Good Day

w.297 | Long Degeneracy, Stock Targets, Active vs Passive, Silver & Gold, & Impact Mafia

Dear Friends,

I love this time of year as a window when we can collectively step back, review current fact patterns (including technology, demographics, economics), update trend lines, and make predictions or decisions about where to focus. I’ll be doing that over the next week, as many others online are, which should be fun.

Several people have asked me about the multi-billion-dollar Minnesota-Somali fraud fiasco that has gone viral over the last month, culminating in a video released this week from a YouTuber conducting site visits (with 86 million views and growing).

First, whatever you think, the situation is probably much worse.

Second, long-standing citizens of Minnesota feel bewildered and unempowered. Helpless. This situation has been percolating for years, and few have been held fully accountable aside from the 68 convictions from Feeding Our Future. As many have noted, Minnesota has a culture of kindness and generous social benefits. Having your goodwill exploited and manipulated is deeply uncomfortable and upsetting for Minnesotans. Few will go on record saying that, but they are thinking it.

Third, almost all fraud in the public sector happens at the ‘last mile.’ You find it through unannounced site visits, not spreadsheets, as the YouTuber did. This is Management 101. I wrote earlier this year about my experience tightening up service delivery in Ethiopia, but there are dozens of similar instances I’ve encountered.

As a native Minnesotan, it’s frustrating, and the feeling of betrayal is real.

At least there is now a spotlight on this issue. And I won’t let it keep me from having a Good Day.

Today's Contents:

Sensible Investing: Trends

Extra Fun Stuff

Weeklies: Selfie & Song

Sensible Investing

The Prison Of Financial Mediocrity. This piece has gone viral on X. It tours through themes we’ve covered over the last 18 months, e.g., behaviors of GenZ, the non-existence of career pathways, and the death of the American Dream. That said, it is well done and is worth a browse. One thing I think people often miss about the decline of the ‘knowledge worker’ or ‘white-collar class’ is that the globalization of talent has made the job world dramatically more competitive.

Interesting statistic: Legal sports betting revenue went from $248M in 2017 to $13.7B in 2024.

I read this remark recently: We once dreamed of the future, now we dream of the 90s. Or as my friend said, “Can we just go back to the West Wing?”

