Gold In Them Hills

w.269 | Berkshire Debrief, Software Engineering Jobs, Creator Commerce, Conclave Network, & Online Betting

Dear Friends,

I spent last weekend at Camp Berkshire Hathaway, one of my favorite gatherings; this was my third pilgrimage to Omaha. It was intense in great ways, but I couldn’t get out the newsletter. Apologies. It was worth it, and I’ve included a few notes below.

A lot of reading of history also waylaid me. We’ll get to that next week.

Today's Contents:

Camp Berkshire Hathaway

Sensible Investing

Song of the Week: Gold In Them Hills

Camp Berkshire Hathaway

Several times this weekend, people asked, ‘Why would an early-stage venture investor go to the Berkshire AGM?’ It's a silly question, but let me explain:

1) I’m a shareholder. It’s a shareholders’ conference.

2) Every investor should want to learn from the GOAT and immerse themselves in the conversations that take place around the event; many of the principles of investing that get discussed here hold across asset classes.

3) Our Avalanche investment thesis on learn → earn → own shares the same ethos and belief system that powers Berkshire. Learning is the only enduring edge. Always look for defensible earnings. And maintain an emphasis on ownership, shareholders, and stewardship.

Takeaways and highlights:

Buffett’s resignation was expected, but still emotional. Before he formally announced he was stepping down on Saturday, most people had discussed how this meeting would be his last. Still, news like this is always a hit when it gets announced. Attendees universally agreed that this transition was handled optimally and professionally, and that while things at Berkshire would be different going forward, they were still optimistic.

The power move comparison at the AGM is: What share class do you own, and what was your buy-in price? This year’s winner in my books was a concrete entrepreneur from Colorado who was attending for the first time with her sons. She bought Berk-A at $10,000 for her parents decades ago.

One of my most interesting conversations was with Ted Merz (welcome, Ted!). He built a 32-year career at Bloomberg and then was fired a few years ago. He shared that experience on LinkedIn and has been sharing his set of career experiences ever since. He now runs a modern ghostwriting firm for business leaders. We bonded over how in today’s world ‘everyone is an entrepreneur or they will have to learn to think like one.’

Over the years, many investors have claimed to be building a firm like Berkshire. For most, either the performance has been terrible, or they have had a dramatically different fee structure.

I’m going to assume that you have read the meeting readout specifics and your fill of Buffettisms that went around and that we share here periodically :). Still, the results merit review one more time:

I tested a doom hypothesis with attendees. I’m not sure what the probability is on this. It’s more of a gut feel - but still seemed worth writing out:

To me, 2025 currently feels like 2008. The economic environment's underpinnings have changed significantly but have not yet revealed themselves. Underneath the surface, changes are happening, investors are repositioning themselves, but the market collectively has not ‘woken up’. Public companies’ Q1 results still look good (with pre-Liberation Day numbers). We will see weaker public company reporting in July when Q2 numbers come through. And if that’s the case, then there is a chance that no one will react until early September.

Something will then break in the fall, interest rates will change dramatically, and we may see systemic issues in the market. Market sectors that look vulnerable to me:

The US consumer is super-stretched. They are burdened with debt, and rampant inflation has taken its toll. Consumers can’t afford to buy things anymore. Cars, real estate, CPG, tourism; bookings into Hawaii and Europe this summer are down, if that is one indicator of how people are responding.

Private Equity cracks show. PE has long covered poor performance with stale marks, continuation funds, and manufactured liquidity (dividend recaps). And now, short sellers are betting against credit lenders.

The US Dollar is in permanent decline. There is increased interest in Gold and Bitcoin. Asian exporters are holding a surplus of $2.5 trillion of currency they could sell. Does something break?

Sensible Investing

The State of Creator Commerce by Kajabi. This report highlights a massive shift in the creator economy from social-first creators who are beholden to platforms and brand deals to those who view themselves as entrepreneurs who own their revenue streams and have direct access to their audience.

The several days of TikTok uncertainty rattled creators who had built their entire business on the platform. They saw how years of work could disappear overnight, and it has changed their behavior and interests significantly. Additionally, the economics of being beholden to the platforms have decreased in attractiveness (as shown below).

I attended the iFlyVC Consumer Commerce Summit this week; iFlyVC were the first investors in Weee!, the #1 Asian grocery store in America. As I walked down the line of consumer brands presenting at the expo (including new products like Yuzu Juice, CaliSober, and Sea Monster Seaweed) and chatted with the founders, I asked them about their creator strategy. Every single one remarked on its importance as a distribution channel and believed they could do it better and more systematically. I told them about the Ownership Management platform from Owm (our portfolio company), and everyone requested an intro.

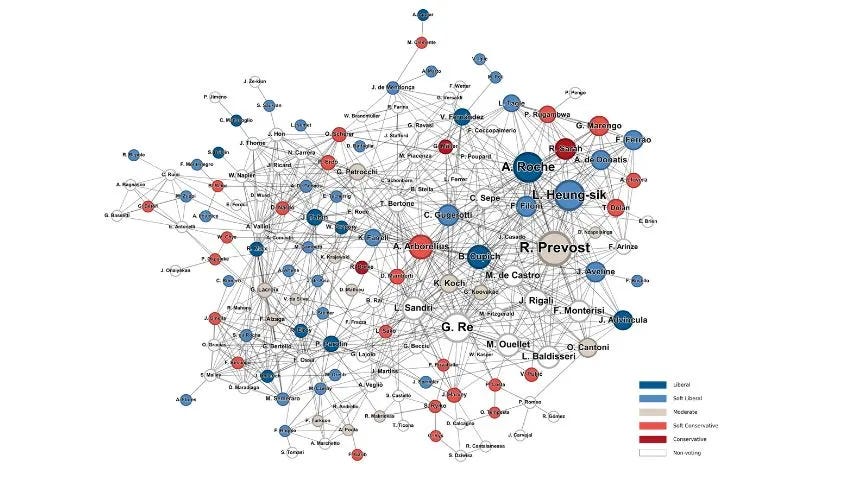

In The Network Of The Conclave, network science can help us understand who will be the next Pope. Several Italian researchers reveal how status, information, and alliances influence the papal election and how their model predicted the selection of Robert Prevost.

