Bulletproof

w.189 | Startup Decoupling, Doug Leone, Education Stocks, Labor Changes, Edutainment Wars

Dear Friends,

Can you believe it’s March already? It’s been a super productive week for me. I’ve been trying a new strategy of stacking calls on Mondays and Wednesdays, and that’s been helping free up time for ‘deep work.’

Shout out to the people who sent me notes and comments on the recent editions. I love receiving those :)

Today's Contents:

Good Reads: Sensible Investing

Trends

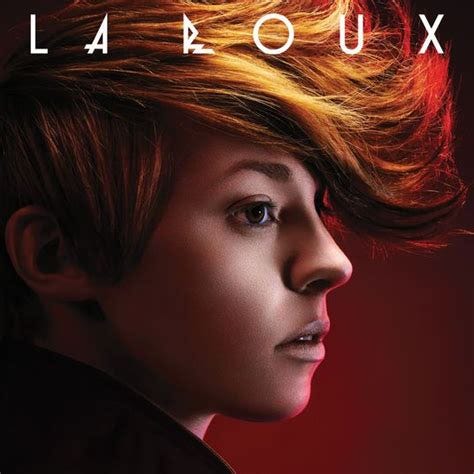

Song of the Week: Bulletproof

Good Reads: Sensible Investing

Lux LP Letter Q4 2022 and the summary in Fortune about the ‘crushing consolidation in the venture industry.’

Startup Decoupling & Reckoning. The coming reset in mid-to-late stage startups in 2023-2024 is at this point likely largely decoupled from interest rates and inflation. All things we’ve discussed here before but in one place with nice charts.

Similar vibes are in the thread below which means it’s now all consensus. Peter Thiel and Founders Fund were smart to half their current fund and push the commitments into the next. That fund operates like they care about performance; it’s a stark contrast with firms optimized to accumulate AUM (and management fees). For what it’s worth, I’m skeptical of private fund of funds because it’s often fees-on-fees going into the AUM accumulators.

Doug Leone - Lessons from a Titian - Podcast on Colossus. Yes, it’s as good as everyone says. It makes a huge difference to listen to someone who shares wisdom from a 40-year career vs some of the young guns.

Business used to be done differently. He described how they handled the 1999-2000 period by making sure that their fund didn’t lose money, using their management fees to reinvested into deals that worked.

Looking for and investing in people with sharp edges, grit, and spiky profiles is a lost art. I don’t see many investors outlining and advocating for those criteria in founders anymore.

Research Notes: The Case For Online Education Stocks. At some point, a company is going to truly change education. We look at two potential candidates (Coursera and Stride Education).

I had a Substack discussion/debate with an equity analyst this week. Anytime someone writes ‘at some point a company is going to truly change education’ it perks my ears. One of my persistent beliefs is that this is true, and one of my greatest fears is that I will somehow miss investing in it.

Anyway, the piece is well-researched, but my push is that I wouldn’t bet on either Coursera or Stride to be the game-changing education company. They are already too absorbed with their legacy business models and incumbent cultures.

If I did have to make a bet on a company already in the public markets, it would be on Duolingo. They continue to perform, the CEO/Founder is a visionary & strong executor, and they aren’t encumbered by a relationship to the existing system. Duolingo recently released its 2022 report and saw revenue rise to $400M (~47% YoY growth), while DAU is at 16.3M (61% YoY growth)—fabulous numbers for a company of their size.

Last note: It’s easy to forget how counter-cyclical education is. When the economy gets tight, consumer-mentality to invest in upskilling and bettering themselves is strong. The companies that I talk to in this space that were not Covid crashers are beginning to see this demand pick up.

Trends

Eye of the Tiger - KKR believes that ‘Without labor nothing prospers’ and we are in for a regime change in approach.

…will make labor the ‘eye of the tiger’ for governments, employers, and investors for the foreseeable future. If we are right, it will likely necessitate enhanced spending on worker retraining while process automation will continue to gain in importance. However, the greatest opportunity is likely for employers to find new ways to align their interests with those of their workers – creating potential for employees to become more engaged across multiple aspects of their jobs. In addition, greater access to and investment in childcare and elder care will be needed for working parents and primary caregivers generally; at the same time, employers should adapt positions to be more attractive for workers aged 55 or older.

AI Art Meets Brain Activity: AI Can Literally Read Our Minds: Using Diffusion Model, researchers can reconstruct visual images from MRI scan data.

This is pretty crazy and is worth a mention.

Domino's Pizza Sounds Warning On Delivery Price Fatigue. Add this to list of symptoms of consumers beginning to slow down.

In January 2023, 15% of Americans placed food delivery orders at least once a week, down from 18% a year earlier, according to Morning Consult.

How TikTok And Bill Nye Are Winning The Edutainment Wars. Article from Forbes on a trend I invest behind called ‘efficacious edutainment.’ I’ve been having so many interesting discussions and outreaches from this essay and on this investing theme.

I’ve been working on ramping up my narrative volume on Twitter and LinkedIn recently. And, while these are still rookie numbers and from a low base, I’m proud of my partial February results (start of Feb 8).

The key for me is writing when inspiration strikes - e.g., when listening to music on the elliptical - and scheduling them for release. The scheduling is key because you get rid of the emotional tension and wasted energy around wanting an instant reaction. It gives you more distance. I’d welcome any feedback/suggestions here!

Song of the Week: Bulletproof

Here on YouTube.

I’ve been listening to La Roux on repeat for most of the last week. I love the 80s techno pop and smart lyrics. I just wish she produced more! It was either Bulletproof or In For The Kill this week - both fabulous, relatable songs.

“Bulletproof” by La Roux

Burning bridges shore to shore

I break away from something more

I'm not turned on to love until it's cheap

Been there, done that, messed around

I'm having fun, don't put me down

I'll never let you sweep me off my feet

This time, baby, I'll be bulletproof

Selfie of the Week

You can’t really see me in the reflection. I’ve been securing a new set of speakers for myself and one of my friends was keen to show off his vintage set. We had a nice listening session.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

Curious how a niche provider (language) will be a company to change education (macro). Their EPS continues to struggle, but financials aside, how does a platform with a myopic focus impact an industry at large?