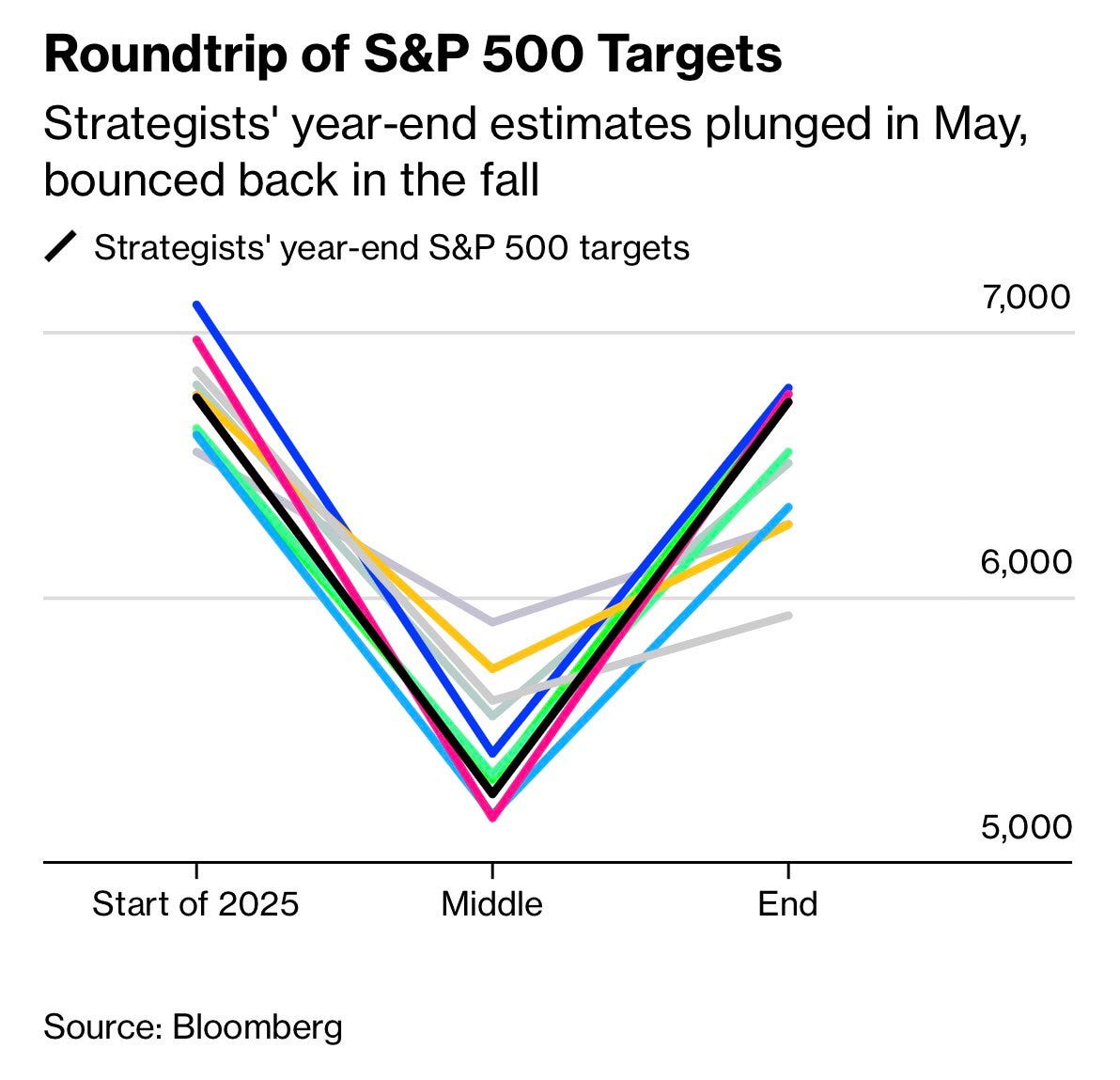

Periodic reminder that nobody knows anything, and if/when institutions start selling, they won’t tell you until they’ve already sold.

