Ends of the Earth

w.287 | Accenture, AI Reading, Public Health, PE Arbitrage, Equity Ownership & Lorax

Dear Friends,

This week’s edition got long, and that’s not counting what I’ve pushed to next week! There’s so much to think about and talk about these days.

One plug: please check out Creatium (formerly known as Prof Jim) and upvote it on Product Hunt. They make it easy to create AI-powered training and learning content, featuring coaches, role-plays, and gamified lessons. Deepak, founder and CEO, is a good friend, a force for good, and one of the most prolific inventors that I know with ~280 issued patents to his name.

Today's Contents:

Sensible Investing

Song of the Week: Ends of the Earth

Sensible Investing

Accenture to ‘Exit’ Staff Who Cannot be Retrained for the Age of AI. One of the things I’ve learned from running a consulting company and investing in the space is how difficult it is to invest in corporate learning and development (sorry!).

Why? Put bluntly: Most companies don’t believe that employees learn. And they aren’t wrong. Learning is hard, and the incentive is often not there for employees to take corporate learning seriously - unless they believe they are at risk of being fired.

Many employers also hold a complimentary view, which is that it is easier, cheaper, and more effective to hire people who have been learning the skills you need than it is to retrain. Large consulting firms may find this especially true given their business model tends to have high annual turnover rates.

“We are exiting on a compressed timeline people where reskilling, based on our experience, is not a viable path for the skills we need,” chief executive Julie Sweet told analysts on a conference call.

AI-Related Reading that Keeps Coming Up in Conversation

AI isn’t Replacing Radiologists. Radiology combines digital images, clear benchmarks, and repeatable tasks. But demand for human radiologists is at an all-time high. Surfaced by Andrej Karpathy.

The Bitter Lesson. The general methods that leverage computation are ultimately the most effective and by a large margin. The ultimate reason for this is Moore’s Law, or rather its generalization of continued exponential decline in the cost per unit of computation.

AI Will Not Make You Rich. While there is a lot of nuance involved here, the basic point is that the gains will go to consumer surplus.

Failing to Understand the Exponential, Again. Julian Schrittwieser (long-time AI researcher) wrote a post to summarize studies of recent progress and what we should expect in the next 1-2 years.

