Bright Side of the Road

w.190 | SVB Spiral, Blues Music, Interest Rate Rises

Dear Friends,

Friday was supposed to be a ‘writing and deep work’ day. Not a ‘text and email with 36 portfolio company CEOs, engage across 20+ WhatsApp groups, and draft an urgent update letter to your limited partners’ day. But here we are.

Sunday is now being repurposed, and DS this week will be brief. Who knows what next week will bring as the weekend and quiet markets are akin to the brief period within the eye of the storm.

Today's Contents:

Good Reads: Sensible Investing

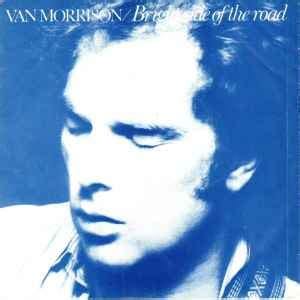

Song of the Week: Bright Side of the Road

Good Reads: Sensible Investing

A Few Words on the Silicon Valley Bank (SVB) Crisis

I’m not going to opine too much. I’m sure that if you are in the ecosystem, then you, like me, are tired from the operational lift of the fire drill over the last couple of days and have heard enough speculation to quench your thirst on that front.

For everyone else, the short story is the dominant banking partner in the startup ecosystem (especially in Silicon Valley, as the name suggests) collapsed on Friday and has been taken over by federal regulators. They have promised to honor the federal insurance limits on deposit accounts and resume access on Monday. Many businesses have accounts well over those limits. There is uncertainty at the moment over how much of the uninsured assets will be recovered (and by when).

I had all of my fund accounts at SVB but with deposits well below the FDIC limit. My fund will be fine. Like many other investors, I have checked with portfolio companies and confirmed their exposure. As of today, about 10% of the portfolio is impacted. I am optimistic for a positive outcome. Two founders physically went to SVB branch on Thursday and emerged with cashiers checks. In this instance, it was a strength to move quickly. It’s also been good to be small.

The signs of the underlying issues were apparent for a while, but the ultimate catalyst for a run on the bank didn’t need to happen. An estimated $42B was pulled out within 24 hours. This led to a spiral.

One of my favorite Twitter follows is Raging Capital Ventures who was early to highlight the underlying issues with SVB. Here is a thread from January 18th.

When interest rates rise, particularly as dramatically as we’ve seen over the past year, it puts stress on the system. The issues at SVB stem from this dynamic. I don’t think we’ve seen the last of the impact. Mortgages are beginning to be reset. Student debt payments are set to resume. We will see.

Song of the Week: Bright Side of the Road

Here on YouTube.

Earlier this week, I asked my Twitter community “What’s the first song you’d play to test an audio system?” One person responded with Back On Top by Van Morrison, which is indeed a great song and got me to listen to more Van Morrison this week. I prefer Bright Side of the Road and thought it’d be a good song for this week. Even during trying times, you can choose to be on the Bright Side of the Road.

In the last few years, there has been an politicization of technology, business, and innovation. There is a lot of finger pointing at ‘elites’ whether they be coastal, technology, or political. With the SVB collapse, questions have re-emerged about the role of government and regulation in our capital markets. In all those discussions, I’m reminded of the Winston Churchill quote:

“Some regard private enterprise as if it were a predatory tiger to be shot. Others look upon it as a cow that they can milk. Only a handful see it for what it really is--the strong horse that pulls the whole cart.”

We can re-emerge from these times with strong systems, greater trust, and a deeper appreciation for that strong horse sharing the load on the bright side of the street.

“Bright Side of the Road” by Van Morrison

And into this life we're born

Baby sometimes, sometimes we don't know why

And time seems to go by so fast

In the twinkling of an eye

Let's enjoy it while we can (Let's enjoy it while we can)

Won't you help me share my load? (Help me share my load)

From the dark end of the street

To the bright side of the road

Selfie of the Week

Speaking of founders, business, and the blues: Here is a picture of me and Sarah Haggard, CEO and founder of Tribute, an Avalanche portfolio company focused on upskilling employees. She invited me last minute to see Walter Trout live earlier this week. It was a great show and nice to unplug just a little.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn