Feeling Fine

w.286 | Generalists, Antichrist, Consumer Debt, Meta, Asia, & Charts

Dear Friends,

My mother called this week. One of the topics on her agenda was reading this newsletter and subsequently not feeling fine.

We had a good talk. For those who have not spoken to me live lately, I’d like to make this point clear: despite a set of gloomy charts and predictions, I am feeling fine! In fact, there is plenty to be optimistic about. Technology has never been more exciting, and its potential continues to rise - and there is a rising recognition that technology will continue to enable people and processes (and not necessarily replace them).

Opportunities remain abundant for those paying attention and with the skills and energy to capture them. And I feel great about that.

Today's Contents:

Sensible Investing

Investing Reading from Off-Piste

Charts

Song of the Week: Feeling Fine

Sensible Investing

On the Value of Being Generalists. Article by the Discerne team making the case for generalists in a world that often pushes toward specialization. The best thinkers and doers tend to be able to apply a broad set of analytical and creative skills to a wide range of disciplines. Specialists will still be needed, of course; they will win when their specialty is in favor.

Systems Thinking is Brain Rot for Analysts. Career Advice from a 28-Year-Old. Sort of fun. Good points.

Why? Well, it’s one thing to know where to look for leverage points in a system (places where you can make a lot of change without a lot of effort, basically). But there are some complicating factors:

Your model of the system will be way too simplistic.

Awareness does not imply ability to execute.

Many of the things that look like patterns are actually emergent and cannot be predictably affected, let alone engineered.

Survivorship bias – anything that’s been identified as a leverage point was not done so through gigabrain insights, but through tinkering.

Lecture 1: Knowledge Shall Be Increased. These are notes from Peter Thiel’s Antichrist lectures, which kicked off this week in SF. It is supposed to be off the record. Someone didn’t follow the rules. This was briefly posted to the Internet, and is now archived on the web (link above), which I have PDF’d here, just in case.

It’s not positive stuff. “Science once promised radical life extension; today, the closest we come to mastery over death is legalized euthanasia.”