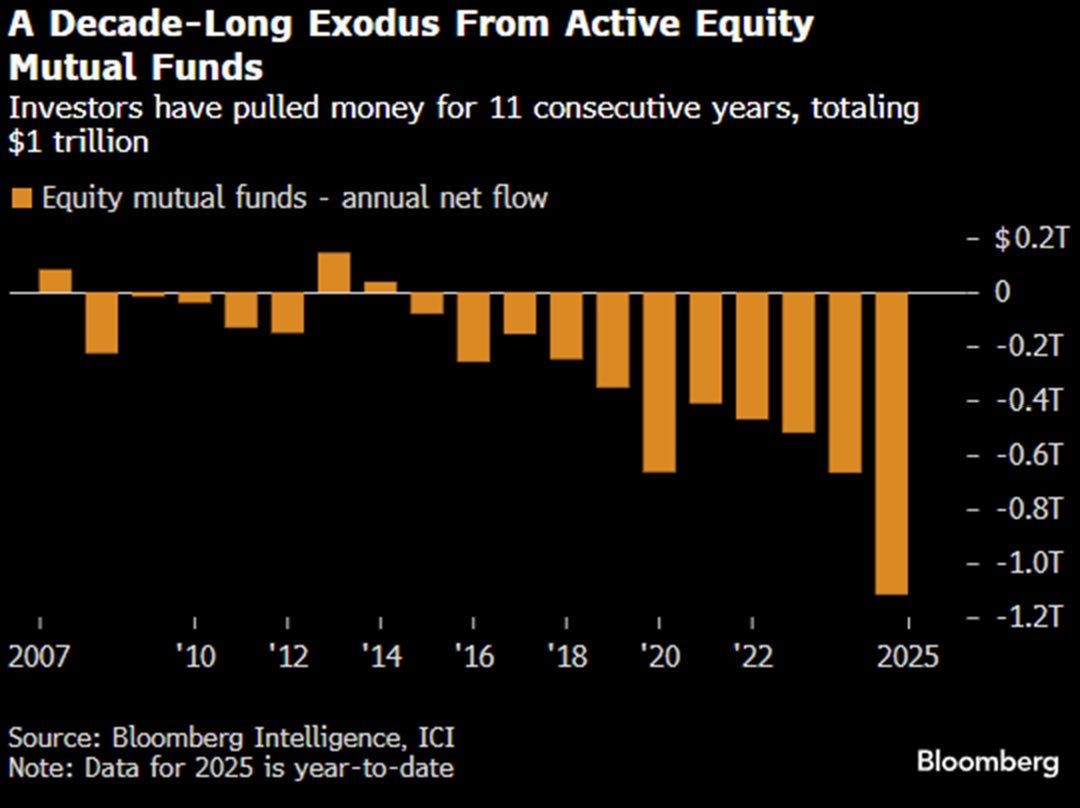

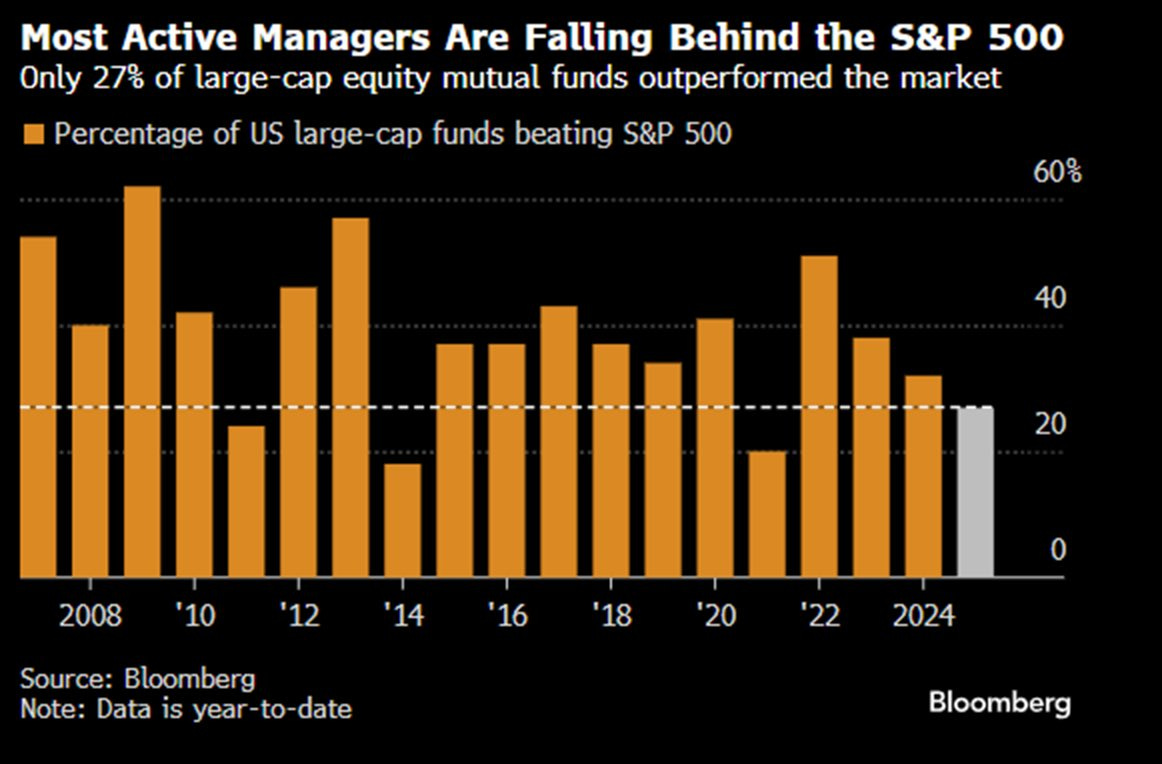

Brutal Year for Stock Picking Spurs Trillion-Dollar Fund Exodus in Bloomberg

A small group of tech super stocks accounted for an outsized share of returns in 2025, extending a pattern in place for the better part of a decade.

Around $1 trillion was pulled from active equity mutual funds over the year, marking an 11th year of net outflows, while passive equity exchange-traded funds got more than $600 billion.

The Last Bet. Masayoshi Son’s $500 Billion Wager on the Architecture of Intelligence. Interesting that this happened.

One of the biggest stories this year has been the surge in precious metals. When all three precious metals move together at this scale, it signals institutional capital hedging against currency debasement and long-dated sovereign risk, not chasing returns.

