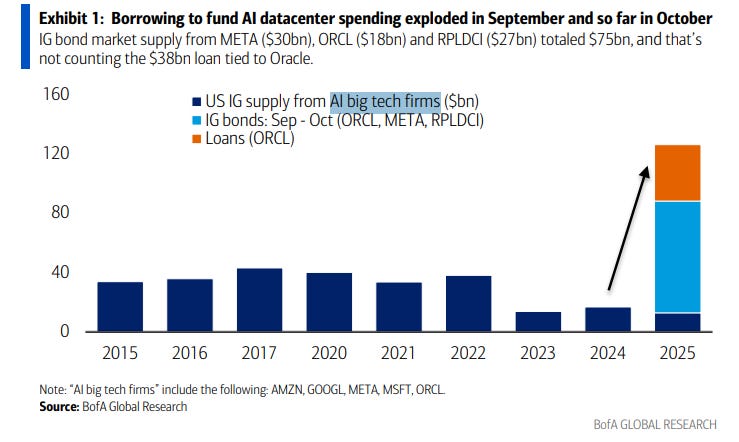

I’m adding this chart for CapEx borrowing information.

Berkshire’s Operating Earnings Jump 34%, Buys Back No Stock and Raises Cash to $381 Billion. Interesting investor sentiment.

For the fifth straight quarter, the firm declined to buy back its own shares, which have fallen nearly 12% since Buffett’s announcement in May that he would step down.

“I think that sends a very powerful message to shareholders,” said Cathy Seifert, an analyst at CFRA Research. “If they’re not buying back their shares, why should you?”