Public Health Charts

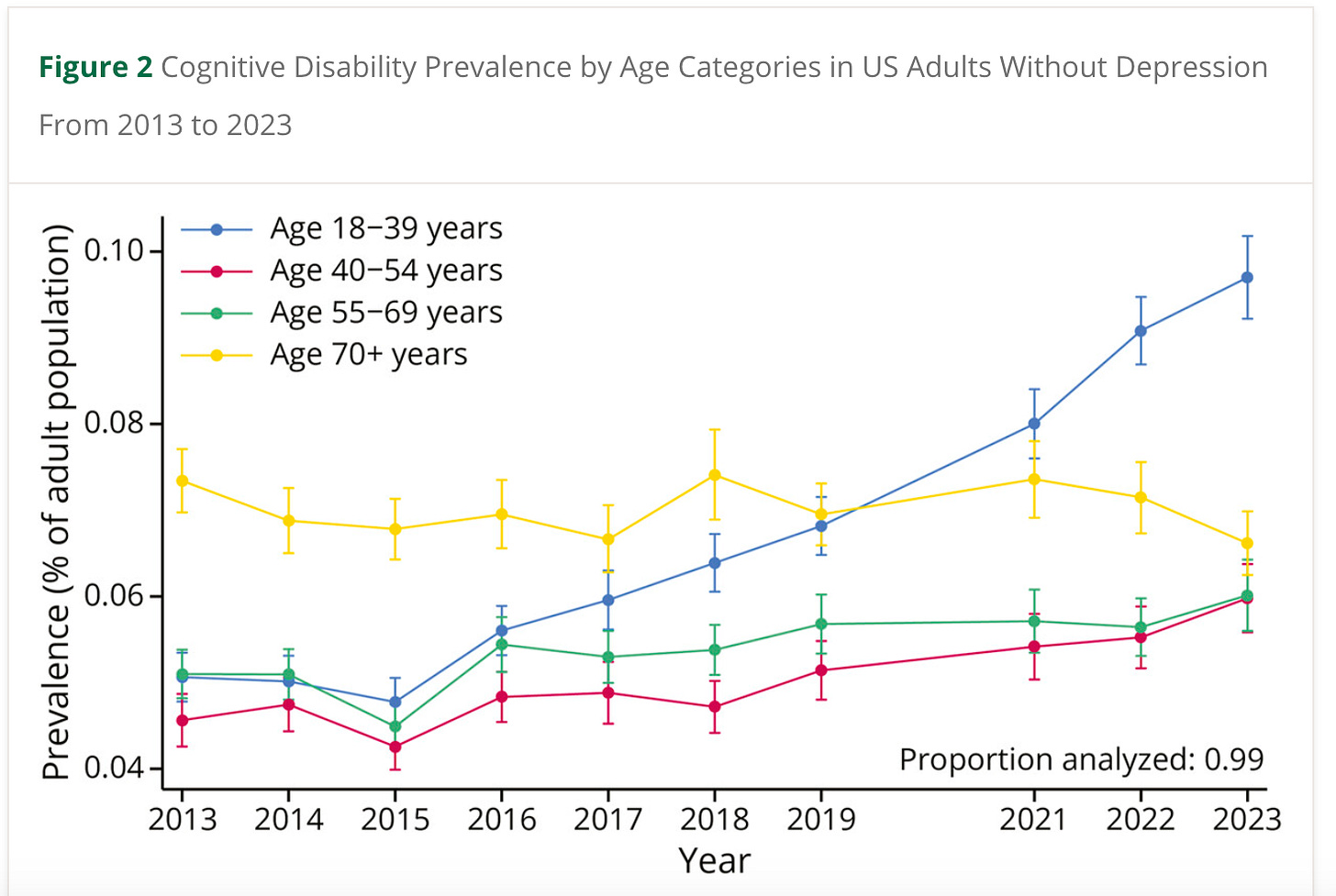

Rising Cognitive Disability as a Public Health Concern Among US Adults. It’s the phones and social media, probably.