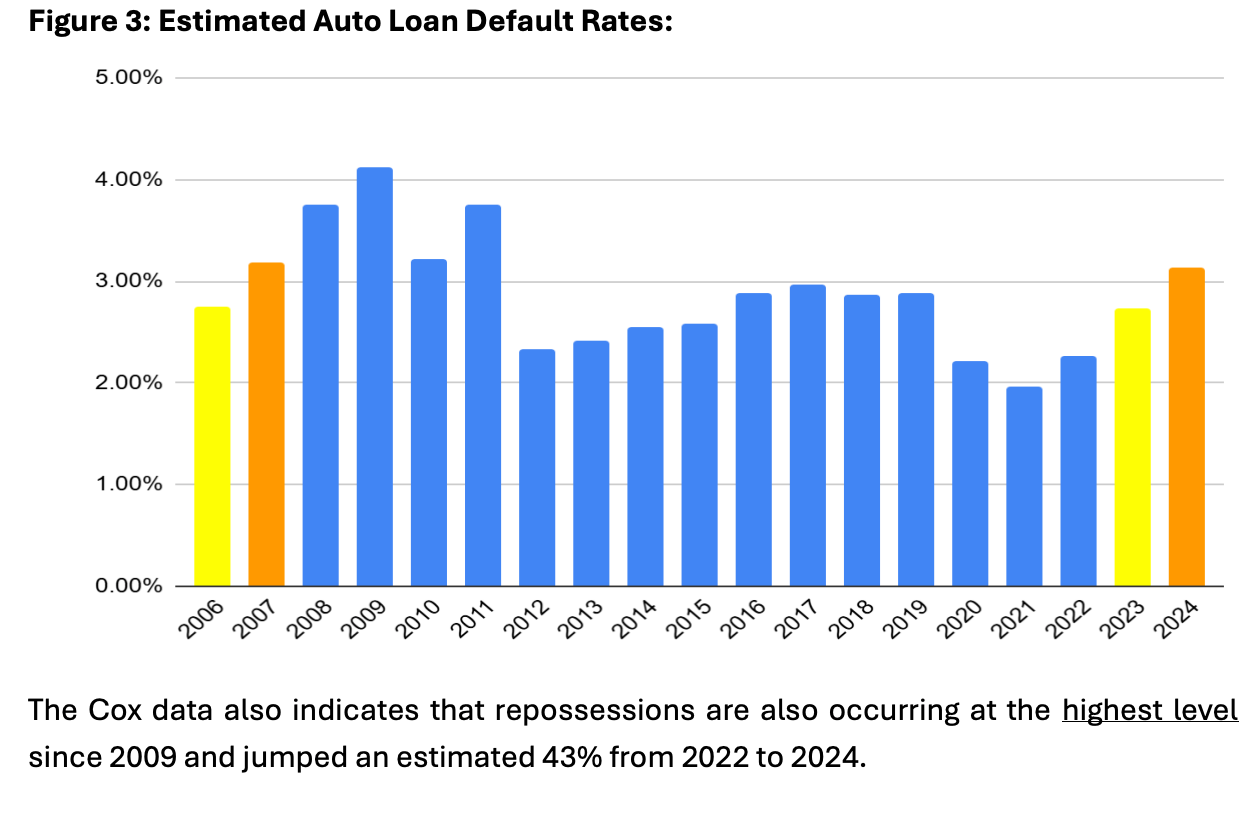

Driven to Default: The Economy-Wide Risks of Rising Auto Loan Delinquencies. Report from the Consumer Federation of America. I don’t know. It could be alarmist, but it's worth noting.

Auto loan delinquencies are spiraling; the nation now owes a staggering $1.66 trillion in auto loans, and some figures show scary similarities to the period right before the 2008 financial crash.

There is a saying that “you can sleep in your car, but you can’t drive your house.” Consumers will prioritize their car payments over many other household expenses and debt obligations, which means that when auto loan delinquencies are rising, serious financial problems are brewing in American households.

Subprime Auto Lender Collapse Delivers Blow to Risky Debt Market. The Tricolor Bankruptcy this week is not unrelated. It also shows the impact of the immigration crackdown.

Founded in 2007, Tricolor has focused much of its business on the low-income Hispanic community in states such as Texas, California, and Nevada. It previously estimated that over two-thirds of its borrowers were undocumented, based on their lack of Social Security numbers. By 2024, lending surged to about $1 billion, close to five times its volume in 2020, according to a report from Kroll Bond Rating Agency.

Dotcom on Steroids. When the odds appear stacked against you. Research from GQG. Trends and charts we’ve talked about before.

"Today’s market, particularly in the tech sector, exhibits dotcom-era overvaluation, with lofty multiples, slower earnings growth, and a weaker macroeconomic backdrop, in our view. We believe today’s technology sector no longer represents forward-looking quality due to decelerating revenue growth, collapsing free cash flow, and increasing competition. We see better investment opportunities outside the tech sector, offering similar potential returns at lower risk and aligning with the goals of compounding capital with strategic downside risk management.

Thoughts on Meta Connect 2025 from MBI deep dive. TL/DR: The glasses are cool, but the business case is still TBD given the size of the continued cap ex.

Every Connect Keynote feels like a referendum to me on the question of Meta’s Reality Labs losses. While it may be nonsensical to capitalize these losses in valuing Meta, this year’s Connect wasn’t super inspiring to think these losses are going to change direction soon.

Good investing curated by Off-Piste Investing.

Jim Mellon: Bearish US, Opportunities in the UK, China & Robotics. YouTube Interview. I appreciate the long theses.

The World In Which We Live by Nassim Taleb. He makes seven points. Worth a browse.

The AI Paradox: Capital Questions. Django Davidson explores what we see as an investment paradox in the world of AI, which raises quite a few capital questions discussed in this paper.