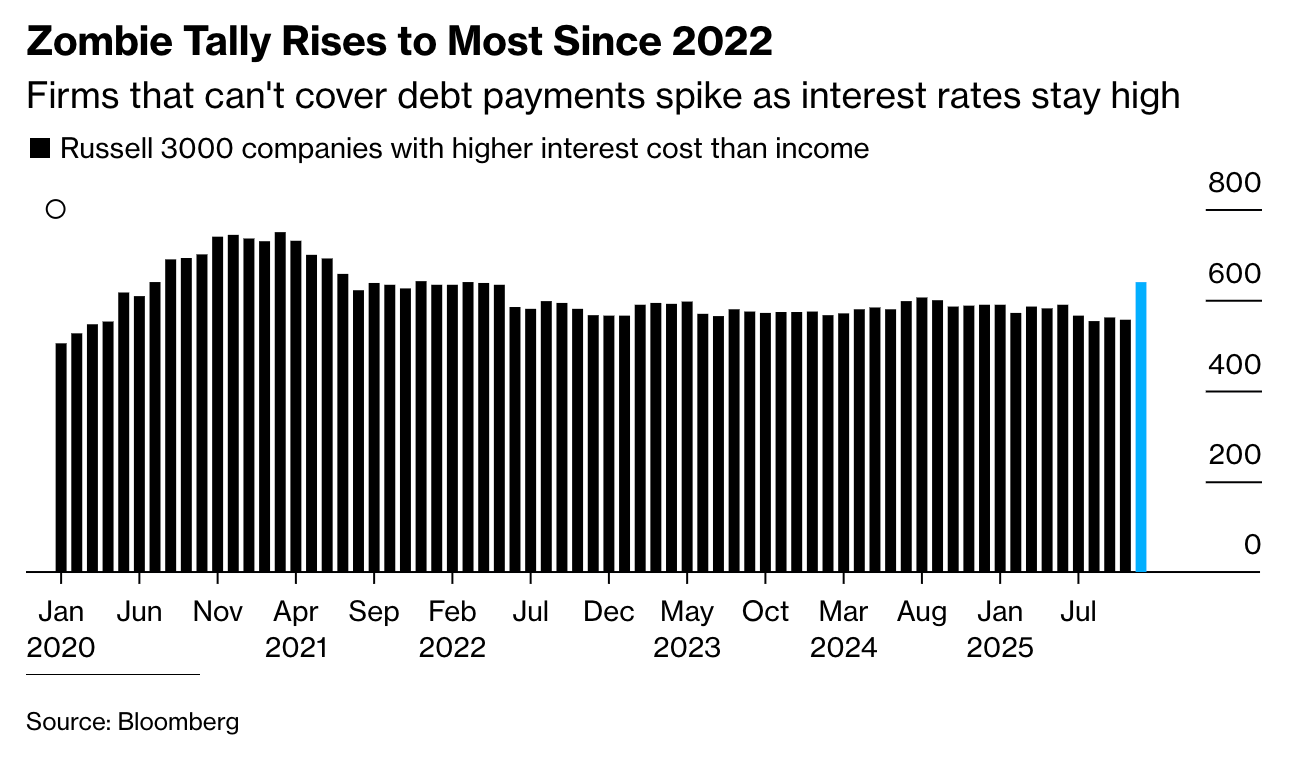

The Ranks of Corporate Zombies Are Growing, in Bloomberg

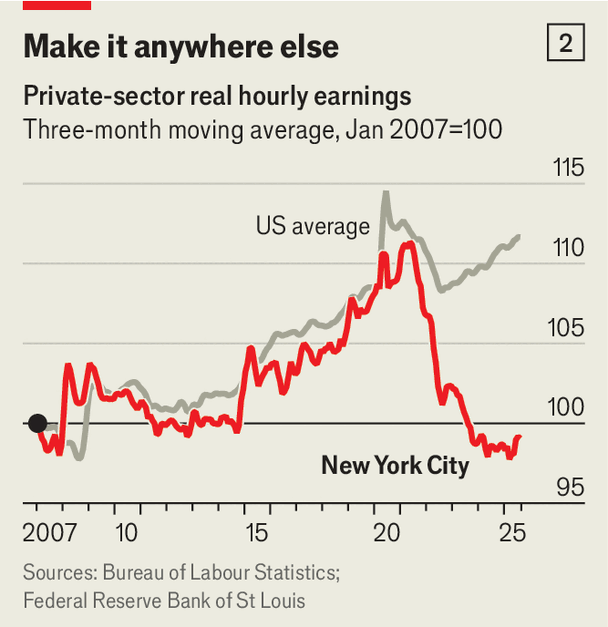

New York City’s Fiscal Model is Wilting (paywall, The Economist). High taxes irk the rich, and high prices plague everyone else. It’s an issue leading up to and through the elections on Tuesday.

Employment in low-wage industries rose, while it fell nearly 5% for middle-wage sectors from 2019 to 2023. Wages increased for all groups, but the decline in middle-wage jobs skewed the average.