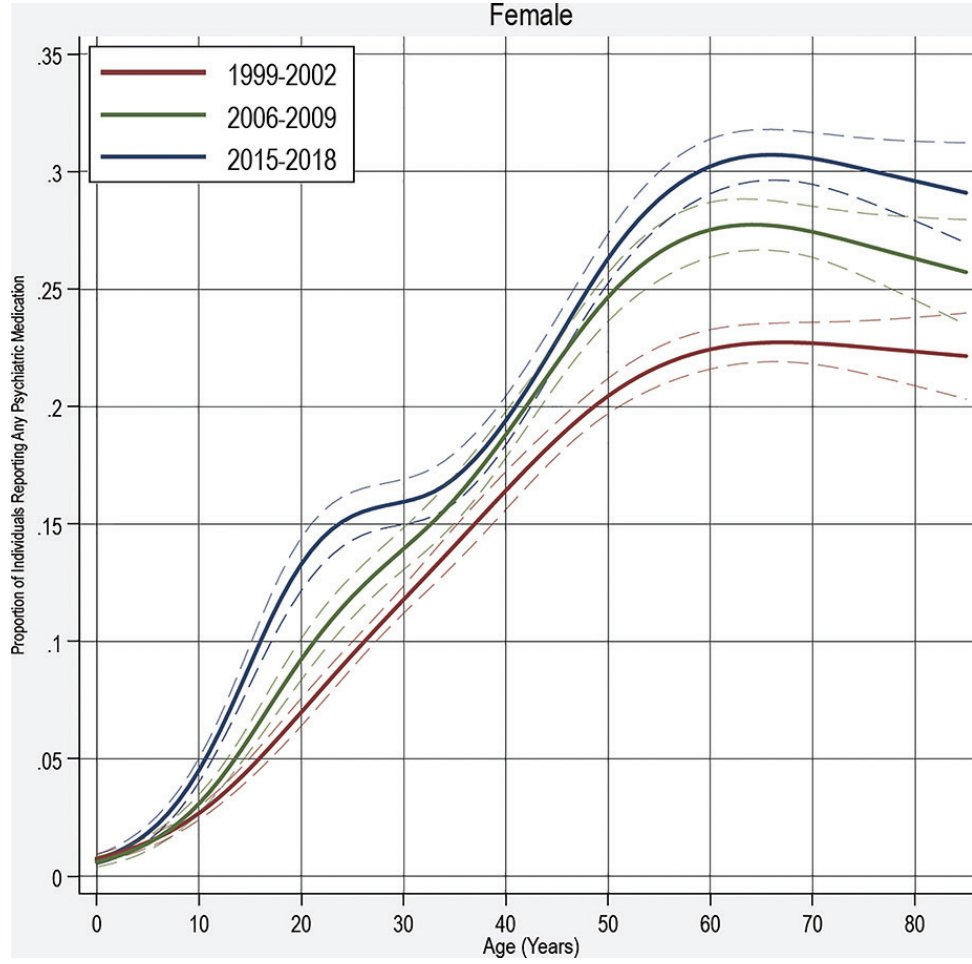

Nearly 1 in 3 American Women Over 60 are on Psychiatric Medications. This is a crazy statistic. Admittedly, I have not met one yet, but I’d be curious to hear if this is more common than what I see in my comings and goings.

Matt Levine was fantastic this week on both Tether and Private Equity. We will cover Tether and Stablecoins next week. On PE, his message is clear: the arbitrage is now closed. Expect lower returns.

Like: There was an arbitrage, and correcting it made people rich, and now it is corrected, so correcting it can no longer make you rich. If you want to buy a good company, lever it up, improve its operations and sell it back to the public markets:

Other private equity firms have already bought most of the good companies;

The companies that are left have all levered themselves up and hired consultants to improve their operations, like a private equity firm would have done, so there’s no reward to you for doing that;

Interest rates have gone up, so borrowing money is more expensive now than it was a few years ago; and,

Other private equity firms own tons of companies that they want to sell, so you have to compete with them when you try to sell your company back to the public markets, and you won’t get a premium price.