Good Charts

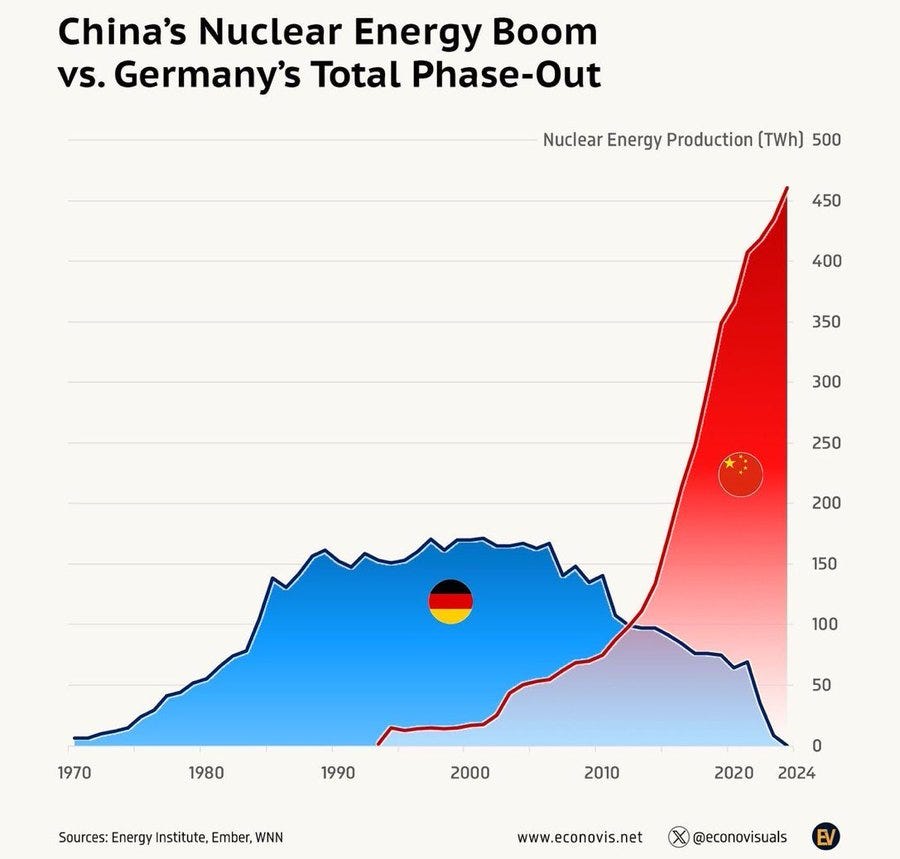

It’s incredible how much solar and nuclear energy China has rolled out over the last few years (and what is planned for the future, albeit not shown below).

Job Openings vs the S&P 500. Job openings are warning of an economic slowdown; at the same time, the market has priced in Fed rate cuts. This disconnect can persist for a while. Eventually, though, the labor market reality and market optimism will have to come into alignment.

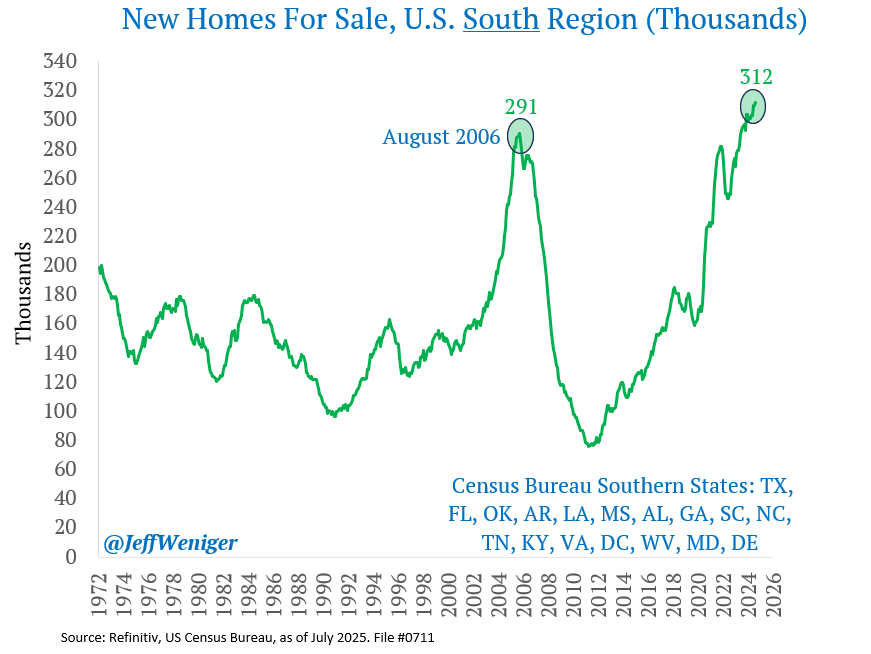

These local dynamics are fascinating to follow and see, especially in individual micro-markets based on what I have seen on Zillow of late.

Not great. It will be fascinating to follow the trend line, especially as we see the rise in auto loan delinquencies and pressure on home loans and sales.

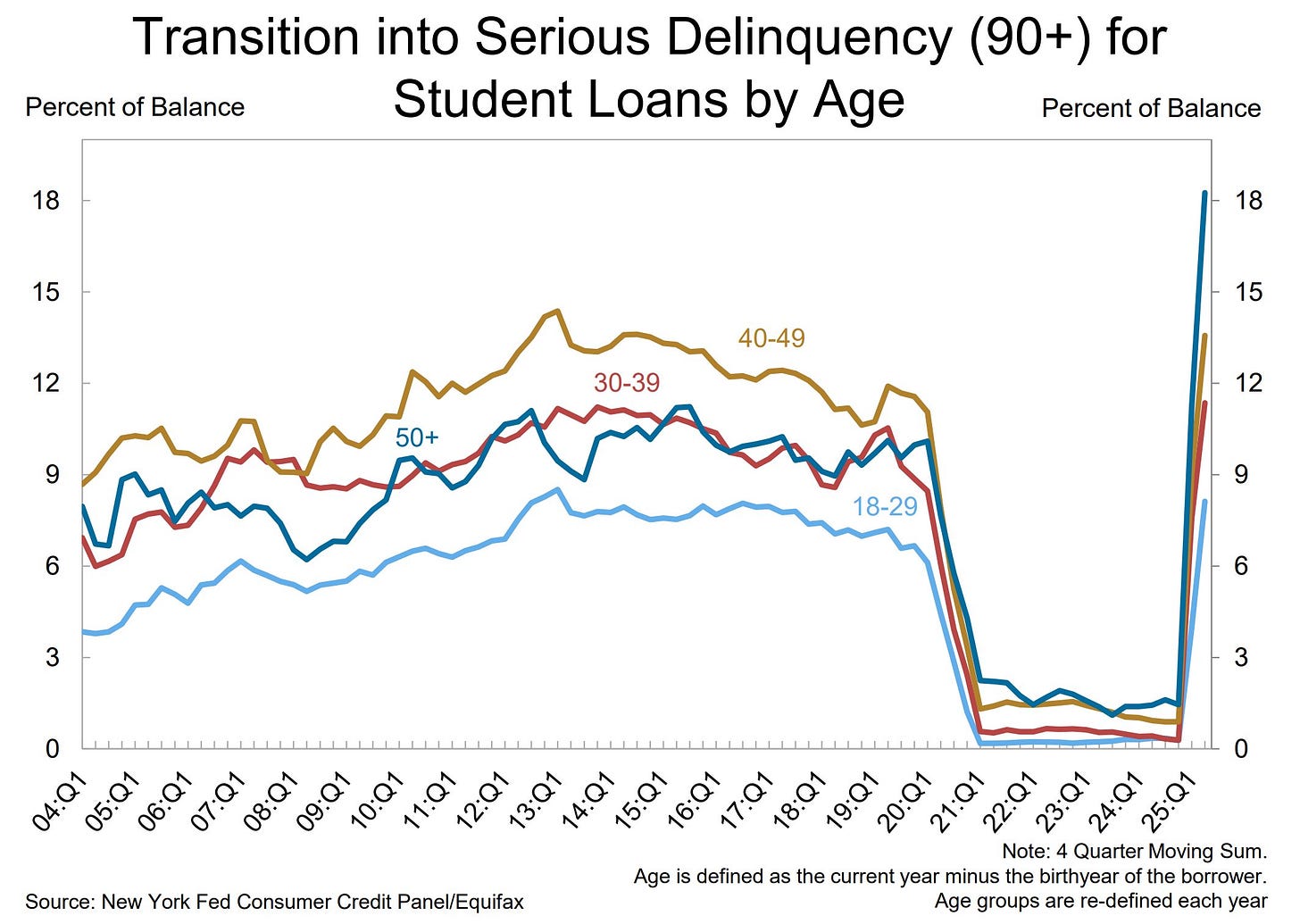

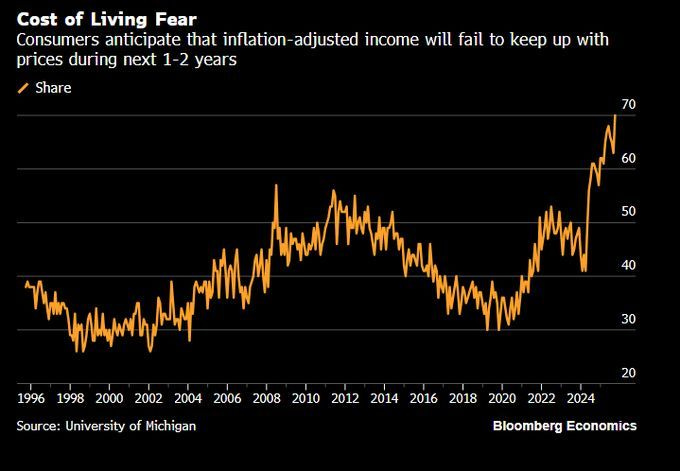

Last one, best one. Unlike other charts, this does not portend that we have a dot-com bust or Great Recession ahead; we have already blown through the benchmarks if we were to use those past periods for comparison.

Song of the Week:

Here on YouTube.

I’ve been listening to this folk duo from Canada for a while. Feeling Fine is their latest release (Sept 5!). This newsletter rarely features new debuts, but this one stood out to me and was at the top of my Discover Weekly. Yes, the AI gods had their reasons.

Their self-description: dusty folk painted in broad strokes of acoustic instrumentation and lyrical eloquence meant for nights under the stars, long drives with no destination, and quiet moments of reprieve.

“Feeling Fine” by Ocie Elliott

Give me feel, give me sight

Let me heal, make it right

Give it all, 'cos I can

Let me yield and let me standSelfie of the Week

I went to Founder Bash this week, the 5th annual mega-event hosted by Kirby Winfield at Ascend, a venture firm that focuses on technical founders, mainly in the Pacific Northwest. He has a signature emoji trio for his investment thesis - ☔ 🔥☔ - which is v. cool.