I’ve certainly been chirping about gold, but the metal of the month and year goes to silver.

Why Silver Price Has Been Surging Even More Than Gold (in Bloomberg but dated to early Dec.) The recent four-sigma price jump this week (see chart below) is due to China, the second-largest supplier, announcing it is halting all exports.

The best source to learn more about the surge in silver is Alexander Campbell’s blog, which has been outlining the silver trade for the past year, starting with this post, "The Silver Squeeze: How Solar Threatens a Decade of Deficits” and most recently “10 Silver Days of Christmas.” Campbell was previously a commodity trader at Bridgewater. TL/DR: Supply of silver is basically fixed, and demand is surging from solar panel production.

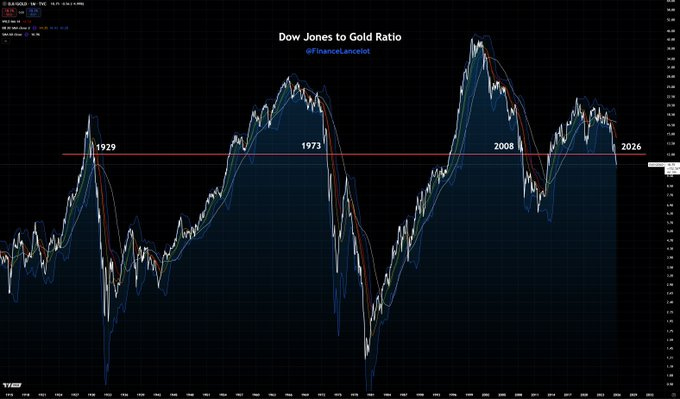

However, let’s not lose sight of the dollar-debasement trade, with all the metals and gold in the lead.

As X account Finacelot notes, the Dow Jones-to-Gold ratio has broken through a level seen only 3 times in history: 2008, 1973, and 1929.

Jevons Paradox for Knowledge Work from Aaron Levin on X.

Of course, many are wondering what happens to all the jobs in this new world? The reality is that despite all the tasks that AI lets us automate, it still requires people to pull together the full workflow to produce real value. AI agents require management, oversight, and substantial context to get the full gains. All of the increases in AI model performance over the past couple of years have resulted in higher-quality output from AI, but we're still seeing nothing close to fully autonomous AI that will perfectly implement and maintain what you're looking for.

The Impact Mafia: How the Elite Invented a Way to Feel Good While Doing Nothing. Wow, Robert Rubenstein just said a lot of truth. Nice.

Weeklies: Selfie & Song

Selfie: Power Mom, System Steward, LatAm Infrastructure

Thought I’d end the year remembering my dear friend Mariana’s power mom: Leonor Montoya Álvarez.

Leonor was an incredible leader over the last 40 years in Colombia's banking and financial sector. She served as the first female director of Fogafin, a regulatory agency for Colombia's financial sector, in 1986. She was the Vice Minister of Finance during the presidential term of Belisario Betancur in the 1980s, when she was just 28 years old. If you click the link, you can read about her many accomplishments, managing socialized financial entities through fraud and achieving a successful privatized outcome.

She was a key defender of privatization and neoliberal doctrine.

In an article published in June 1990 in the magazine Debates on the economic situation, Leonor Montoya Álvarez analyzed the financial situation in Colombia at the beginning of the nineties and the need to implement privatization policies for national and state-owned companies. According to her, the deep economic crisis that the country went through at the beginning of the eighties caused governments during that period, from the presidency of Betancur to the mandate of Virgilio Barco, to begin to use policies aimed at decentralizing the state, through the concession of public service companies to the private sector, in theory to alleviate the state’s fiscal burdens.

Sadly, Leonor passed away this time last year. Her legacy lives on, but she is sorely missed. Mariana, my good friend for over 15 years, has always been an astute infrastructure investment executive, and now she is a senior investment officer at the IFC, financing major projects across Latin America.