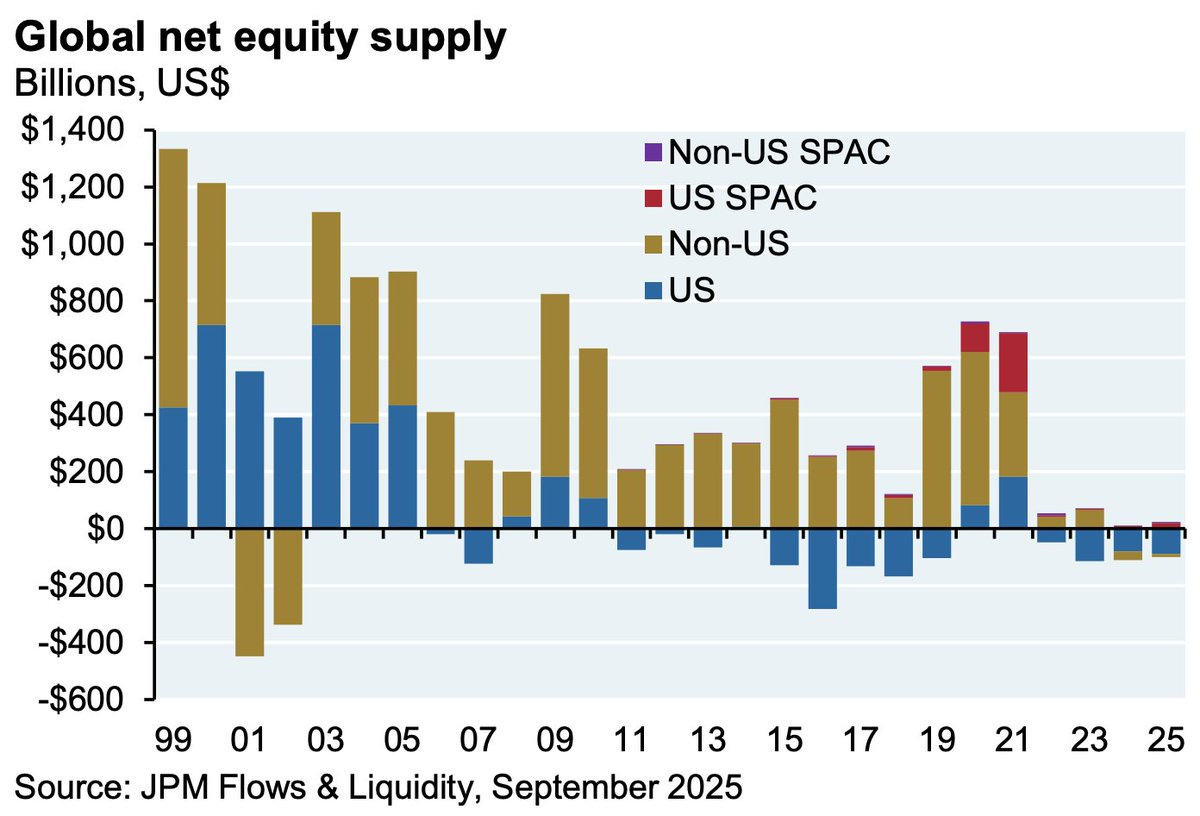

We’ve discussed how richly valued equities are today, but haven’t totally considered why stocks are so overvalued.

One idea is that there is a limited supply of equities available for purchase. Why? As the FT describes, uncertain executives are favoring share buybacks over tapping buoyant markets to fund investment.

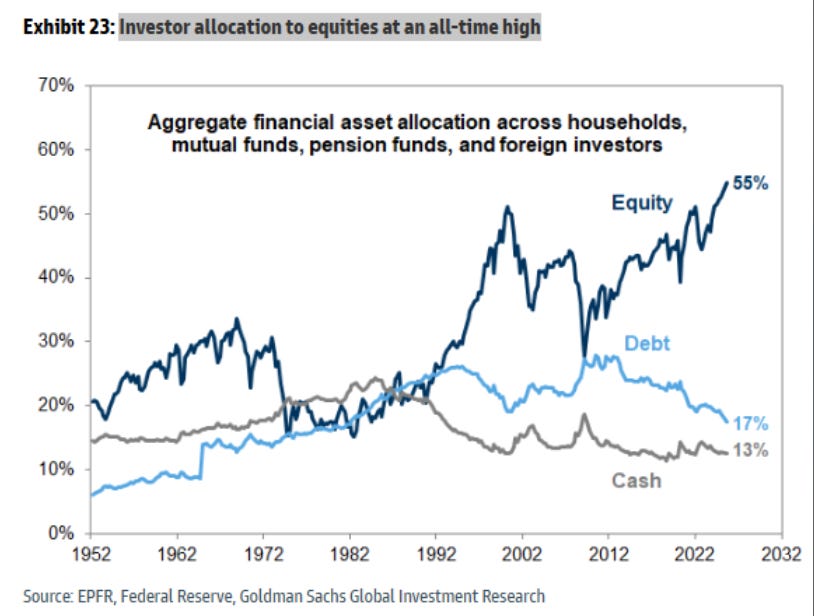

Investors are also choosing to allocate to equity vs debt at all-time high rates (the returns have been better, historically).