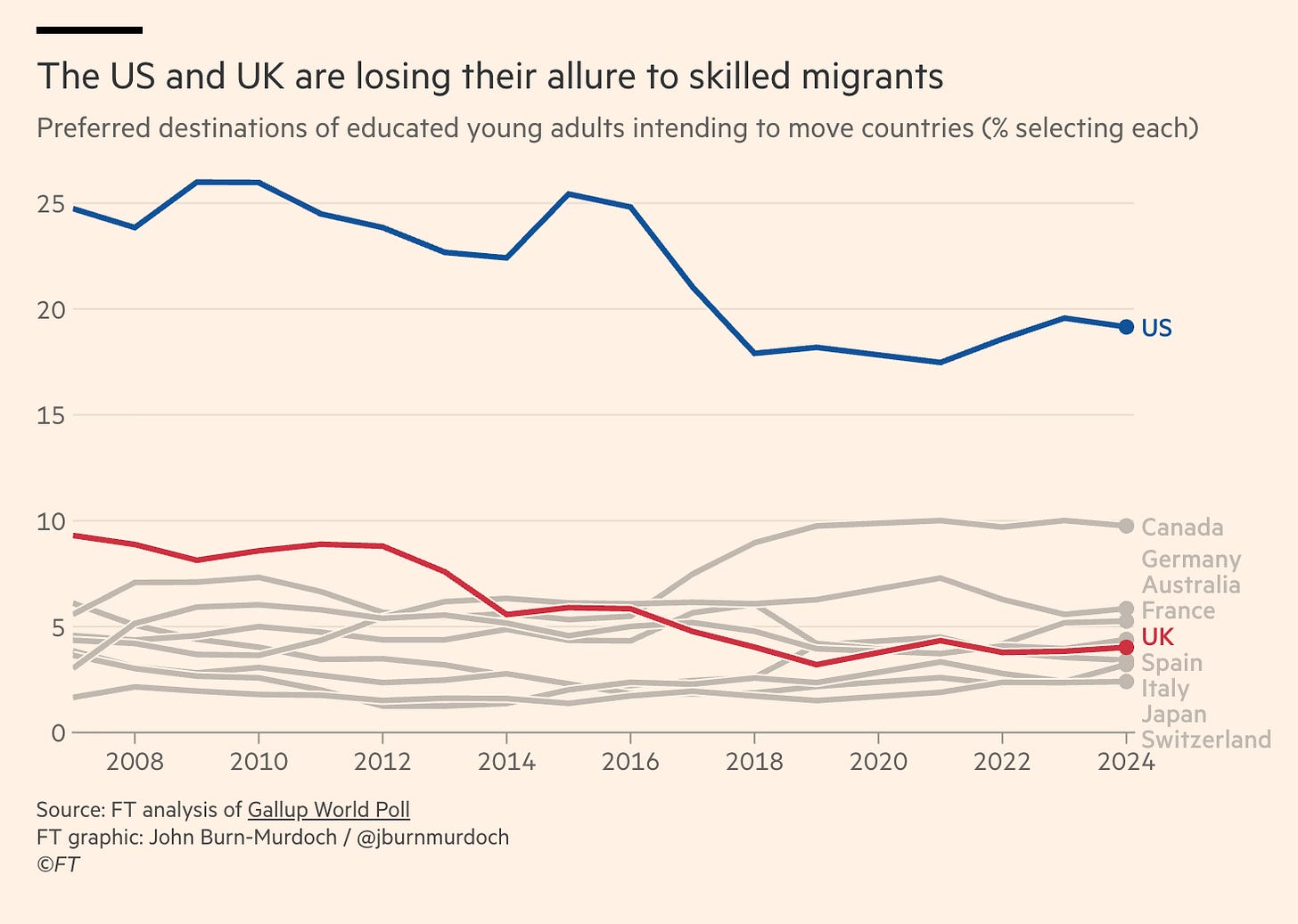

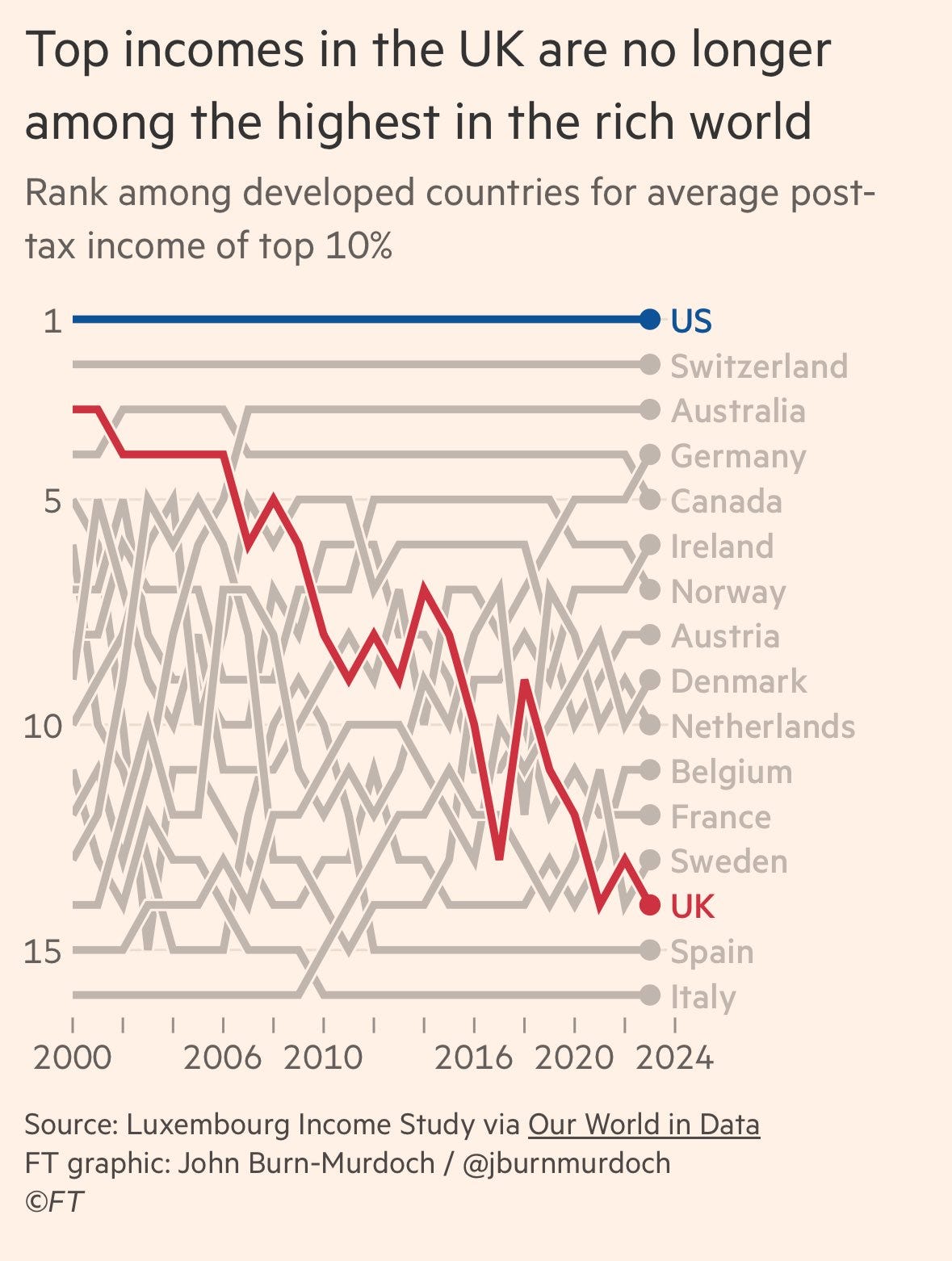

Are Britain and the US Losing Their Allure for Top Talent? Open hostility and high visa fees are a risky bet amid intensifying competition for the world’s brightest and best, in the FT. Canada appears to be absorbing a good share of the difference.

And, let’s be real, the UK is in a much worse shape than the US—at least today.

Weeklies: Selfie & Song

Selfie: Josh, West Nile, NY Marathon

Today, likely as you read this, my friend Josh will be running the New York Marathon in memory of the 10th anniversary of his beloved mother's passing; he raised $15K for the Breast Cancer Research Fund in the process.

In 1999, Dr. Deborah Asnis (Josh’s mom), an epidemiologist and chief of infectious diseases at a hospital in Queens, quickly identified the West Nile Virus and prevented the spread of the disease. Because of her actions, it is not necessarily a memorable event.

Preventing tragedy is easily lost to history, but today we can remember. And if you are friends with Josh, you can often remember because, as you know, this newsletter encourages and appreciates power-mom bragging (past, present, future)!

‘This is my quant.’ Besides being a runner, Josh ‘Kaz’ Kazdin, is also a life-long investor and professional works as the Co-Head of Private Markets Research and Co-Head of Geospatial Research for BlackRock Systematic Active Equities (SAE). Basically, he conducts alpha-generating research on stock selection for a wide-range of BlackRock strategies.

Josh also wants you to know that our friend Rachel’s 40th birthday was ‘mostly’ a girls’ trip - because he also received an invitation. He’s right to be proud of the accomplishment. I think his power mom would be proud of that, too.