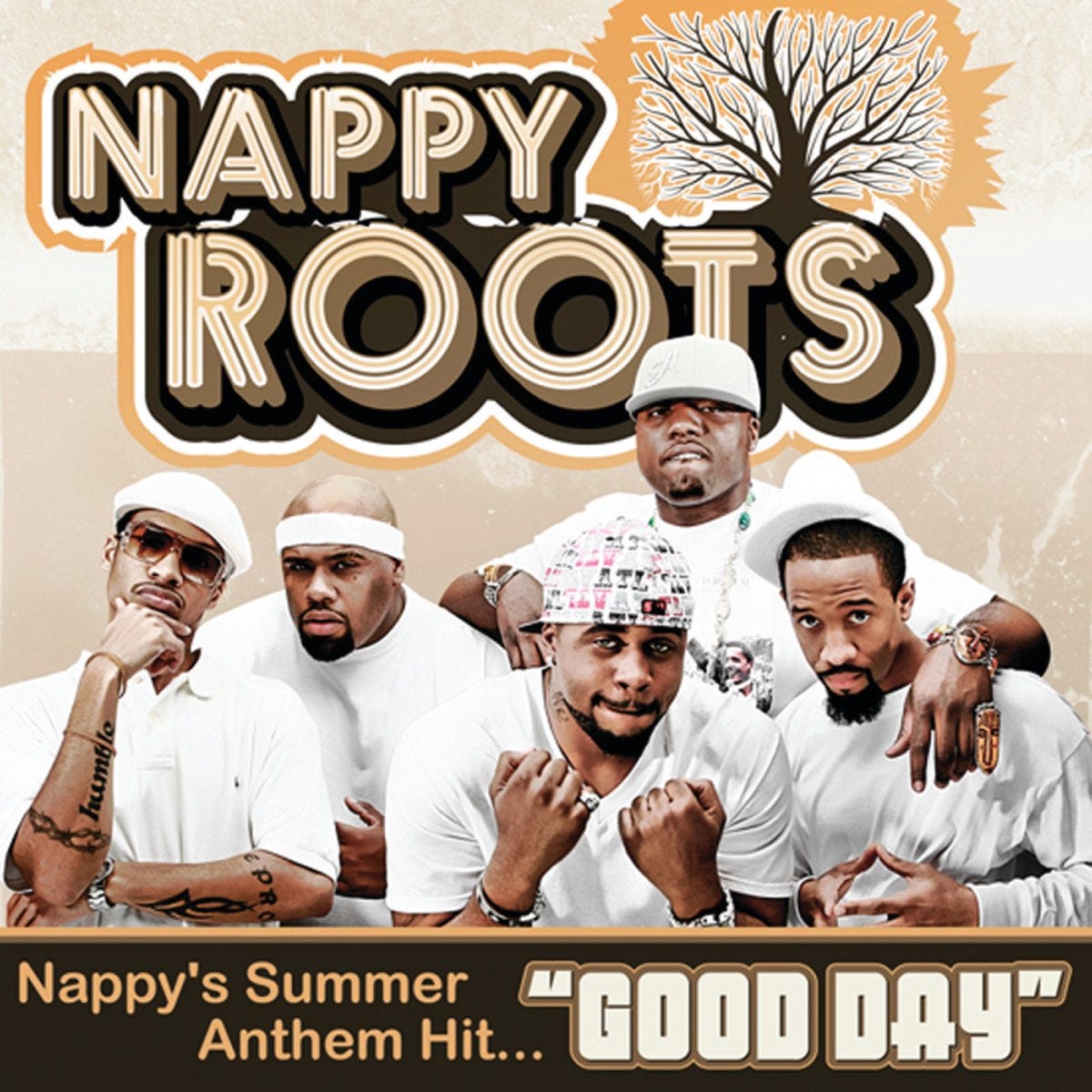

Song: Good Day

Here on YouTube.

Released in 2008, "Good Day" is recognized for its uplifting message and catchy hook, making it a fan favorite. The song reflects the group's ability to create feel-good music that resonates with listeners.

I love all the comments below the YouTube video:

It's impossible to be sad listening to this song.

My 44 year old daughter died March 17. She played this song every morning when she put her makeup on. I listen to it daily now in her memory.

This song is keeping me clean today. Thank you.

I’ve been through the amputation of half my right foot. I’m in hospital fighting to save my leg and life right now. Thank you for this song. It always picks me up.

“Good Day” by Nappy Roots

We're gonna have a good day

And I finna worry 'bout what nobody say

I'm still above ground that's the reason I pray

Got my car cleaned up now I'm ready to playThanks for reading, friends. Please always be in touch.

As always,

Katelyn