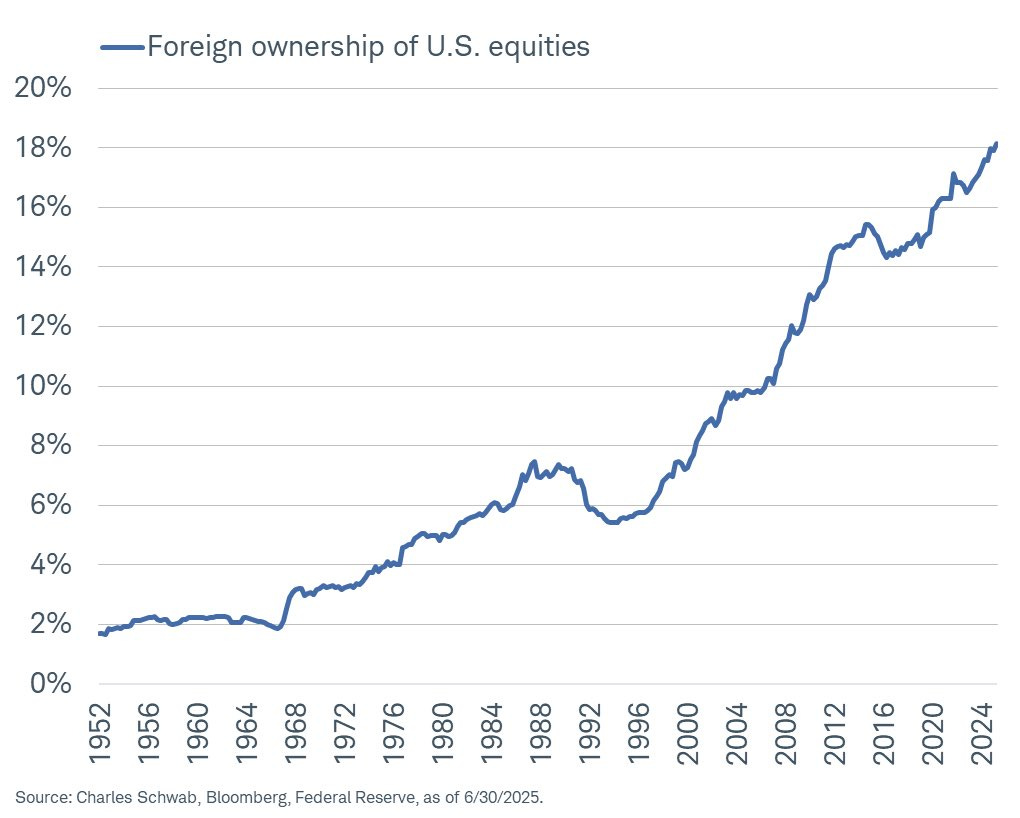

There is an increasing trend of foreign ownership as the world becomes wealthier and catches on to the resilience of the U.S. equity market.

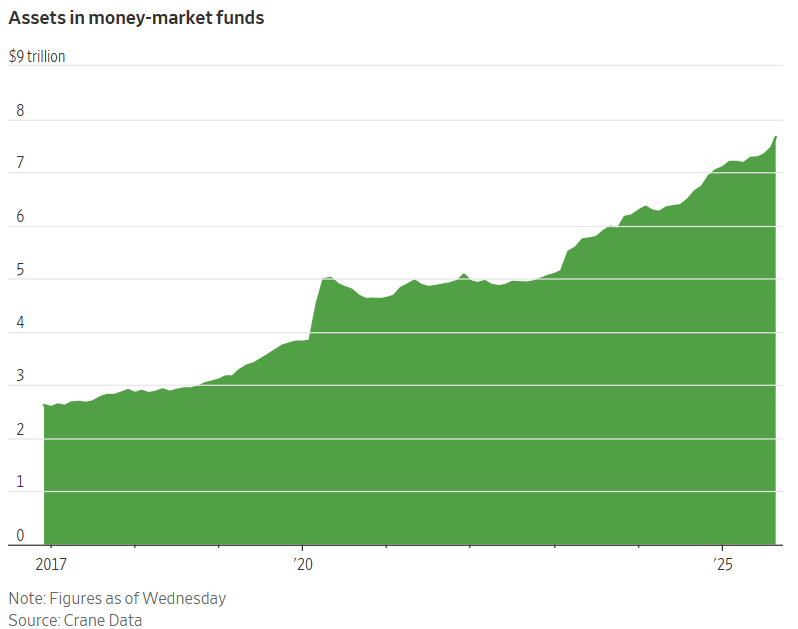

Even so, a substantial amount of capital remains available for retail investors to allocate to equities. Total assets in money market funds have hit a record $7.7 trillion, tripling over the last 8 years.

Song of the Week:

Here on YouTube.

More Indie Folk. Why not? I liked this song.