Kirby told me once that in a different life, on the road not taken, he’d be a music executive in New York City. I have not discovered the overlap of our musical tastes. He’ll list some like ‘50-ish records he’s listened to 100 times,’ and I haven’t heard of the vast majority. Our only overlap is Purple Rain by Prince, which has been featured as Song of the Week (w.77 on Jan 11th, 2021, which feels like a lifetime ago). Prince felt the color purple symbolized the end of the world. He said, “When there’s blood in the sky – red and blue = purple… purple rain pertains to the end of the world and being with the one you love and letting your faith/god guide you through the purple rain.” Maybe Peter Thiel would like that, :).

Kirby is one of the nicest and most approachable people in Seattle's venture scene and a friend to many. He warmly welcomed me in. A founder first and a founder always.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

i really, really love reading your stack, thank you for uploading the notes from his lectures. would've loved to attend his lecture in person, I think I was the sole person who uploaded a video titled "peter thiel isn't the antichrist" on july 1st in a rather ragebaity sense (which succeeded in doing so), but i would say his take was entirely accurate.

one thing i would say (unsure if its covered by his lecture) is that I really believe many parts of progress are downstream of fixing money, as value transfer is integral to human coordination.

patients, researchers, and investors can all co-own research outcomes via tokens tied to therapies or IP pools, and I believe through this crypto fixes the money, then fixes the coordination stack, which removes both bottlenecks.