Last thing: Several years ago, I attended Shabbat services with Josh, which had the theme of remembering loved ones who had passed away. It included the hymn below, which I thought was an appropriate sentiment.

I’m at the age when friends start losing their parents (👀💔 Tom, Gregg, Michael, Colleen + others), and I’m told that “friends are the family you choose.” That’s more important as you get older.

It’s a fearful thing to love

What death can touch.

A fearful thing to love,

Hope, dream: to be –

To be, and oh! To lose.

A thing for fools this, and

A holy thing,

A holy thing to love.

For

Your life has lived in me,

Your laugh once lifted me,

Your word was gift to me.

To remember this brings a painful joy.

‘Tis a human thing, love,

a holy thing,

to love

what death has touched.Song: Hear You Me

Here on YouTube.

“Hear You Me” is a tribute song written by Jimmy Eat World for their friends, Mykel and Carli Allan. The Allan sisters were huge fans of the band during their early days and died tragically in a car accident on the way back from a Weezer concert.

“Hear you me” was their signature saying to address their friends. It hasn’t gotten much pickup as a line since then, but I like it!

“Hear You Me” by Jimmy Eat World

Hear you me, my friends

On sleepless roads, the sleepless go

May angels lead you inThanks for reading, friends. Please always be in touch.

As always,

Katelyn

United Healthcare was deviously undervalued post Luigi (interestingly happened on my birthday, mid dinner party “The united CEO’s been shot!”) and their scandal ~ Circa April 2025 I believe they were only at $250/share. Too much merit in Americas largest insurer to be valued so low, I believe the one cited is correct in it being a buy.