Online Sports Betting Is Draining Household Savings. New research shows that the bettors who can least afford it are the most impacted. We should all be concerned, for we will be footing the bill as taxpayers.

By the end of their sample period, the researchers saw that nearly 8 percent of households were involved in gambling. These bettors spent, on average, $1,100 per year on online bets. While the amount of money people put into legal sports gambling rose, their net investments fell by nearly 14 percent. For every $1 a household spent on betting, it put $2 fewer into investment accounts.

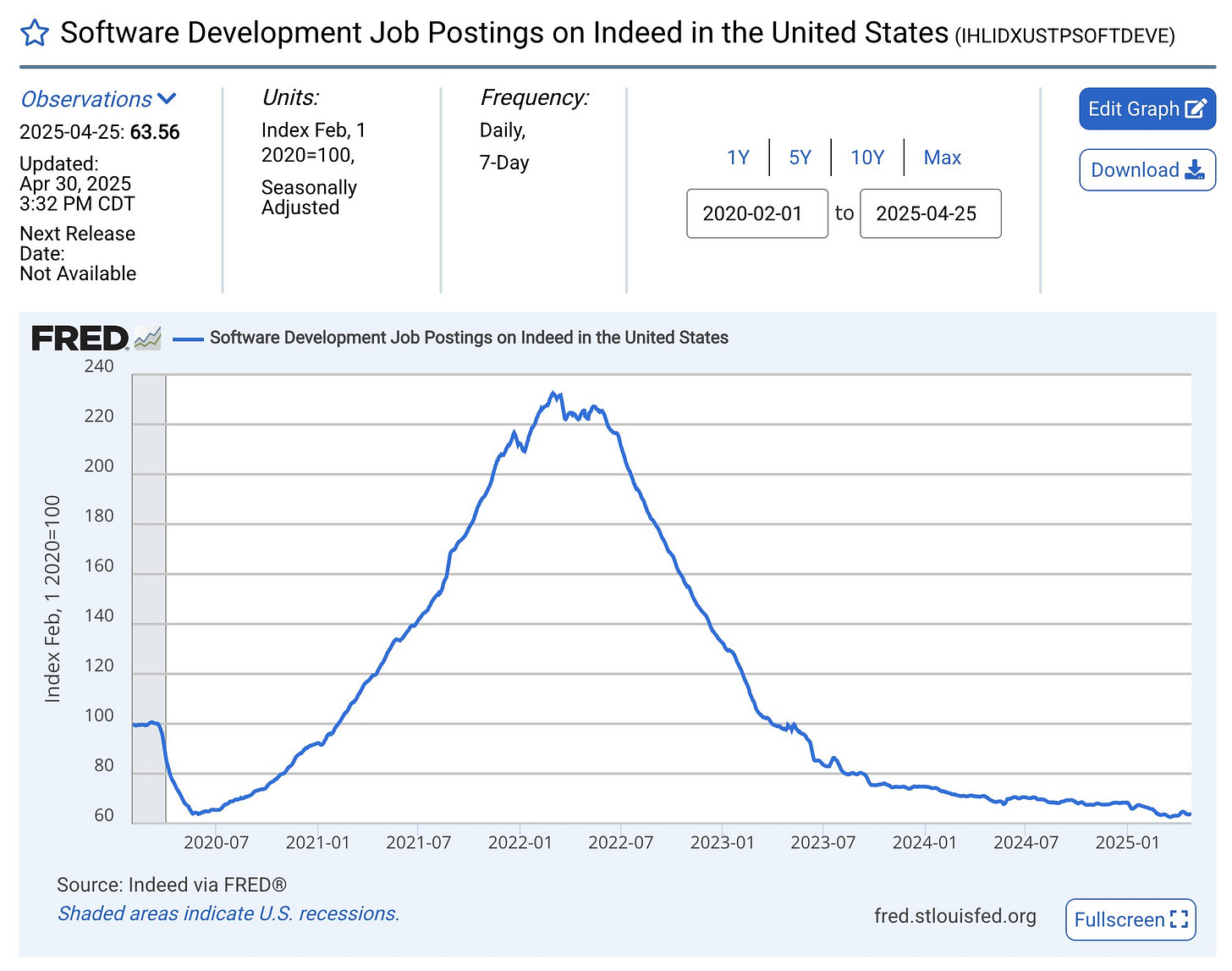

Software Engineering Hiring: End Of An Era?

This last chart is from State of AI Talent 2025 Report by Zeki, a talent data company in the UK. I’m not sure how good their data tools are and this is the first time I’ve come across them.

The report includes a few interesting predictions, such as India will be an AI talent importer, Google will have the best AI talent, and medical research will suffer from AI brain drain.

Song of the Week: Gold In Them Hills

Here on YouTube.

This song conveys optimism, resilience, and the potential for finding hidden treasures in life's challenges - and maybe in a heap of potential investment choices :)

“Gold In Them Hills“ by Rex Sexsmith

There's gold in them hills

So don't lose heart

Give the day a chance to startSelfie of the Week

And, for an encore, the sun sets on Warren and Charlie, but their legacy endures. (These are Squishmellows, owned by Jazwares, a Berkshire Company.)

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

it was great to meet you there. love your newsletter