The open call of unexplored rivers and unmapped peaks forms the backbone of ‘Ends of the Earth.’ As Schneider’s voice rises and falls with the natural rhythm of the flows he describes, listeners are drawn into the sense of adventure that the song captures. It tells a story of letting go, of breaking free from the limits that society and time place on us, and instead embracing the excitement that comes with life's unpredictable nature.

“Ends of the Earth” by Lord Huron

No time for ponderin' why I'm a-wanderin'

Nowhere the buses lay

To the ends of the earth, would you follow me?

There's a world that was meant for our eyes to seeSelfie of the Week

I was in Buffalo, New York, this week. Why? Well, because Jack Greco told me to come.

Who is Jack Greco? I think of him as ‘Mr. Buffalo, but he’s a serial founder and investor. A decade ago, he co-founded ACV Auctions, a used automotive auction marketplace, which IPO’d in 2021 for approximately $5.5 billion (as of today, ACVA has a market cap of roughly $1.8 billion). It's the most significant tech win by far from Buffalo, NY. Jack has been reinvesting his wealth from the sale into startups and venture funds ever since.

I met Jack about four years ago in the most lovely way. You see, Jack refers to himself as ‘The Lorax’ from Buffalo. The reference is from the Dr Seuss book by the same title.

“Unless someone like you cares a whole awful lot,

Nothing is going to get better. It’s not.”

― Dr. Seuss, The Lorax

I have an expensive habit of collecting domain names for which I have an intellectual affinity about an underlying concept (Declarative Statements, Obviously The Future, Don’t Take The Money, etc.). One of those domain names I had claimed was Unless.VC, which Jack wanted.

Jack suggested we grab a drink while he was in NYC with the intention of getting the domain name. Well, half a negroni in, Jack committed to investing in my first concept fund, and the domain awaits…something.

So, what was going on in Buffalo this week? Chris (on the right), like Jack, is a lifelong Buffalonian and is working with the Ralph Wilson Jr. Foundation on jump-starting the technology and venture community in Western New York. They organized an event called Springboard to bring venture investors to Buffalo and contribute ideas and insight to economic development in the region.

Who was Ralph Wilson? Well, first, he was an entrepreneur from Michigan, making his fortune after serving in WWII. He took over his father’s insurance business and invested in Michigan-area mines and factories, eventually purchasing several manufacturing outlets, construction firms, and television and radio stations.

But secondly, and maybe more importantly, he owned the Buffalo Bills for 54 years—the proceeds from the sale of the Bills after Ralph’s passing form the basis of the foundation. On Ralph:

Most comfortable in a blue sweater, Buffalo Bills shirt and tennis shoes, Ralph shied away from flash and championed difference makers from all walks of life. Because for him, people mattered more than tangible things. He put that conviction into action—even making sure that everyone in the Buffalo Bills organization (from top executives to custodial staff) got the chance to travel to each of the team’s four Super Bowls.

For Ralph and his wife, Mary, Buffalo Bills fans made team ownership an incredible experience. Walking through the stadium after a game, they were always greeted by the affection and appreciation of the fans, and inspired by their loyalty to the team that meant so much to the Western New York community.

Ralph’s essential qualities were clear for all to see. An optimist and a fierce competitor, he was guided by clear convictions. A person of unquestioned integrity, he believed in always playing by the rules, and expected, received and reciprocated deep loyalty from those close to him. These characteristics earned him the trust of many—and the freedom to seize chances in business, sports, and life.

What an American hero! It seems like Ralph really cared. It’s nice to remember what our country was built on and what may rise again in the future.

It was my first time in Buffalo, but as I told the crowd, not my last. I was impressed by the vibrant food scene, the world-class art museum, but mainly by the welcoming warmth of everyone in Buffalo and the deep pride they have for their city.

Go Bills!

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

![Lord Huron- Lonesome Dreams [1000x1000] | Lord huron, Huron, Album art Lord Huron- Lonesome Dreams [1000x1000] | Lord huron, Huron, Album art](https://substackcdn.com/image/fetch/$s_!cW8t!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcd1a0e2c-c4c4-4abb-b800-dc8aa912be41_864x864.jpeg)